As anticipated, President Trump deployed military forces to capture Venezuelan leader Nicolás Maduro and his wife in an operation that demonstrates President Trump's willingness to assert U.S. dominance in the Western Hemisphere. The situation at the time of writing remains very fluid, but we continue to caution market observers that it will be a long road back for the country, given its decades-long decline under the Chávez and Maduro regimes, as well as the fact that the U.S. regime change track record is not one of unambiguous success.

President Trump has declared U.S. control over the Venezuelan oil sector as a core objective of the military operation. We believe that this places a heavy burden on U.S. oil companies and will potentially force them to play a quasi-governmental role on the capacity building and development front. Oil executives currently operating in the country contend it will cost at least $10 billion annually to turn the sector around and that a stable security environment is an absolute prerequisite to expanding production capacity towards historical levels.

"Since the 2003 PDVSA oil workers' strike, the national oil company has essentially been run as an ATM for the military, leading to the exodus of thousands of skilled workers and extreme deterioration of physical infrastructure."

Helima Croft, Head of Global Commodity Strategy and MENA Research, RBC Capital Markets

Extracting the military from PDVSA as well as the broader economy could prove challenging, and the armed forces, particularly the colectivos, could potentially undermine an orderly transition. The fate of the extensive Chinese and Russian interests in the energy sector also appears to be a TBD situation at the time of writing.

President Trump's pledge that the U.S. will run Venezuela until there is an orderly transfer of power suggests that the U.S. is back in the nation-building business. It remains unclear at the time of writing which U.S. agencies and personnel will lead this enormous undertaking. Given the significant cutbacks to the State Department and the dismantling of USAID, the Pentagon and the U.S. Treasury department will likely have to play principal roles.

The list of challenges is long and includes removing the nearly six million small arms in circulation as well as facilitating what is expected to be one of the most complicated debt restructuring efforts ever undertaken. It is an open question which local partners the White House will work with given President Trump's public dismissal of the viability of a María Corina Machado-led government as well as Vice President Delcy Rodríguez's statements demanding the release of Maduro and condemnation of the U.S. action.

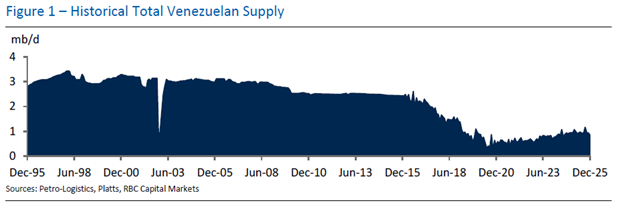

"There will undoubtedly be a segment of the market that will embrace a 'Mission Accomplished' narrative and will pencil-in an easy glide path back to 3 mb/d of production. However, all bets are off in a chaotic change of power scenario like what occurred in Libya or Iraq."

Helima Croft, Head of Global Commodity Strategy and MENA Research, RBC Capital Markets

Certainly, we think full sanctions relief could unlock several hundred kb/d of production over a 12-month period in an orderly transition situation. However, all bets are off in a chaotic change of power scenario like what occurred in Libya or Iraq. We also wonder what moves the Iranian government will now take to stave off a similar U.S.-led operation there given President Trump's warnings about possible military action this week.

Helima Croft authored "Venezuela: U.S. Back in the Nation Building Business?" published on January 3, 2026. For more information on the full report, please contact your RBC representative.