Published January 12, 2024 | 4 min read

Key Points

- Despite ever-growing competitive pressures, there is sustained enthusiasm for innovation in the biotech sector.

- A rise in M&A transactions may create a virtuous cycle, fostering further growth and improvement for the biotech landscape in 2024.

- Drug pricing and anti-industry sentiment might hold back revenue despite an improved macro-outlook.

- Large biotechs face slower growth, while smaller players struggle with limited funding.

- A key trend to watch will be if cash-rich, growth-poor large-caps can integrate with cash-poor but innovation-rich counterparts.

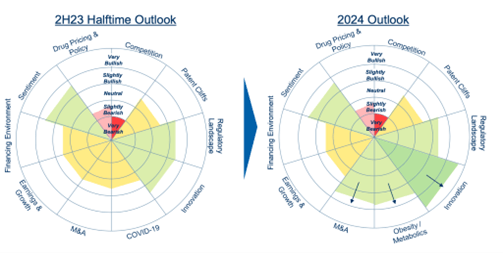

While biotech underperformed the broader market in 2023, RBC remains optimistic in 2024, noting significant signs of improvement across innovation and M&A.

Source: RBC Capital Markets

Innovation at the helm: A pivotal force driving biotech sector advancements.

Innovation continues to propel advancements in the sector, driven by an increasingly sophisticated grasp of biology and the intricacies of diseases. Novel therapeutic strategies benefit from more efficient, effective, and targeted modalities, reshaping the landscape of treatment approaches. Many emerging and maturing modalities/indications are under study, including ADCs, bispecifics, and radiopharmaceuticals in cancer, gene therapy/editing, neuropsychiatry, diabesity/CV, and cell therapy for oncology and inflammation. Innovation even remains top of mind for drugs that have experienced massive success. GLP-1 drugs may become less of a perceived headwind to the biotech sector, as their current shortcomings, like weight regain and loss of lean muscle, serve as a significant opportunity for companies developing drugs in adjacent spaces and companies working on next-gen therapies.

Innovation, however, is a double-edged sword; competition in the biotech space remains high, with multiple companies operating in overlapping therapeutic areas. This has the potential to limit long-term revenue share and slow development. Some long-term potential of blockbusters face uncertainty with the imminent threat of generic and biosimilar competition entering the marketplace.

The Inflation Reduction Act (IRA) also serves as a potential hindrance to innovation as companies reconsider development in the small molecules and biologics space given shortened lifespans. IRA policy combined with a high rates environment and general market volatility, has limited available capital, creating obstacles to R&D for biopharma firms.

“Innovation, increased M&A, and a better macro backdrop will help biotech remain constructive. We should see better performance more broadly among both catalyst-driven and value-oriented names.”

- Brian Abrahams M.D. Head of Biotechnology Research

M&A: A growth driver for the coming year

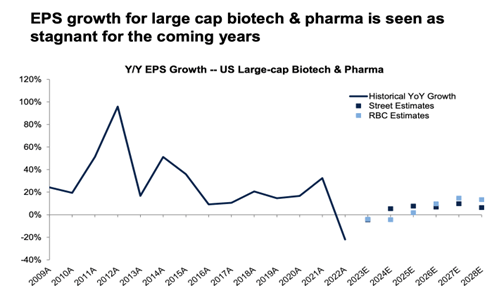

Following revenue boosts from GLP-1 and COVID-19, major biopharmaceutical companies are currently boasting record-high cash levels at approximately $199 billion. Given that many of these large-cap companies are facing modest EPS growth amidst major patent cliffs, and some have experienced setbacks within their own pipeline, acquiring smid-cap companies with attractive profiles could be key to ensuring long-term success.

Note: Consensus estimates obtained from FactSet on 11/20/2023

Source: RBC Capital Markets, Company reports, FRED, FactSet

Potential take-out targets include smid-cap companies who have de-risked commercial or near-commercial stage drugs, companies with platform technologies in emerging areas, and companies with strong assets in the metabolic and obesity realm. Along with M&A, companies have begun exploring restructuring efforts in order to cut costs, but it will take time for this to translate into EPS re-acceleration.

“As many as half the 300 unprofitable smallest mid cap biotechs have less than a year and a half of cash and will likely need to raise capital. Despite an improved funding picture, it may still be tough for those companies without catalysts.”

- Brian Abrahams M.D. Head of Biotechnology Research

Approximately half of the around 300 unprofitable small and mid-cap biotech firms, excluding microcaps, are predicted to have less than 18 months of cash on hand, which should necessitate capital raising in the months ahead. Although follow-on amounts and average deal sizes are trending upwards, the majority of deals are likely to remain contingent on positive clinical updates. Companies lacking such updates or facing limited catalysts may need to explore creative and potentially highly dilutive financing. A key trend to watch in the coming year is whether cash-rich, growth-poor large caps can integrate with cash-poor but innovation-rich counterparts.

Navigating forward: the dynamics of an improving but cautious macro environment

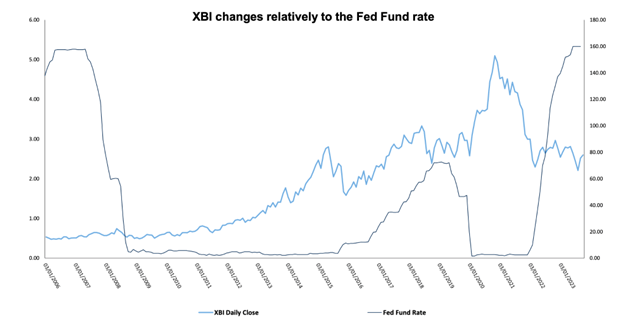

A slowdown in interest rate hikes is expected to create a conducive atmosphere for investment in smaller-cap biotech enterprises. Historical trends, including the XBI index's inverse relationship with the federal funds rate, underscore the biotech sector's historical resilience and quick recovery during economic upswings.

Source: RBC Capital Markets estimates, FactSet

While the IRA and Medicare discounting are expected to negatively impact biopharma revenue, many Street projections now factor in its effects more accurately; various strategies have been deployed to offset this revenue loss, including M&A. Acquisition approaches are anticipated to further stabilize the financing environment, leading to a more even pace of deals in 2024, with IPOs primarily among companies with clinical validation and follow-ons for companies following key de-risking events. However, even with a more favorable macroeconomic environment, limited market tolerance is expected for higher-risk stories; on the whole, investors appear to be taking a risk-averse stance heading into 2024.

“The regulatory environment will not be as big an impediment as we feared. Large caps are exploring an array of M&A options in order to grow and help drive newer capabilities for them. We expect this to be a focus, especially with small and mid-caps in the earlier stage with clinically validated assets, particularly in oncology, I&I, and rare diseases.”

- Gregory Renza, M.D., Senior Biotechnology Research Analyst

Bipartisan anti-industry sentiments, which are expected to be a talking point on the upcoming campaign trail, have the potential to further temper enthusiasm within the biotech sector. There has been recent discussion within the Democratic party of potentially expanding the IRA and enabling patent march-in rights, while on the Republican side, there has been strong admonition against the biopharma industry, stating that people are getting “ripped off” by drug prices. Furthermore, state legislatures are increasingly engaged in healthcare reforms, with a distinct rise in the adoption of prescription drug affordability boards (PDABs) that have the capacity to impose price caps on medicines. Lastly, the impending possibility of a government shutdown in February introduces concerns about impediments to FDA activities and sector-wide disruptions.

“Given our view that a summary judgement against the IRA is highly unlikely and that Congress has no appetite to actually make changes to the bill, we see implementation progressing in 2024, with the key event being the start of price negotiations in February, which will culminate with the publication of the negotiated prices on September 1st of 2024.”

- Leonid Timashev, PhD, Analyst

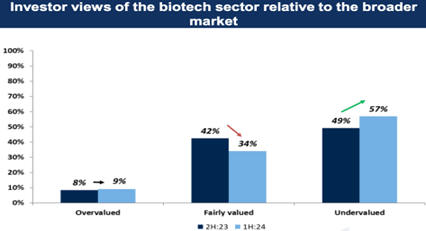

Despite these negative influences, overall, sentiment appears favorable, with the RBC investor survey showcasing a noticeable uptick in optimism relative to mid-year, especially in terms of planned positioning and expected biotech performance, with 57% of investors viewing the sector as undervalued (vs. 49% in 2H23), 55% of investors of thinking that biotech will outperform the broader sector (vs. 53% in 2H23), and the majority of investors planning to either maintain or increase their position in 2024.

Source: RBC Capital Markets Survey, Factset. *Data as of 12/05/2023 market close.

Brian Abrahams, Luca Issi, Gregory Renza, and Leonid Timashev authored “2024 RBC Global Biotech Outlook: Turning the Corner,” published on December 12, 2023. For more information about the full report, please contact your RBC representative.