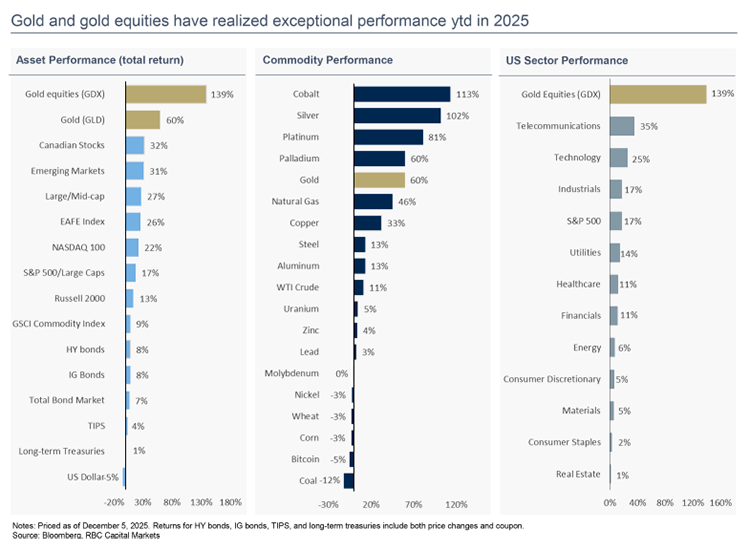

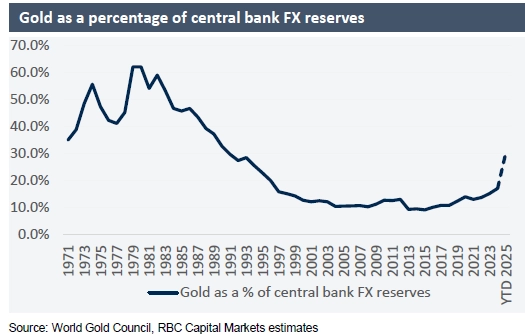

Gold prices surged 60% year-to-date in 2025, with gold equities climbing 139%, as central banks and investors embraced the precious metal's qualities as a non-sovereign asset and portfolio hedge. This momentum of growth is expected to continue, with our current forecasts projecting gold price could reach new highs in 2026 at an average of $4,600 per ounce and climb further to $5,100 per ounce in 2027.

A sector transformed

The precious metals sector is experiencing what may be characterized as an extraordinary transformation. After decades of expansion-focused business decisions that historically led to sharply higher costs, inflated resource estimates, and poorly timed acquisitions during periods of rising gold prices, today's gold producers are operating with significantly more careful approaches to spending and business planning.

Gold producers have paid down debt, controlled costs, and increased cash returns to shareholders in the current bull market, marking a significant shift from the sector's historical business decision-making patterns. This represents a fundamental change that distinguishes the current cycle from previous gold price rallies where companies typically expanded more aggressively into rising gold prices.

Record performance, disciplined operations

Gold producers are experiencing a "perfect storm" – high gold prices combined with relatively low cost inflation. This performance has translated into unprecedented profit margins for producers, with 2025 margins calculated at approximately $1,470 per ounce, representing a remarkable seven-fold increase versus 2023 levels.

At current gold prices, the sector has essentially eliminated net debt, providing a larger-than-normal safety cushion in any potential downside gold price scenario. This financial positioning stands in stark contrast to historical patterns where companies typically increased borrowing during bull markets to fund expansion projects.

Producers are also being more conservative with reserve calculations. Cash returned to shareholders for RBC's large cap gold producer coverage improved to 2.4% in 2025 with expected increases to 3.2% in 2026, more closely matching the S&P 500's trailing twelve-month yield of 3.0%. This represents a fundamental shift toward returning money to investors that was notably absent in previous commodity cycles.

The sector's newfound discipline extends to resource calculations and development planning. Producers are expected to calculate reserves at conservative levels below $2,000 per ounce, less than 50% of current gold prices. This conservative approach to reserve pricing should help mitigate the resource quality decline and cost inflation that typically accompanied previous bull markets.

"Gold producers are experiencing a perfect storm and are behaving responsibly, in our view."

Josh Wolfson, Head of Global Metals & Mining Research, RBC Capital Markets

Economic environment influences gold market dynamics

The broader economic environment continues to provide multiple factors that historically have influenced gold price movements. Key themes include hostile global policy that has divided economies, increasing geopolitical risk and the shifting outlook for growth and inflation. Additionally, artificial intelligence development is prompting technological change and reshaping economic landscapes, adding to uncertainties over growth and inflation trajectories.

Softer monetary policy remains on the horizon despite above-target inflation being sustained, while high government debt loads, and ongoing budget deficits remain enduring challenges to economic stability. These factors have historically contributed to investor interest in gold as markets seek alternatives to traditional assets during periods of economic uncertainty.

While high government debt loads, and ongoing budget deficits remain enduring challenges to economic stability. These factors have historically contributed to investor interest in gold as markets seek alternatives to traditional assets during periods of economic uncertainty.

Near-term challenges amid broader positive trends

Despite the positive long-term trajectory, the sector faces some interim headwinds as industry costs are expected to rise and capital spending may increase as companies with strong cash positions look to accelerate project development. This environment may create some divergence between expectations and company guidance as the sector enters the upcoming reporting season.

Current market valuations for gold producers appear to reflect sector fundamentals, with companies trading at levels that we view as reasonable relative to underlying business metrics. The stability in valuations despite strong sector performance suggests markets are taking a measured approach to pricing in the recent gold price gains.

While near-term risks exist, the combination of continued supportive economic conditions, disciplined spending decisions, and current market valuations suggests an overall continued positive outlook for the sector into 2026.

The Global Mining & Metals Research team authored "Global Precious Metals Equities 2026 Outlook," published on December 10, 2025. For more information on the full report, please contact your RBC representative.