RBC Capital Markets’ Canadian Private Technology Conference highlighted a pivotal shift in how AI is perceived and deployed, the undeniable power of data, and a strategic re-evaluation of growth paradigms. Companies centered their conversations around these five defining themes, offering a clear window into where the market is heading next.

1. AI as a strategic growth driver

Companies are increasingly turning to AI as a source of strategic advantage. Productivity gains are being reinvested into better products, stronger market positioning, and entry into new verticals, underscoring AI’s role as a true technological unlock.

“[Many] companies are seeing 20–30% productivity gains in coding and product development. While these translate into tangible cost savings, the focus isn’t on cutting headcount or margin enhancement but on using AI to build better products.”

Paul Treiber, Director, RBC Capital Markets

As a result, Enterprise AI is now seen as mission critical, driving rapid adoption as organizations move from experimentation to production. Tangible ROI is emerging not only from cost savings, but also through new AI-driven revenue streams across a broader range of industries. Even if AI achieves just 30% of its potential in the coming years, it is expected to have a transformative impact across numerous sectors.

In highly regulated industries like healthcare and financial services, adoption is accelerating, with close attention being paid to risks around accuracy, security, and data governance. Still, the pace and scale of disruption remain up for debate, as companies balance urgency with responsible implementation.

2. Proprietary data as a competitive moat

Data remains the foundational enabler of AI, particularly in traditional machine learning applications. For firms operating at scale, proprietary data represents a growing source of competitive differentiation. This dynamic is even more pronounced in generative AI, where the quality and uniqueness of underlying datasets directly influence the relevance and reliability of outputs. As data grows in strategic value, organizations are expected to take a more protective stance toward their proprietary assets.

“While new tools can accelerate product development cycles, they cannot replicate the deep understanding of customer needs and pain points.”

Paul Treiber, Director, RBC Capital Markets

Nevertheless, domain expertise remains essential. While AI can accelerate product development, it’s sector-specific knowledge that ensures outputs are relevant, differentiated, and aligned with strategic goals. AI tools cannot replicate the deep understanding of customer needs and pain points that Vertical Market Software (VMS) incumbents have built over time. This gives VMS leaders a strong foundation to integrate AI in ways that deliver highly specialized solutions and expand their addressable market. Still, as competition accelerates, maintaining that edge will require ongoing vigilance and adaptation.

3. Robotics and industrial automation

Tariffs, near-shoring, and labor shortages are pushing North American manufacturers to find ways to improve both margins and productivity. Robotics and industrial automation platforms are emerging as viable solutions, especially in high-mix, low-volume (HMLV) environments, which have traditionally been harder and more costly to automate. Advances in vision perception, autonomy, and precision handling are making humanoid robotics increasingly capable of tackling these more complex manufacturing use cases in the next two to four years.

4. The “Rule of 50” era

There is a clear shift toward prioritizing measured, efficient growth over a “growth at all costs” mindset. As AI drives stronger operating leverage, many firms are finding they can scale meaningfully with leaner teams, contributing to the rise of more “Rule of 50” companies. Despite macro headwinds earlier in the quarter, resilience is improving as organizations and customers adjust to ongoing uncertainty.

5. Canada's push to lead in responsible innovation

Momentum is building around Canada’s role in the global AI landscape. With rising geopolitical pressure and growing trade friction accelerating interest in domestic innovation, Canada is increasingly being positioned as a leading AI hub. The focus is on balancing speed with responsibility, reinforcing the country’s place in the next wave of global technology leadership.

“The companies we hosted at RBC’s Private Technology Conference took great pride in their ability to help turn Canada into a hub for innovation.”

Paul Treiber, Director, RBC Capital Markets

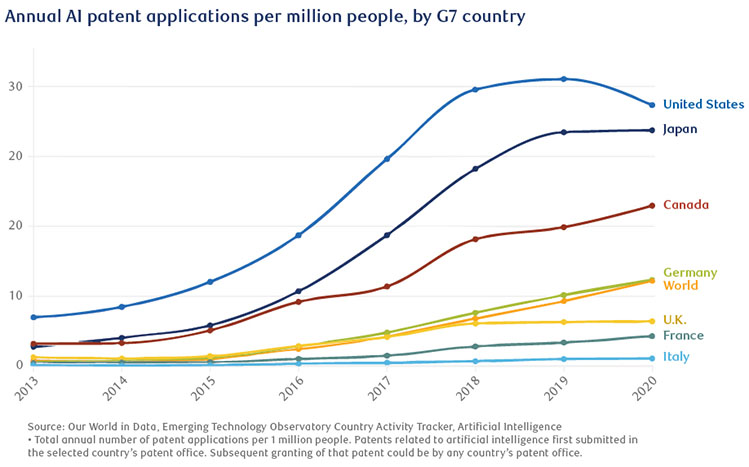

This ambition is supported by meaningful depth. Canada was among the first nations to launch a national AI strategy in 2017 and now has a strong research ecosystem, a growing pipeline of startups, and increasing commercial adoption1. A recent Statistics Canada survey found that the number of businesses using AI to deliver goods or services doubled between May 2024 and May 20252, though its effect on headcount has yet to be seen. Ambitious companies are emerging across the AI stack, backed by access to top-tier talent and growing investor interest. Together, these factors are strengthening Canada’s credibility and capacity to lead in shaping the future of AI.