Published January 17, 2023 | 1 min watch

Key Points

- Europe’s dependence on Russian energy imports has been a source of competitive advantage, but has also exposed the lack of focus on energy security as well as the cost of energy, amid the drive for decarbonization.

- The EU’s plan to accelerate the renewable generation build out is largely depending on simplifying the permitting process. With a strong ecosystem of incumbents in this space, and plenty of capital willing to invest, we believe Europe can be a leader in green hydrogen to help offset current grey hydrogen consumption.

- While the energy crisis has prompted reviews of nuclear, it remains a politically charged topic with many varying views.

- Imports of liquefied natural gas are part of the near-term solution, but will require a ramping-up of terminal, regasification and storage capacity.

- Options to step up domestic oil and gas production could be less carbon intensive than energy imports, but given the current market structure, this will require support from banks and investors to help underwrite the investments.

Russia’s war in Ukraine has exposed Europe’s lack of energy security and its dependence on Russian energy imports.

European governments will need to balance the ‘energy trilemma’ – the key challenge for the energy transition, assessing trade-offs between decarbonization, the cost of energy and domestic energy security.

Energy: not just an environmental issue

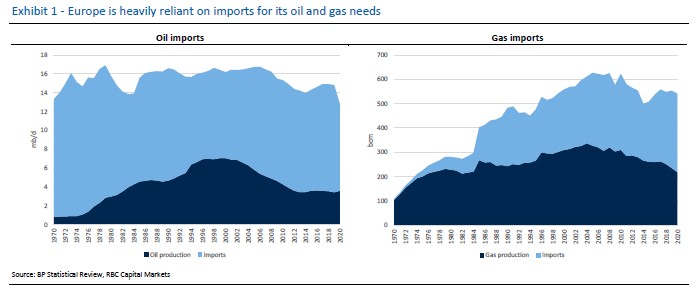

Despite its “leadership” in energy transition, Europe remains heavily reliant on oil and gas imports. Demand for oil and gas has been relatively stable over the last decade while domestic production has declined.

Meanwhile the Ukraine invasion has exposed the fact that Russia accounted for around 35% of EU gas needs, and was a source of competitive advantage for the continent, particularly in Germany, Europe’s largest industrial manufacturing base.

As consumers on the continent face energy bills two or three times higher this year, alongside rising food and transport prices, we see 2022 as the first real test of consumer and political will for net zero goals.

Access to energy is a critical social and governance issue as well as an environmental one. Solving it will require a fundamental rethink of European energy infrastructure, and support for domestic energy supplies alongside an acceleration of renewables. The opposite of dependence, is diversity, and we believe European policy makers will need to incentivise investment across a variety of energy sources in order to help drive energy security and independence.

Speeding up renewables

The EU has moved to accelerate investment in wind and solar power. Success will be dependent on simpler permitting processes for renewables and the cutting of red tape associated with new projects.

We believe this could add 20 Gigawatts of new capacity by the end of 2022. Successful implementation will be important for companies with significant renewable growth pipelines. Further discounts for rooftop solar could help accelerate the pace further.

Development of green hydrogen (derived from renewable sources) should also be accelerated, to replace grey hydrogen in industrial processes. While current European targets for green hydrogen look unlikely to be reached, we still expect substantial growth from current levels by 2030, which presents opportunities for large energy consumers to reduce emissions, and smaller players to help build out the infrastructure required.

A nuclear rethink?

The energy crisis has prompted European governments to look again at nuclear. The response is varied. While the UK and Belgium are exploring an extension to the operating lives of reactors, Germany has decided to proceed with shutdown of its remaining nuclear assets, with only a limited extension to operating lifetimes to help with energy security this winter.

While some European countries are now looking more favourably on nuclear as a component of net zero, any new-build reactors would merely replace ageing assets.

LNG: limited capacity

Importing more liquefied natural gas (LNG) is part of the short-term solution to wean Europe off Russian gas.

However, this requires regasification capabilities. Over a third of capacity is in Iberia, which has limited capacity to transport to the rest of Europe.

Momentum for new LNG terminals has increased, but investors may be hesitant, given that gas was vilified in Europe until recently. In the near term, we expect more growth in floating storage capacity, which can help to bridge the gap.

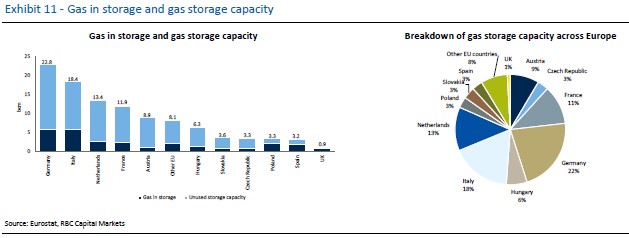

In fact, gas storage is key to security of supply, since it can provide over a quarter of the gas Europe consumes in winter. This is where the UK stands out, and even after the recent reopening of Rough Storage the UK is only likely to have storage for 4-5 days of gas demand.

Domestic supply: part of the solution

While higher LNG imports are the largest element in the European Commission’s plan to end dependency on Russia, we see a role for more domestic gas production too. Domestic gas is likely to be cheaper, as well as less carbon-intensive.

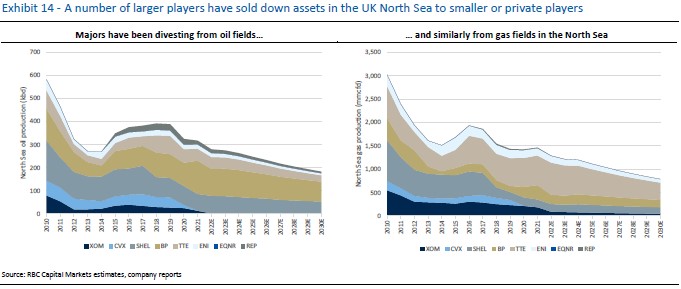

The larger oil and gas players have mostly divested from UK North Sea production. This leaves a smaller, more fragmented set of companies, with higher costs of debt and equity financing. Norway has a healthy ecosystem of players, but companies may want long term commitments from gas consumers before stepping up investments in a material way.

We see a significant opportunity for new projects with two- to three-year paybacks. However, banks and investors will need to be willing to support these with a more nuanced approach than has recently been the case.

In the face of shifting priorities, we believe European energy companies could be seen as part of the solution to Europe’s energy woes, rather than part of the problem. If stakeholders are to balance the energy trilemma, they will need to place equal emphasis on social and governance as well as environmental factors.

One country stands out positively on the continent. Norway’s stable fiscal regime and status as a net exporter of oil and gas has enabled it to subsidise its energy transition efforts, while also providing significant tax revenues for other parts of the economy. It has a key role to play in advancing its near neighbours’ energy security, in our view.