Key Points

- Saudi Arabia used its opening remarks at the 8th OPEC International Seminar to project confidence that unilateral production cuts will yield the desired data impact to silence the skeptics

- Another on-stage Seminar takeaway is that OPEC seems to be sticking to the strength in numbers doctrine

- Iran’s oil minister, Javad Owji, was also upbeat at the Seminar, expressing satisfaction on stage that his country’s production has climbed

Saudi Arabia used its opening remarks at the 8th OPEC International Seminar to project confidence that unilateral production cuts will yield the desired data impact to silence the skeptics.

HRH Prince Abdulaziz bin Salman explicitly acknowledged that this is a “show me” not a “tell me” oil market, and essentially implored market participants to watch and wait for the production cuts to take full effect. He also tried to put to rest the reoccurring rumor of a relationship rift with Russia, citing Moscow’s own production cut announcement as a sign that they remain in close cooperation. We found it noteworthy that Prince Abdulaziz mentioned that this was not the first time that the Kingdom unilaterally cut output alongside a collective OPEC adjustment, citing both the 2020 and 2021 cases. Currently,

Saudi’s 1 mb/d cut through August would bring the entire OPEC-13 group supply estimates down to ~28 mb/d in 3Q’23, the lowest since September 2021. It is our view that the Kingdom may replicate the 2021 playbook and keep this voluntary cut in place for three months as the Saudi oil minister seems very intent on rising to the “show me” challenge.

Another on-stage Seminar takeaway is that OPEC seems to be sticking to the strength in numbers doctrine, with the UAE’s minister HE Suhail Al Mazrouei indicating in our ministerial session on market stability and energy security that the group is looking to grow its ranks.

Immediately after that session, there were multiple reports of potential membership additions. The rumors of Emirati OPEC angst seemed to be in the rear-view mirror with Al Mazrouei championing OPEC’s potential membership expansion as well as having secured a bigger production quota for his country at the June meeting. Minister Al Mazrouei did Seminar double duty, sharing the stage with ministers from South Sudan and Congo to discuss the energy diversification effort. He emphasized that COP28 would be the most inclusive COP to date, and that developing nations will have an important seat at the table in the global climate discussion. The African ministers, for their part, urged Western leaders to “walk at their speed” as they seek to balance the access, affordability, and sustainability imperatives.

Iran’s oil minister, Javad Owji, was also upbeat at the Seminar, expressing satisfaction on stage that his country’s production has climbed to 3.8 mb/d (3 mb/d crude | 800 kb/d condensate).

We continue to contend that Iran is our most improved OPEC Watch List country at the midpoint of the year, as it has seen its economic and diplomatic positions enhanced. Minister Owji also showed no signs of regret about his country’s close relationship with Moscow, citing Russia’s investment in its energy sector as a sign that the country is open for business.

Russia did not have a significant presence at the Seminar aside from the TASS media partnership and junior diplomatic attendance.

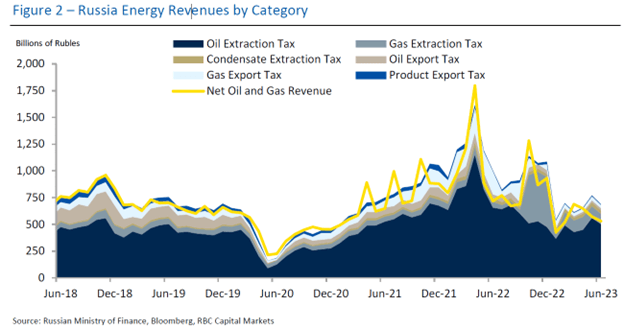

Nevertheless, the recent internal unrest, as well as Russia’s robust seaborne exports were the subject of considerable conversation in the conference corridors and hotel lobbies. Some seasoned experts indicated that the Russian production picture is more complicated than aggregate supply numbers suggest. For example, Deputy Prime Minister Novak is described as owing his political elevation to his success in managing the OPEC portfolio. Hence, they say it is likely that he has indeed asked the Russian companies to pull back exports. We estimate that Russian production has dropped roughly 300 kb/d through the first six months of the year.

A key difference between Russia and many OPEC nations has always been that Novak has had to manage multiple energy companies with powerful CEOs rather than a single national oil company.

We also continue to see Rosneft CEO Igor Sechin as a unique person of interest in the post-Prigozhin political landscape, given his deep state credentials/éminences grises. Finally, leading Russia experts at the Seminar noted that a post-Putin Russia may not be a more Western-friendly one, as nationalism seems to be on the rise and many opponents of the regime have already left the country. They also contend that Russia may be more resilient to sanctions than many in the West realize, given that the country endured years of economic deprivation and isolation during the Cold War, and like Iran, the system may have adapted to the difficult circumstances.