President Trump has put the Iranian regime on the clock, imploring them to make a new nuclear deal or face more military action that could put energy supplies at risk if it becomes a regime-change effort. While Tehran has signaled a willingness to negotiate with Washington, it remains far from certain that it will agree to forego uranium enrichment and mothball its entire nuclear program. Though the combined U.S.-Israeli June strikes did significant damage to main Fordow and Natanz enrichment sites, some non-proliferation experts have suggested that Iran may have been able to remove enough highly enriched uranium and highspeed centrifuges to clandestinely restart its program. As we have previously noted, there have been no IAEA inspections of nuclear facilities since June, which triggered the snapback of the UN-level sanctions by the remaining members of the P5+1.

Beyond ending enrichment, President Trump will likely seek to limit Iran's missile activities as the leadership has been quickly moving to rebuild aerial defense capabilities, which could potentially limit Israel's unfettered access to Iranian airspace. To date, the Supreme Leader has resisted making such curbs on his nuclear and missile activities despite years of sanctions and the recent military action. It is far from certain that he will give in now, even in the face of the armada of U.S. ships in the region, especially as it is unclear whether such concessions will lead to the full revocation of sanctions given that the bulk of the punitive economic measures were imposed by Congress and not the White House.

The Iran Nuclear Agreement Review Act of 2015 gives Congress the authority to vote on any agreement reached by the White House before sanctions can be waived, and hawks on both sides of the aisle may balk at sweeping sanctions repeal given the large number of demonstrators killed in the recent round of protests. Unlike the case with Venezuela, there is no easy process for the President to repeal the congressional measures, even if the White House has some latitude on enforcement, though Congress does retain some oversight over that area as well. As long as the sanctions remain on the books, Western financial institutions are unlikely to return to Iran, limiting the potential economic upside of a deal.

"It is far from certain that [Khamenei] will give in now, even in the face of the armada of U.S. ships in the region, especially as it is unclear whether such concessions will lead to the full revocation of sanctions.”

Helima Croft, Head of Global Commodity Strategy and MENA Research, RBC Capital Markets

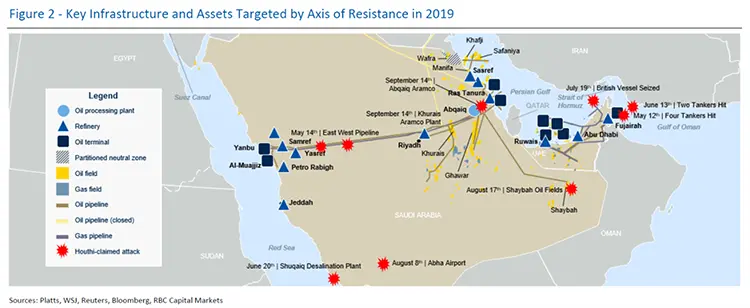

We see a U.S.-led regime change effort to remove Supreme Leader Khamenei as posing the biggest near-term risk to regional oil supplies, as the IRGC could retaliate by replicating the 2019 playbook. While Iran's Axis of Resistance proxy network has been significantly degraded by U.S. and Israeli action, its own naval forces as well as militias in Iraq and Yemen likely retain the ability to target individual tankers in the Strait of Hormuz, as well as regional production and export facilities. Concern about the militias in Iraq seems to be rising, with the White House warning that it will cut support for Baghdad if the Iran-aligned actors maintain influence in the country. If Washington opts to impose a Venezuela-style oil blockade on the country, it risks a material reduction in Iranian exports, as well as regional retaliatory threats, at a time of relatively thin OPEC spare capacity.

Beyond the clear and present risk of oil supply disruptions, it remains uncertain who would seize power if Khamenei was forcibly removed from office. As we have previously noted, a number of leading Iran experts contend that the IRGC may be best placed to consolidate power in the event that the Supreme Leader is ousted, raising questions about the overall efficacy of the U.S. intervention. Regional allies of the United States seem especially concerned about a post-Khamenei power vacuum fragmentation that could extend beyond the country's border. While Iran opted against expanding the conflict to neighboring states and waterways last summer, we do think that the direct targeting of Khamenei would potentially lead to a more explosive response, especially in the event of a lethal strike on the 86-year-old cleric who has run Iran since 1989.

Helima Croft authored "Iran Update: Tehran on the Clock," published on January 28, 2026. For more information on the full report, please contact your RBC representative.