Published July 19, 2022 | 4 min read

Key Points

- Low-carbon capex and generation targets are likely to become irrelevant metrics, as investor focus shifts to net carbon footprints.

- Markets are pricing European majors’ cost of equity higher as they aim for absolute Scope 1, 2 and 3 emissions reductions vs. the carbon intensity focus popular for U.S. companies.

- Amid constraints on absolute emissions, if companies want to keep hydrocarbon sales close to current levels, they need to grow their low-carbon businesses rapidly to reduce carbon intensity. If they shrink hydrocarbon volumes, less capital is needed to grow renewables, but there would be pressure on cash generation and dividends.

- RBC’s analysis suggests that while U.S. majors’ approach to carbon capture and storage might be a financially simpler business model, it’s likely to be just as capital intensive, if not more in the near team, as embracing renewables, while also dependent on government subsidies.

- Ultimately, some companies could return the majority, if not all, of their market caps back to shareholders via dividends and buybacks over the next decade.

There’s a key question in investors’ minds as European and U.S. oil majors look to transition to the new economy – what will happen to those businesses going forward? At this early stage in the energy transition, the market is skeptical. Energy majors have a poor track record on capital allocation, carbon metrics are confusing and inconsistent, and there are a number of methods to reach the “Brag-a-Watt” goals they have set. But despite a number of uncertainties, our analysis anticipates that oil majors may be more adept at navigating the transition than the market currently expects.

A tale of two geographies

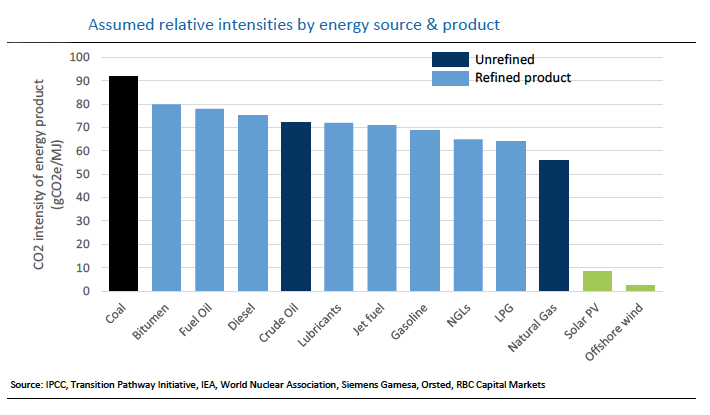

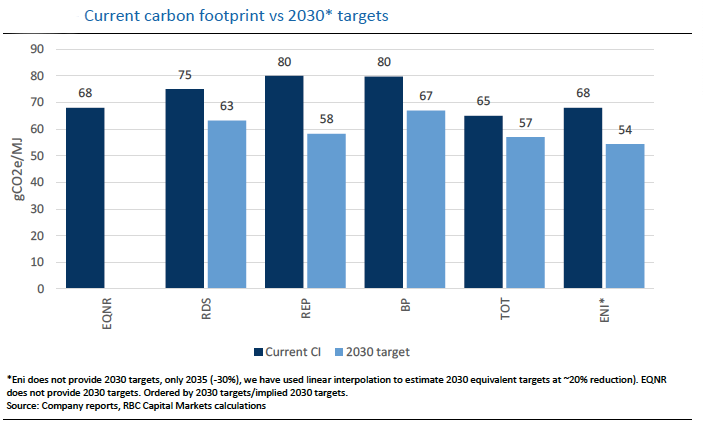

A clear divide is emerging between the European oil majors and their U.S. counterparts in tackling the energy transition. Europe’s companies have adopted net zero goals focused on absolute reductions, while American firms tend to favor carbon intensity goals that deal with changing the product mix. Within this metric, oil is generally more carbon intensive than liquefied natural gas (LNG), LNG more intensive than non-liquefied gas, and gas more intensive than both solar and wind power. There is a range of intensity for hydrocarbons, but then a big jump to the much lower intensity of renewables, so a shift to renewables is still enormously impactful for majors pursuing this approach.

So far, however, we believe the wrong type of behavior is being incentivized. Observers are measuring how much capex each company is spending in low carbon areas, with the higher end of the spectrum seen as being "ahead" in the transition. Or, more recently, companies with the larger gigawatt targets have been deemed the most ambitious. This is a “spend more to be rewarded” mentality, which doesn’t address underlying challenges. But the conversation is already starting to evolve to focus on net carbon footprints (NCF), which we believe is the most reasonable metric for a carbon intensive business in transition.

Scale is the key challenge… but it’s complicated

Although the relative carbon intensity looks starkly different between hydrocarbons and renewables, most companies have put forward targets based on how much energy is sold. That makes scale the single greatest challenge for transition objectives, because it takes a significant number of gigawatts to produce the same amount of energy as the equivalent in hydrocarbons.

To further complicate the matter, some firms are converting electricity sales into “fossil equivalents”, which amplify their impact on carbon footprint calculations.

Shell is a great example to use when examining scale, since its total energy sales in 2019, including produced and third-party volumes, were equivalent to the entire energy consumption of Canada and Brazil combined. We built an interactive energy transition model using key principles on carbon intensity and sales, declines in hydrocarbon sales and production and growth in low-carbon sales to ascertain how companies can meet their top-down climate related targets.

In one scenario, we assume that a company sells a similar amount of energy in 2030 as 2020 and try to back-solve for the mix required to achieve a 20% reduction in carbon intensity.

In a second scenario, we assume a more gradual decline in core businesses, with a 3% volume and sales decline per annum. We then back-solve for the required low-carbon electricity and biofuels sales in order to reach the targeted reduction.

In either scenario, it’s clear that a company will need to either grow its renewables or carbon capture utilization and storage (CCUS) businesses aggressively, or shrink its most carbon-intensive business lines, particularly oil. The more a company wants to maintain its hydrocarbon production, the faster it will need to grow its low-carbon businesses. This is something of a paradox, as some stakeholders may want companies to maintain oil businesses as they are highly cash-generative, at least relative to renewables. Conversely, if they were to shrink their oil business faster, there would be less pressure to build its low-carbon business to balance the carbon intensity of products sold.

The cost of low-carbon

Based on our scenarios, we believe that for Shell, low-carbon spend would need to be $15 billion to $23 billion over a ten-year period, which appears to be more than manageable. But as Shell, or any other major, demonstrates a similar business model in low-carbon similar to its oil and gas business, it should be able to grow that business materially, without further substantial capital outlays (i.e. sell more low carbon electricity than it produces). This is often under-appreciated in the current outlook for valuations of European majors, which are focusing more heavily on developing renewables.

“Right now, the market is taking a skeptical view of European majors’ transition plans compared to U.S. companies...But in our analysis, CCUS and renewables work out at a level of similar capital intensity.”

Because U.S. majors have focused largely on intensity targets, based on Scope 1 & 2, they are not incentivized to shrink oil and gas production volumes in the near term. However, we expect pressures to mount on the U.S. majors to shift course, or at the very least, announce peak production in order to address total carbon footprints.

Right now, the market is taking a skeptical view of European majors’ transition plans compared to the U.S. companies, with data from Bloomberg putting the gap in implied cost of equity at around 800bps as of December 2021. But in our analysis, CCUS and renewables work out at a similar capex, but CCUS won’t pay out. Once the European majors have invested, they should benefit from low-carbon earnings.

Transition risk clearly starts to mount as we approach 2035 to 2040, when targets accelerate, but for the next decade, companies should generate enough cash to support significant returns of capital to shareholders.

Biraj Borkhataria, Erwan Kerouredan and Victoria McCulloch authored “RBC Imagine: Euro & US Integrated Energy – The Transition Pathway,” published on May 19, 2021. For more information about the full report, please contact your RBC representative.