Key Points

- While at times a fraught affair, OPEC’s marathon working weekend ended with a compromise agreement that managed to address multiple issues facing the producer group.

- The announcement of the additional 1 mb/d voluntary cut by Saudi Arabia demonstrated that it is once again willing to midwife the recovery and is back in “whatever it takes” mode.

While some market participants will focus on the fact that Saudi Arabia is not acting in concert with the rest of the producer nations with next month’s reduction, the fact that it is willing to shoulder it alone adds to the credibility of the cut and signals real barrels coming off the market.

In addition, the Kingdom made clear with this action and its press conference statement that it is not especially worried about Russian output or poised to resume a price war to recapture its Asian market share. From a market perspective, Saudi Arabia has a track record of delivering on material cuts. Hence, we would expect the full 1 mb/d unilateral cut to hit the market in July, nearly doubling the true physical reduction we have seen from the producer group since October.

The United Arab Emirates clearly had a good weekend. Since July 2021, the specter of the UAE’s upward production adjustment request has fueled concern about OPEC’s unity.

ADNOC’s investment in expanding spare capacity and its Murban benchmark has fueled concerns that it might eventually look to exit the producer group and fully monetize these investments. Affording it the 200 kb/d quota adjustment for 2024 seems to settle the issue of its OPEC membership for now. We think the timing of this revision decision is especially fortuitous for Abu Dhabi, as it can now turn its full attention to the final stages of planning for COP28.

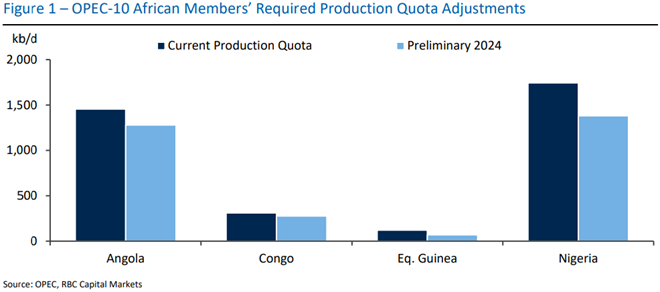

If there were a grace under pressure award for OPEC producers this weekend, we would make the case that it should go to the African nations that agreed to accept an aggregate quota revision of more than 600 kb/d.

While these countries have been underproducing their quotas for some time, we do not believe it was easy for them to make a public acknowledgment of their production difficulties, especially when a key African producer like Nigeria has a new president in office, doesn’t have an oil minister in place, and has embarked on politically sensitive fuel subsidy reform initiatives. We remember when Nigeria was producing 2.4 mb/d, with plans to raise supply to 4 mb/d by 2010. While some would say that today’s agreement to accept a -362 kb/d adjustment for 2024 to its current quota of 1.74 mb/d was bowing to reality, we think that this compromise deserves some praise. Given the huge economic and societal challenges that these African producers face, their willingness to compromise clearly helped to ensure that OPEC+ was able to craft such a comprehensive agreement this Sunday.