Published February 17, 2022 | 4 min read

Key Points

- Investors are increasingly viewing the space as undervalued, signaling that the biotech industry could be ready to bounce back.

- M&A is a large potential tailwind, with an uptick due on stronger balance sheets, looming patent expirations, depressed smid-cap valuations and potential visibility on a post-pandemic world.

- IPOs and investment are also still high, despite some poor post-market performance, and there’s a better landscape for drug policy and regulation ahead.

- But competition, continued COVID pressure and patent cliffs all present potential barriers to growth.

The early successes of the COVID-19 vaccination program, along with a number of innovative breakthroughs, drove record capital flow and enthusiasm for the biotech sector in 2020. But the sector cooled considerably in 2021, with the XBI down 21% overall last year, and an additional ~19% thus far in 2022. Clinical trial failures, regulatory setbacks, drug pricing concerns and a lull in M&A all contributed to the slowdown, while newly public small firms faced the challenge of moving from blue-sky potential to concrete business models.

There still remain some prices, especially among smid-caps, that seem inflated relative to their stage and risk level, but on the whole, the sector has slowed too much. There are increasingly compelling valuations among large-caps and reward/risk setups among smaller-caps that should propel appreciation through this year. There are also a number of macro tailwinds that make the backdrop more favorable in 2022, while at an individual company level, some big names have big trial data and drug decisions due this year that could reverberate and reignite enthusiasm.

“M&A activity is due for an uptick in light of stronger balance sheets, looming patent expirations, depressed smid-cap valuations and potential visibility on a post-pandemic world.”

However, the sector is growing and that breadth and diversity means less broad ripple effects from positive developments and potentially difficult stock selection going forward. COVID-19 could also cut both ways for biotech this year, and we see hurdles for 2022 growth given higher comps in FY2021 than FY2020, especially on the COVID-related business contributions to top-/bottom-line growth in 2021 so far.

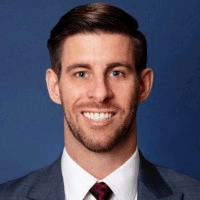

Investor sentiment suggests increasing appetite

One sign of potential rebound is the strengthening investor appetite for the group. According to our latest investor survey, 66% think that biotech will outperform the broader market in 2022 and 58% plan to increase their exposure to the sector. The majority of investors (64%) also see the sector as undervalued versus our survey results from the second half 2021 where only 49% thought biotech was undervalued.

Source: RBC Capital Markets Survey, Factset.

Source: RBC Capital Markets Survey, Factset.

*Data as of 12/10/2021 market close.

Investors have strengthened their views on M&A as the biggest tailwind going into 2022, and we agree. M&A activity is due for an uptick in light of stronger balance sheets, looming patent expirations, depressed smid-cap valuations and potential visibility on a post-pandemic world. We expect single-asset companies in mid-to-late stage clinical development valued at $1 billion to $5 billion to be the sweet spot for most activity, though we wouldn’t be surprised by a large blockbuster deal.

The sustained influence of COVID-19

The pandemic narrative has a role to play here, but it’s a mixed picture. If 2022 sees market volatility due to continued pandemic worries, companies may continue to sit on the sidelines or deploy their cash towards dividends and buybacks instead of M&A. But the same worries could ensure that biotech continues to benefit from the R&D spotlight and vaccine/treatment revenue.

If we get nearer to a post-pandemic world, there are still risks and benefits. Reopening could see drug launch momentum improve with greater company-physician-patient interactions on the plus side. But reopening may also encourage investors to divert money flow to other sectors with more potential upflow, such as tourism and hospitality, as the virus transitions from pandemic to endemic.

The landscape for policy and regulation improves

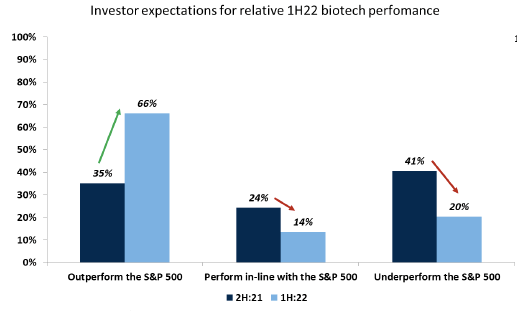

Drug policy and the regulatory landscape both provide more tangible upsides for 2022. The ongoing policy gridlock in Washington means reforms are unlikely for now. Even if some reform measures were to pass, we see them as a clearing event that may remove the overhang and attract generalists to the space but with only limited material impact on the bottom line. And that’s a big if, since mid-terms are coming up and there’s an increasingly likelihood that Republicans could recapture one of the legislative bodies this year.

Source: RBC Capital Markets estimates

The FDA Commissioner Nominee Dr. Robert Califf should bring stability and a history of support for innovative technologies if confirmed. Regulatory bodies are also projecting amenability to the key gene therapy space and permissiveness on accelerated approvals, which will perpetuate a favorable environment for drug approvals and label expansions. However, companies will still need to conduct high-quality clinical trials and Dr. Califf has shown stricter scrutiny of chemistry, manufacturing and controls, which could impact biologics and novel modalities (gene and cell therapies).

Barriers to growth

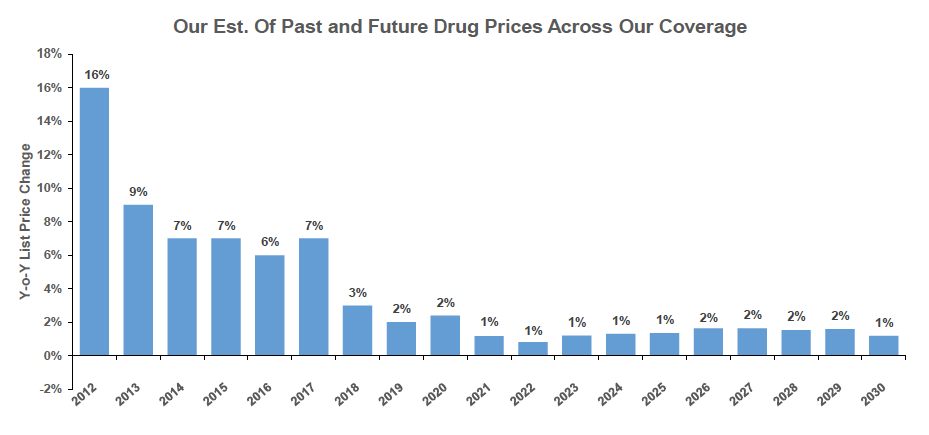

Growth for biotechs in 2022 is uncertain, with long-term EPS/sales growth expectations near the lowest levels in years. A number of factors are coming to a head here. If we continue to see more variants of concern similar to Omicron, specialities that require in-patient visits and elective specialities will be impacted and higher costs in developing new COVID vaccines and treatments could add pressure to margins. At the same time, franchises are maturing and the new entrance and continued penetration for legacy blockbuster biosimilars could potentially discount novel product launches – although they could also increase M&A sentiment.

There are higher comps of 2021 versus 2020, in some cases boosted by COVID, and increased competition and upcoming patent cliffs will make some investors cautious. The fact that key biotech drugs from a number of big players will lose their exclusivity before the end of the year continues to weigh on sector sentiment, although it could be balanced by pipeline enhancements and better business development efforts. Competition is also an important headwind, as multiple biotechs and pharmas are pursuing the same promising targets or disease areas and solid products may struggle to launch.

“Our revenue estimates for select RBC covered legacy large cap names are aligned with the Street through 2025, but we are cautious on the long-term outlook (2026).”

Source: RBC Capital Markets estimates, FactSet

Reasons for optimism

Increased investment in early-stage companies in the private market in 2021 should result in a robust pipeline of potential future IPOs and, with weak sector performance in 2021, favorable valuations at base could attract more investments in the public market.

In recent years, biotech innovation has been a key driver of the sector, and is expected to continue at a rapid pace – possibly benefiting from R&D advances and funding following the pandemic. We expect innovation around new drug targets, design, and manufacturing, as well as delivery of advanced cell and gene therapies and expansion into new diseases particularly in the cancer, neurology, and rare disease spaces, all of which will drive enthusiasm for the industry in 2022.

Brian Abrahams, Kennen MacKay, Gregory Renza, Luca Issi and our European biotech research team authored “2022 RBC Biotech Outlook Report: Opportunities Abound, After a Tough Year” published on December 14, 2021. For more information about the full report, please contact your RBC representative.