A comprehensive global analysis of consumer markets reveals five transformative forces reshaping retail landscapes worldwide as companies prepare for another challenging year in 2026. Research spanning the U.S., Canada, Europe, Asia, and Australia demonstrates consistent patterns of economic bifurcation and behavioral shifts that transcend geographic boundaries while creating both opportunities and pressures for multinational enterprises.

Consumer bifurcation becomes global reality

The most pronounced trend emerging across all major markets is the deepening economic divide between high and low-income consumers, fundamentally altering spending patterns and retail strategies. This bifurcation reflects macroeconomic dynamics, policy changes, and rising costs for essentials that affect consumers differently based on their income levels.

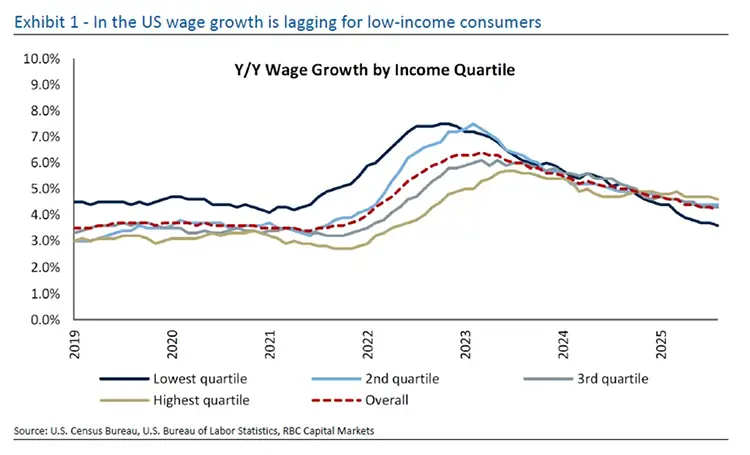

In the U.S., wage growth among low-income consumers has lagged significantly, creating mounting pressure as tariff-led inflation affects daily necessities. The comprehensive tax and spending package known as the One Big Beautiful Bill Act, passed in July 2025, restructured government assistance programs, including federal funding cuts to SNAP benefits – the Supplemental Nutrition Assistance Program serving approximately 42 million Americans. High-income consumers are likely the primary beneficiaries of the bill's tax savings, while lower and middle-income consumers may see net negative to slightly positive impacts on their financial situations.

Similar dynamics appear globally. Canadian higher-income households benefit from easing mortgage renewal headwinds and strong financial markets, while lower-income groups struggle with rising essential costs. The Canadian economy currently resembles a lowercase "k", with young Canadians in particular facing employment and income challenges, as income growth for the under-35 cohort has failed to keep pace with inflation.

In the United Kingdom, average weekly discretionary income for top household quintiles maintains healthy but fading growth, while bottom quintiles experience year-over-year declines in discretionary spending power. Higher income groups benefit from robust wage growth and wealth effects, whereas lower income groups face the full brunt of cost-of-living pressures.

"Our household cashflow analysis suggests that disposable incomes should continue to grow but at a lower rate next year. However, the lagged effect of interest rate reductions in major markets should help consumer demand."

Richard Chamberlain, Co-Head of Global Consumer & Retail Research, RBC Capital Markets

Value-seeking behavior transforms shopping globally

Consumer behavior is shifting dramatically toward value-focused spending across all income levels, manifesting through multiple channels that reflect mounting financial pressures. According to LendingTree's April survey, 25% of consumers now use buy-now-pay-later services for groceries, up from 14% a year ago, indicating growing strain on household budgets for essential purchases.

The trend extends beyond traditional discount shopping. Even within luxury markets, consumers are trading down to premium affordable brands, which demonstrate positive growth rates while traditional luxury brands face declining revenues. This shift is evident in changing brand influence measures: The Lyst Index – a global fashion search platform that tracks online shopping behavior and brand desirability – now features an unprecedented five premium brands in its Top 10 list.

"Across the globe, our teams are seeing consumers search for value, which can come in many forms, including increased share of private label, a shift to more at-home eating occasions, and focusing on non-discretionary purchases."

Private label adoption accelerates as national brand price inflation consistently outpaces private label pricing, contributing to sustained private label unit growth that exceeds national brand performance. Cost of living pressures have shaped consumer behavior globally, making "value for money" and promotional sensitivity key factors in purchase decisions across multiple markets.

Food consumption patterns reflect this value orientation. Food away from home as a percentage of total food spending has grown 370 basis points since 2019, though growth has flattened year-over-year as consumers pull back. There's been an observable trend away from eating out toward eating at home, driven partly by health considerations and cost inflation at restaurants.

Agentic AI revolutionizes retail engagement

The rise of artificial intelligence and first-party data utilization is transforming retail and consumer engagement on a global scale. Companies with robust data capabilities are leveraging AI for personalized experiences, improved marketing efficiency, and enhanced customer loyalty, creating significant competitive advantages. The transformation is already measurable in major markets.

Agentic AI represents the next evolution—artificial intelligence that functions largely without human involvement. In time, agentic AI is expected to provide more personalized offerings for customers, facilitating cross-selling and up-selling while increasing basket sizes and expanding market opportunities.

Social commerce is expected to accelerate significantly, particularly among Gen Z and Millennial shoppers, given its potential for frictionless purchasing. UK social commerce could grow 31% year-over-year in 2025, with global social commerce sales projected to exceed $1 trillion by 2028.

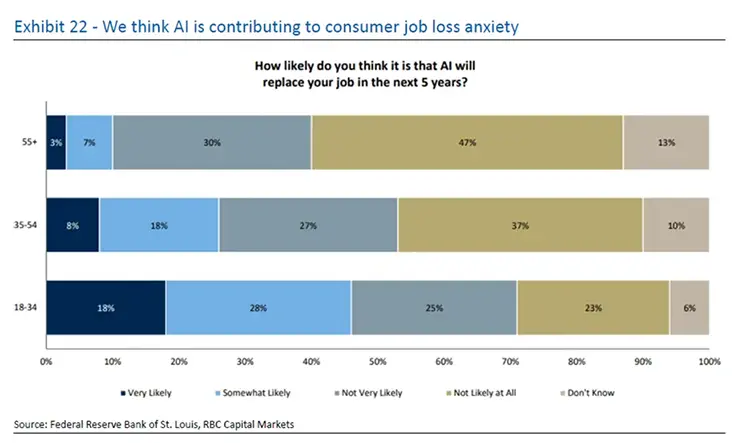

However, AI adoption creates consumer anxiety alongside opportunity. Among 18-34 year-olds, 46% believe AI is likely to replace their job in the next five years, contributing to discretionary spending caution and economic uncertainty.

Health and wellness reshapes categories

Post-pandemic health consciousness continues driving significant category shifts across global markets. According to a KPMG Consumer Pulse Survey, approximately 49% of U.S. adults report focusing more on health and wellness since the pandemic ended, creating sustained demand for functional foods, fitness services, and wellness-focused products.

These trends create distinct advantages and challenges across categories. Consumers are drinking less but drinking "better." Increased moderation and health consciousness has driven approximately one-third of drinkers to reduce consumption, preferring lower-carb options when they do drink. No-alcohol and low-alcohol wine categories are forecast to grow in major markets.

Protein preferences are shifting dramatically as well. Chicken continues being perceived as the healthier option versus beef, with steady pricing providing margin support while allowing food service operators to meet market value expectations. The chicken market is twice the size of beef and growing much faster, attributed to consistently lower prices versus tariff-impacted beef and growing consumer preference for lean protein.

GLP-1 medications represent a potential acceleration factor for health trends. Recent policy developments in the U.S. may reduce GLP-1 costs by up to 70% for cash-paying patients, with availability expanding to Medicaid and Medicare patients under new pilot programs.

Alternative revenue streams drive market consolidation

Retailers globally are increasingly focusing on alternative revenue streams to navigate challenging market conditions and diversify income sources. Key strategies include leveraging retail media for high-margin advertising opportunities, utilizing AI for personalized customer experiences, and expanding marketplace offerings.

In U.S. retail, alternative profit streams are concentrating power at the top. Mentions of retail media have spiked significantly over recent quarters, with retailers investing to establish fast-growing, high-margin businesses fundamentally changing their profit structures.

"We believe there is a first mover's advantage to retail media and size/scale will have a meaningful influence on advertising dollar allocation, which bodes well for larger players."

Steven Shemesh, U.S. Hardlines/Broadlines & Food Retail Analyst, RBC Capital Markets

This dynamic accelerates industry consolidation. Alternative revenue streams enable larger players to consolidate market share while smaller competitors face growing challenges. Given 2026 is likely to be another challenging year for like-for-like volume growth, many retailers will pursue retail media, AI personalization, and marketplace strategies to drive top-line growth.

The transformation affects profitability models fundamentally. Retail media allows companies to leverage online websites and digital screens in-store to advertise supplier products, providing additional revenues at high margins that can offset traditional retail pressures.

Inflation and tariffs create margin pressures

Tariff-related cost pressures persist globally, with studies suggesting tariffs have raised overall U.S. retail prices by approximately 4.9% relative to pre-tariff trends. Imported goods face approximately 6% inflation while domestic goods see 4.3% increases, with categories like apparel, coffee/tea, household textiles, and furniture experiencing outsized inflation.

The full impact of tariff-induced price increases on consumer volumes remains to be fully understood, though U.S. consumer resilience has been notable in robust year-over-year apparel sales growth.

Geographic diversification offers limited relief as consumer weakness appears widespread across major markets. Benefits from geographically diversified portfolios may remain elusive given broad-based consumer challenges.

Companies face mounting challenges balancing revenue growth with profitability as they navigate rising costs, limited pricing power, and shifting consumer behavior. Many businesses grapple with margin pressures while addressing value-driven demand, particularly among price-sensitive lower-income segments.

Strategic implications for global companies

The convergence of these five themes creates both challenges and opportunities for multinational consumer companies. Successful navigation requires strategic courage and realistic target-setting as traditional growth models face unprecedented pressures.

Marketing investments continue at elevated levels across consumer staples companies, though these expenditures are not delivering improving sales growth. This suggests potential need for strategic changes in approach as companies balance investment with profitability pressures in an environment where organic revenue growth may be harder to achieve.

The current environment favors companies offering significant consumer value, possessing scale and logistical advantages, and operating in non-discretionary categories. Alternative profit streams are structurally changing retail, enabling those with comprehensive first-party data and technological capabilities to expand margins while investing in competitive positioning.

Industry consolidation appears inevitable as larger players with scale and technological advantages consolidate market share while smaller competitors struggle with operational challenges. Retail bankruptcies have increased as alternative revenue streams create competitive disadvantages for companies lacking data capabilities and scale.

"We believe the companies that create value over the next 1, 3 and 5 years will be those that have the courage to make decisive decisions that others are not willing to make."

Nik Modi, Co-Head of Global Consumer & Retail Research, RBC Capital Markets

Geographic portfolio benefits may remain limited given widespread consumer weakness, suggesting companies must focus on operational excellence and strategic positioning rather than relying on market diversification alone.

RBC Capital Markets' Global Consumer & Retail Research Team authored "2026 Global Consumer Outlook," published December 9, 2025. For more information on the full report, please contact your RBC representative.