Published July 3, 2023 | 4 min read

Key Points

- Insurers are having to adjust to higher catastrophe losses due to the frequency and severity of events often linked to climate change.

- Losses sustained in primary risks – hurricanes and earthquakes – have been outstripped by the costs of so-called ‘secondary perils’, such as wildfires and floods.

- Life insurance will be affected as climate changes increase the transmissibility of infectious diseases.

- Many underwriting and investment policies are switching to support climate-friendly activities.

- Regulators need to balance the needs of consumers against those of insurance companies, to ensure continuing insurance capacity amid the mounting impact of climate on losses.

Counting the cost of catastrophe

Record drought conditions. The worst wildfires on record. Extreme rain, causing floods and landslides. An especially harsh winter. California’s recent weather patterns demonstrate a wide variety of the spillover effects of climate change.

One effect has been billions of insured losses which has caused a number of bellwether insurers to exit their property insurance exposures in the state.

Insurers are having to adjust to a world of higher catastrophe losses. The cost of events such as hurricanes, floods and fires have hit near record levels – over $100bn in five of the past six years. There is growing evidence of a link between climate change and the severity of these events.

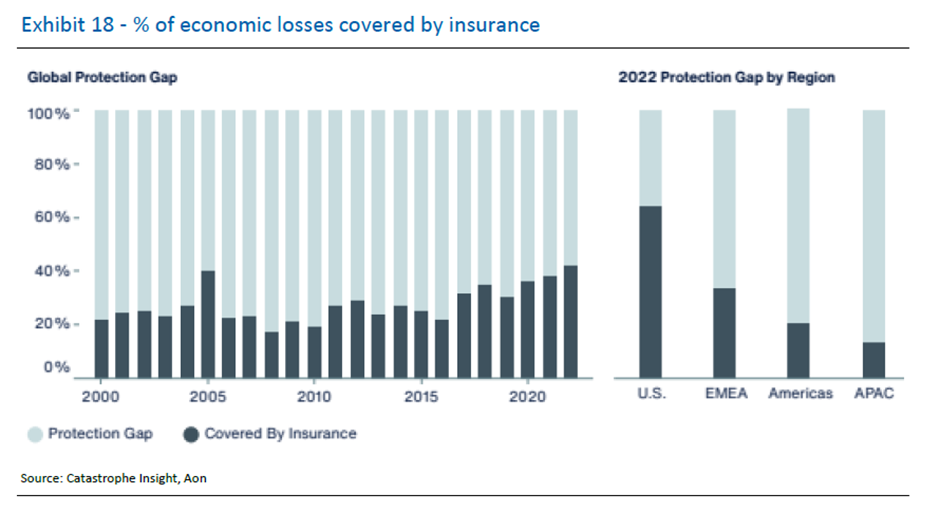

Meanwhile, there has been no significant improvement in the protection gap – the coverage of catastrophe losses. In 2022, 58% of economic catastrophe losses across the globe were not covered by insurance. This has big impacts on societies and economies.

In response to these trends, many insurance companies have reduced their catastrophe exposures over the past five years. Some have lifted retentions on reinsurance contracts due to higher reinsurance pricing.

We believe climate change has reinforced the relevance of reinsurance as a risk mitigation tool for carriers of all sizes. Catastrophe bonds will remain another alternative to manage weather-related volatility.

Society as a whole needs to act to manage catastrophe exposures – for instance, through improved building standards, limiting building in risky areas, and fire prevention efforts. Carriers can also offer discounts for environmentally-friendly policies, such as having a LEED-certified home or owning energy-efficient vehicles.

‘The cost of events such as hurricanes, floods and fires have hit near record levels – over $100bn in five of the past six years’

Secondary risks, primary costs

So-called ‘secondary perils’ are a growing area of concern for property and casualty (P&C) insurers in recent years. While definitions vary, secondary events range from wildfires to severe thunderstorms and flooding.

Recent examples include the Texas freezing events of 2021 and the fierce Midwest windstorms of recent years. These were multi-billion loss events that have been linked to climate change.

In fact, ‘secondary’ perils have caused more losses than primary perils (hurricanes and earthquakes) over the past 50 years. Some prominent insurers have suggested abandoning the secondary category term altogether, arguing that these perils are worth the full attention of insurers and risk managers.

For now, modeling of secondary perils is lagging, and likely an area for further investment. The rise of AI, quantum computing and other advanced data and analytics techniques should allow risk modelers to more accurately model weather systems and complex outcomes for loss events.

‘‘Secondary’ perils have caused more losses than hurricanes and earthquakes over the past 50 years.’

March of the mosquitoes

P&C insurers are not alone in being affected by climate. Changes in global weather patterns have impacts on mortality and morbidity, which have implications for life and health insurers.

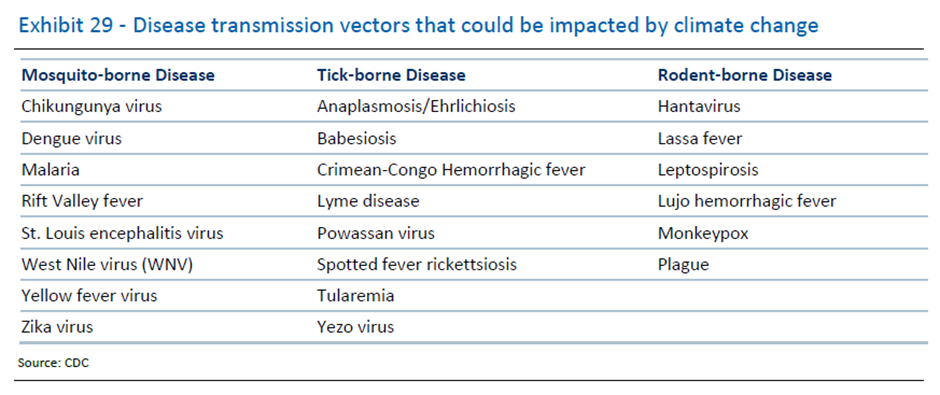

Together with globalization and biological evolution, climate change could create higher rates of change in infectious disease, and increase transmissibility over time. Scientists believe mosquitoes, bats, rodents and other disease carriers are likely to expand their ranges further from the equator, introducing traditionally tropical viruses to the US and Europe.

For instance, mosquitoes like warmer temperatures, and stand to benefit from substantial habitat expansion as a result of climate change. This will bring diseases such as malaria, West Nile virus and other mosquito-borne illness into new regions of the world, including the US.

Ultimately, however, we believe technological improvements such as mRNA vaccines and increased monitoring and health solutions should outpace the evolution of infectious diseases.

Underwriters back the energy transition

Recent years have seen some global insurers announce standards designed to reduce or eliminate underwriting involving fossil fuels.

Many companies also use their investment portfolios as a tool to encourage positive climate behavior – establishing investment guidelines that seek to promote ‘green’ investing and avoid ‘brown’ investing.

The flip side is that the energy transition should create new insurance demand in areas such as wind farms, solar projects, and electric vehicles.

However, many underwriters remain willing to take on less climate-friendly risks, and there are few signs of that changing in the near term.

In our view, an investment philosophy that ties in closely to key elements of a company’s underwriting exposures is a useful tool in balancing risk exposures. Socially responsible investing is often smart from a total return standpoint too.

Regulators and unintended effects

While climate may be the catalyst for elevated loss frequency and severity, regulators also play a critical role in the degree to which insurance is both affordable and available.

Varied approaches at state level – where most insurance regulation takes place – have clear impacts. For instance, the regulatory environments in Florida, California and Louisiana exacerbate the costs of providing insurance in these states. By contrast, Mississippi, North Carolina and South Carolina enjoy comparatively lower insurance costs, despite similar exposure to catastrophe losses.

Limiting pricing actions, encouraging bad faith lawsuits, limiting the ability to drop customers after a loss and even ‘insurers of last resort’ are all actions that appear consumer friendly, but in the long run limit availability and customer choice.

Federal regulators are also beginning to impose costs on the system. New disclosure requirements on businesses, and the potential to mandate additional green-friendly policies, could lead to increased directors’ and officers’ liabilities.

Over time, if insurance capacity cannot make reasonable risk-adjusted returns, the capacity will be lost. Regulators need to balance the needs of consumers against those of insurance companies as both manage the impact of climate on losses.

‘Over time, if insurance capacity cannot make reasonable risk-adjusted returns, the capacity will be lost’

Mark Dwelle authored “RBC Imagine™: Climate Change & Insurance,” published on April 12, 2023. For more information about the full report, please contact your RBC representative.