Case Study at a Glance

Overall, investment in digital channels is the top corporate banking product priority—globally. Investments in this area now focus on more than mere product functionality, but increasingly on new digital experiences powered by modern technology architecture.

In the heightened competitive environment, RBC Clear stands out for developing an integrated, contextual, digital transaction banking experience from onboarding to transaction execution and insights.

– Colin Kerr, Celent

Table 1: Case Study at a Glance

- Deeper client relationships across the organization

- RBC brand and reputation amplification in the US

- Deeper access to large and attractive growth market

- Lower counterparty risk

- Stable source of funding at lower cost

- Decreased costs

- All components of the platform are cloud-native and micro-services enabled

- All experiences are designed from a client perspective, to be simple, intuitive, and omni-channel

- RBC differentiates with a "build and collaborate" strategy with client-informed experiences

Celent Perspective

Celent believes digital channels and platforms are central to corporate banking experiences, offering operational improvements and enabling new services.

Much of a bank's corporate banking revenue is attributable to meeting the complex financial operational needs of business customers, who rely on their banks to deliver an extensive set of products and services. Banks that want to attract and retain a substantial piece of an institutional customer's banking business must continue to invest in the technology infrastructure required to deliver a broad array of products across multiple corporate banking product segments. Furthermore, in Celent's conversations with leading banks, the quality of the digital experience is seen as a driver of client retention and product adoption. Businesses seek banking relationships that balance high-tech products and services with high-touch strategic advisory services.

Voice of the customer

Listening to the voice of the customer helps drive innovation and shape product road maps. Leading banks now engage select clients for feedback on product road maps, solution design, and participation in early adopter programs. RBC drew upon its deep relationships with Fortune 1000 companies to assemble a client advisory board. Over the course of over 150 conversations with corporate treasurers, the bank grew to understand clients' typical cash management journeys, including their numerous pain points with existing cash management providers.

Design

RBC used these insights and design-thinking techniques to learn not only what these corporate treasurers need now but also what they will need in the future. Having designed for the complexity of the largest companies, RBC is confident that RBC Clear can serve organizations of diverse sizes across both the for-profit and non-profit space.

New technology stack

RBC acknowledged that this vision would require a new technology stack, free from outdated legacy systems that were prevalent over the past 30 years. By designing with today's technology, the bank could reimagine process flows to meet client desires, rather than being constrained by legacy product and application architecture, and increase its speed of delivery.

Reinventing cash management

Celent selected RBC Clear for this year's Model Bank Award for Reinventing Cash Management. The bank has brought a bold vision to life: entering a new market with a next-generation technology platform. The results not only meet client needs, but also lower the bank's cost of funding.

Detailed Description

RBC Clear represents a new business opportunity for the RBC Capital Markets division in the US. Since the financial crisis of 2008, transaction banking has emerged as a vital source of stable revenue with low capital costs, driving banks to invest heavily in the technology infrastructure necessary to meet the complex financial needs of corporate clients.

Introduction

RBC is the largest bank in Canada and the tenth largest investment bank by fees1 with CAD$2.2 trillion in assets and ~98,000 employees across 29 countries. RBC Clear was established with the remit to stand up a digital-first, cloud-native, cash management platform for large corporations. Table 2 is a snapshot of key statistics.

Table 2: Royal Bank of Canada (RBC)

Snapshot as of October 31, 2024

Source: Royal Bank of Canada, Celent research

of banks stated that corporate digital banking platforms are the top product priority.

Source: Celent Dimensions Survey 2025

Digital banking platforms and digital channels are often used interchangeably. Celent's annual Dimensions surveys consistently show this area as the top priority. In fact, in 2025 the gap has widened over the second-placed products.

Celent sees many banks in the US modernizing and rejuvenating their digital banking platforms and cash management capabilities. However, the RBC Clear initiative is a new market entry in the US cash management market that required not just a new client experience, but a completely new technology stack.

1 Dealogic based on global investment banking fees LTM Q1/24

Opportunity

In the US, RBC Capital Markets has full industry sector coverage and investment banking product range, as well as capabilities in credit, secured lending, municipal finance, fixed income, currencies and commodities, and equities. As part of this, the bank has a lending presence in over half of the Fortune 1000. However, due to its historical lack of corporate cash management capabilities in the US, clients had been unable to use RBC for their working capital needs in the US. RBC recognized that this was a sizable gap in its client offering, as well as a disadvantage to its funding costs (requiring RBC to rely on costlier wholesale funding sources versus an organic deposit base). To fill these gaps, the bank launched RBC Clear, a reimagined cash management business in the US.

A minimum viable product (MVP) offering was launched for the first beta clients in October 2023. Since then, the bank has onboarded over 100 clients and rolled out another wave of functionality, including ACH payments. In addition to providing RBC Capital Markets division clients with a more comprehensive offering, it will also serve as a foundation for long-term revenue growth.

Solution

RBC Clear has created a digital-first cash management solution that is intended to put clients in control of their working capital.

Celent considers engaging corporate clients in advisory boards to steer product strategy as a best practice. Before building this new platform, RBC drew upon its deep relationships with Fortune 1000 companies to assemble a client advisory board. Over the course of over 150 conversations with corporate treasurers, the bank grew to understand clients' typical cash management journeys, including their numerous pain points with existing cash management providers. RBC used these insights and design-thinking techniques to learn not only what these corporate treasurers need now but also what they will need in the future. Having designed for the needs of the largest, most complex companies, RBC is confident that their offering can serve organizations of diverse sizes across both the for-profit and non-profit space.

RBC Clear is a platform purpose-built for clients' needs. RBC synthesized the client learnings and developed a bold vision that reimagines cash management from the ground up. The RBC team knew that the ability to deliver this vision was strongly reliant on leveraging the right technology and building with a fintech mindset paired with industrial heft. RBC's methods, processes, and governance were all a Tier 1 bank model, including reimagining operations and controls and building them into the core processes to bring RBC Clear to market. The bank evaluated its existing technology, including payments and core systems, with a goal of building quickly without sacrificing the integrity of the design. One major advantage was leveraging RBC's extensive investments in areas such as cloud and AI.

Innovation Highlights

Through the use of increased digitization of experiences and workflows, corporate treasury teams receive a "consumerization of corporate banking" experience. When RBC Clear was initially launched in 2023, the focus was on creating a superb onboarding experience and ensuring that transparency was evident in every aspect of the user experience.

Figure 1 shows a selection of innovation highlights.

Fast and simplified onboarding

Fast and simplified onboarding Transparency in payments

Transparency in payments Omni channel servicing

Omni channel servicing Payment orchestration and intelligent file processing

Payment orchestration and intelligent file processing

Source: Royal Bank of Canada

Fast and simplified onboarding

A major US retailer was successfully onboarded onto the RBC Clear platform in a single day.

Source: Royal Bank of Canada

RBC Clear combines modern technology with automated behind-the-scenes workflows that enable clients to onboard in as little as a single day. This compares very favorably to typical industry timelines of 35–60 days. Solution highlights include:

- Reusing documents already on file with RBC, rather than making clients resubmit paperwork that is already on file elsewhere in the bank.

- Tracking a client's onboarding process on the RBC Clear platform so they can easily see where they are in the process and what they need to do next.

- A "shopping cart" design theme that allows an appointed representative of clients with multiple related entities to digitally orchestrate the opening of multiple accounts across the group at the same time, and the ability to clone existing account structures in a simplified manner.

- A comprehensive self-service entitlement engine that permits clients to maintain complex user access privileges in a simplified manner.

Transparency in payments

Clients no longer have to chase the bank to find out the status of their payments.

Source: Royal Bank of Canada

The RBC Clear payment experience helps treasurers expedite payments and experience more transparency and agency in payment operations. This is achieved by providing near real-time statuses on all payments, from creation through approval, through the payment being sent, in the form of a visual "pizza tracker" that is available to clients in the portal. Clients will know right away if any errors have occurred.

Omni channel servicing

Omni-channel functionality offers users more visibility into all aspects of their relationship with RBC Clear.

Source: Royal Bank of Canada

Every component of RBC Clear was designed to be omni channel with an API-first mindset. Having to call the bank has been the de facto process for many corporate treasury teams for everything from searching for a payment's status, to resolution updates, to updating administrative rights. RBC Clear provides clients these essential capabilities through self-service. For example, client users can easily view and change access rights through the portal, with no call to the bank or manual paperwork necessary.

Throughout 2024, as client adoption grew, the bank launched more complex products—all adhering to its paradigm of seamless client experience. The RBC product team took the time to understand clients' critical, time-consuming workflows and replaced them with new, automated solutions. The rollout of the ACH offering serves as a good example of this.

- Simple integrations and setup: RBC Clear has designed a host-to-host (H2H) connectivity process that is simple enough to be done by their clients' treasury account administrators, with only minimal consultation needed by their clients' technology teams. With some upfront preparation by clients, the entire ACH set-up—including establishing H2H connectivity—can be completed within a day or two. Included in this is a customer integration testing (CIT) environment that is self-service, user-friendly, and available 24/7/365, which allows clients to test their payment file configuration before going live in production.

- Customizable solutions: As RBC Clear offers more complex products and services, clients can select and configure product bundles suited to their individualized needs. In ACH, this means that clients can set the percentage of failed transactions (from 0% to 100%) at which the entire file is rejected. Therefore, one bad transaction will not cause an entire file to be rejected (unless the client has chosen that setting).

- Payment orchestration and intelligent file processing: A new payment orchestration engine sits on the top of the bank's payment rails and provides a "pre-screening" capability. This streamlines the entire process flow and ensures that every payment has gone through all screening functions (sanction, fraud, AML, credit limit, etc.) without issue before being sent to the relevant payment rail. During RBC's early client focus groups, one theme that emerged was how much time treasury teams spent chasing and calling their bank to find out the status of their payments.

Technology

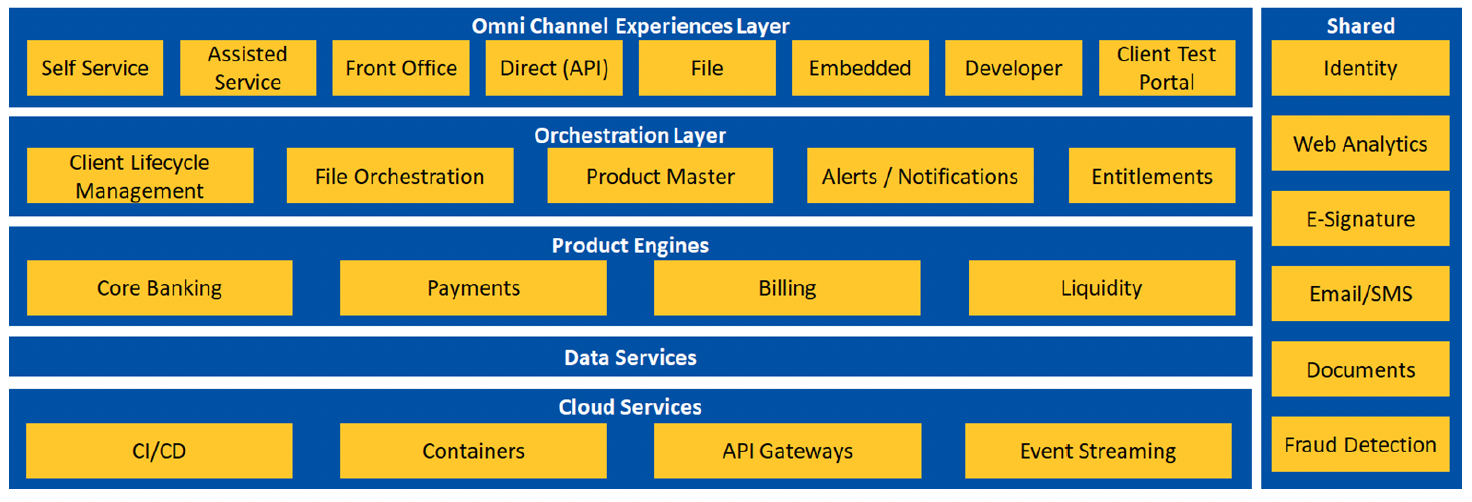

Early on, RBC acknowledged that the reimagined vision would require a new technology stack, free from outdated legacy systems that were omnipresent over the past 30 years. RBC Clear is API-first and was built with cloud-native architecture. It is microservices based and employs next-gen technology. This sets it apart from other banks that have repurposed sub-optimal, traditional infrastructure and applications. By designing with today's technology, the bank could redesign process flows to meet client needs, rather than being constrained by legacy product and application architecture.

The RBC team followed a philosophy of "shamelessly borrow, generously give" by leveraging existing best-in-breed components and contributing to the bank's IP wherever possible. The build was characterized by three features:

- All components of the platform are cloud-native and microservices based.

The platform allows RBC to benefit from the cloud's elasticity, availability, and automation, as well as faster delivery and feedback cycles. Cost efficiency is made possible via on-demand system architecture with optimized compute, storage, and network usage. This cloud-based architecture is designed to provide resiliency and high availability of banking services.

- All experiences are designed to be omni channel.

All customer journeys are based on extensive design thinking workshops conducted with key clients. The experiences are highly digital and offered across multiple channels (self-service, assisted service, and direct). The channels are fully digitized and self-serve to increase efficiency and eliminate reliance on the back-office operations team.

- RBC differentiates with a "build and buy" strategy.

RBC selected industry leading vendors for its next-gen core banking platform and payments processing. Other components were built from the ground up in an open architecture that enables the integration of additional vendor platforms. RBC's architecture enables integration with third-party service providers and partners. RBC also wishes to recognize the contributions of their cloud platform provider, Microsoft.

Figure 2 shows a high-level illustration of RBC Clear.

Source: Royal Bank of Canada

An entrepreneurial mentality permeates the business unit, but it is held to the same risk, compliance, and control standards as the rest of the bank. Risk and controls are foundational to the build. The platform serves as an innovation incubator, pioneering a new development paradigm and creating technical assets (especially in the open cloud and AI arena) that will be leveraged across the enterprise. Additionally, components are being evaluated for use in other RBC banking divisions, contributing to the backbone of the platform.

Development Timeline

Due diligence for this initiative kicked off in late 2021 and RBC started building in September 2022. A beta release to early adopters went live in the marketplace in October 2023, followed by the brand launch in April 2024. The majority of the time was spent designing an end-to-end client journey and experience that would be truly focused on simplifying the experience for the most sophisticated clients.

Results

The bank has already seen benefits across the RBC ecosystem from new ways of working and the agile frameworks that were used to deliver across many value streams. Those frameworks leverage key assets to integrate with other parts of the RBC Capital Markets division, which includes data aggregation and display, and key processes (e.g., onboarding). Additionally, from a P&L standpoint, new clients on the platform are already driving interest revenue. Some highlights are shown in Figure 3.

- 1 day – time to onboard a major US retailer

- 100+ clients onboarded within the first year

- Stable source of funding at lower cost, and lower counterparty risk

"RBC Clear is the next generation of cash management platforms, which puts clients in control of their working capital and leverages today's technology to create a frictionless and unprecedented experience."

— Kartik Kaushik – Managing Director, Head of RBC Clear

Source: Royal Bank of Canada

Other qualitative metrics include:

- Deeper client relationships: In offering cash management, the RBC Capital Markets division strengthens relationships with clients. Working capital is a day-to-day activity and building RBC Clear helps bring RBC closer to those treasury activities. Complementary areas of strength for RBC Capital Markets are in lending and investment banking, which both focus on large, episodic transactions. Thus, the cash management relationship is a unique one, and one that helps bring RBC's mission to deliver complete solutions as One RBC™ to life.

- RBC brand and reputation amplification in the US: This initiative should help demonstrate RBC's commitment to the US market and provide an opportunity to build the overall RBC brand in the US. RBC is a trusted mainstay of Canadian banking, and the bank hopes to achieve similar recognition in the US.

- Large and attractive growth market: RBC Clear was highlighted as a key component of RBC's overall growth strategy during RBC's Investor Day earlier this year. The company recognized that the transaction banking category represents 28% of the global Corporate and Investment Bank wallet and is looking to drive growth and disrupt the market with this differentiated offering.

- Decreased counterparty risk: RBC anticipates reducing risk by providing the bank with an in-house cash management solution for its own deposit and payment needs.

- Decreased costs: Deposits placed through RBC Clear reduce the bank's US funding costs. This enables new lending deals that would not have been profitable in the past.

Success Factors and Lessons Learned

In reviewing the success of the RBC Clear initiative, Celent views that the critical lessons learned can be categorized into four main areas:

- Client engagement and collaboration: The inputs and learnings from treasury clients allowed the bank to prioritize capabilities and features that would provide the greatest benefit.

- Innovation should not be isolated: It is essential to involve all stakeholders, including clients and the entire organization, in the innovation process. This approach ensures that the new offering is well-received and beneficial to all parties involved.

- Emphasize institutional benefits: The innovation should not only benefit a specific area but should carry the entire institution forward. RBC Clear is a new business that has lasting effects on corporate and investment banking.

- Be bold and foster a culture of change: It is important to think big and challenge established beliefs. This involves unlearning legacy processes, making technology work for you, and promoting a distributed and empowered decision-making culture. This mindset is essential for fostering a startup or fintech culture within an institution, without compromising the organization's strength.

"Client collaboration is at the core of RBC Clear. Taking the time to deeply listen to corporate treasurers has enabled us to create a purpose-built, digital-first platform that reimagines the cash management client experience, creating a modern architecture foundation for building the future."

– Kartik Kaushik, Managing Director, Head of RBC Clear

Leveraging Celent's Expertise

If you found this report valuable, you might consider engaging with Celent for custom analysis and research. Our collective experience and the knowledge we gained while working on this report can help you streamline the creation, refinement, or execution of your strategies.

Support for Financial Institutions

Typical projects we support include:

- Vendor short listing and selection. We perform discovery specific to you and your business to better understand your unique needs. We then create and administer a custom RFI to selected vendors to assist you in making rapid and accurate vendor choices.

- Business practice evaluations. We spend time evaluating your business processes and requirements. Based on our knowledge of the market, we identify potential process or technology constraints and provide clear insights that will help you implement industry best practices.

- IT and business strategy creation. We collect perspectives from your executive team, your front line business and IT staff, and your customers. We then analyze your current position, institutional capabilities, and technology against your goals. If necessary, we help you reformulate your technology and business plans to address short-term and long-term needs.

Support for Vendors

We provide services that help you refine your product and service offerings. Examples include:

- Product and service strategy evaluation. We help you assess your market position in terms of functionality, technology, and services. Our strategy workshops will help you target the right customers and map your offerings to their needs.

- Market messaging and collateral review. Based on our extensive experience with your potential clients, we assess your marketing and sales materials—including your website and any collateral.

For more information about this case study,

Colin Kerr, ckerr@celent.com

This is an authorized reprint of a Celent report profiling a Model Bank Award winning technology initiative and was not sponsored by RBC in any way. Reprint granted to RBC. For more information, please contact Celent (www.celent.com).