Published February 24, 2022 | 3 min read

Key Points

- The long term fundamentals are still very strong as adoption is accelerating and the vast majority of the opportunity is still ahead.

- Total addressable market in the space is very large and we are still in the very early days of penetration.

- Key themes for 2022 include virtual care, AI alleviating labor challenges and continued digitization of marketing in pharma.

- It’s increasingly difficult to discern which companies and strategies will ultimately prove successful, which will continue to weigh on valuations, but also represents an opportunity for investors.

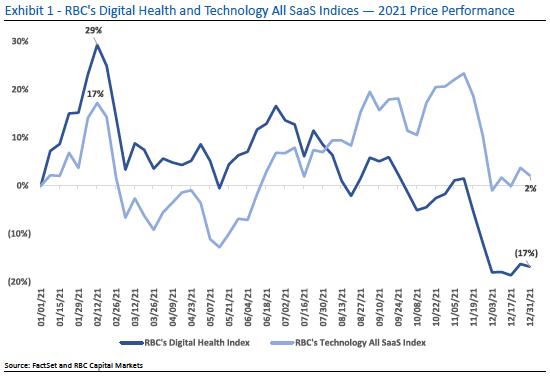

Digital health was on a high in 2020, with the RBC Digital Health Index, a composite of 62 stocks, rising 82%. But 2021 saw a downward adjustment with a fall of 17%, despite the S&P500 rising 16%. Certainly, 2021 was a challenging year but much of the weakness in the stocks was due to their sensitivity to long-term rate and inflation outlooks. Multiples in the wider tech space reduced for the same reason.

The fact remains that the total addressable market and long term opportunity in the space is very large and we are still in the very early days of penetration. We expect investor interest in the space to continue to grow. Investors are looking for innovation, which digital health has in spades, and adoption of various solutions is accelerating.

Continued growth in virtual healthcare

Virtual healthcare growth is evident in the profound impact of the pandemic on virtual care. From a historically low utilization, telemedicine exploded as federal and state governments quickly relaxed regulations to help patients during stay-at-home orders. We expect 2022 to give us our first glimpse into what virtual care utilization will start to look like in a more normalized environment.

Payers are increasingly designing plans to incentivize virtual care adoption and providers are further integrating telehealth into workflows. Meanwhile, consumers are sharpening their preferences for the right mix of virtual and in-person care, which is deepening trust and brand loyalty for preferred providers. We expect the regulatory and reimbursement backdrop to continue becoming more telehealth and remote-patient-monitoring friendly, further powering the sector.

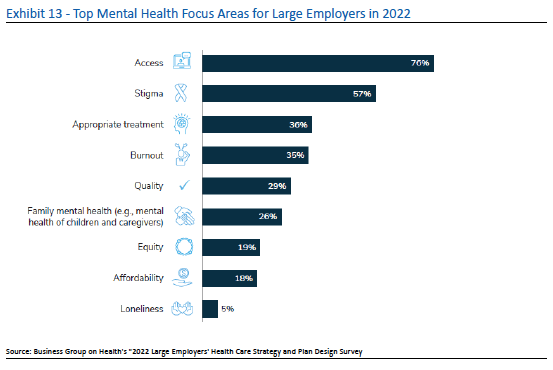

There is a renewed focus on mental health following the pandemic, which accelerated the global mental health crisis. At the same time, there is growing recognition of the links between behavioral health issues and medical spend, which is encouraging payers to include more behavioral health benefits into plan designs.

Supporting technologies

Just as the pandemic kept patients out of doctors’ offices, driving virtual care adoption, it also kept out pharma sales reps, moving marketing dollars increasingly towards digital channels. Given the scale ($30B+) spent on marketing each year, we believe there is room to support growth across multiple vendors. The opportunity as it relates to digital marketing vendors will likely be more than $1 billion each year as the channel mix should continue to shift in favor of digital solutions and away from physical solutions such as free drug samples.

The pandemic is once more the culprit as we look at exacerbated staffing shortages across the entire healthcare sector. As these labor pressures continue, companies will increasingly leverage technology to optimize their resources or outsource entire functions. AI can streamline functions from low-skill revenue cycle management to high-skill drug discovery, making it a necessary capability to remain competitive today.

"Just as the pandemic kept patients out of doctors’ offices, driving virtual care adoption, it also kept out pharma sales reps, moving marketing dollars increasingly towards digital channels."

"Just as the pandemic kept patients out of doctors’ offices, driving virtual care adoption, it also kept out pharma sales reps, moving marketing dollars increasingly towards digital channels."

Sean Dodge, Healthcare Equity Analyst, RBC Capital Markets, LLC

An evolving competitive landscape

These trends are only part of the rapid changes and increasing complexity of the competitive landscape across the digital health space. For existing vendors, new competition is coming from every direction—"big tech" and other non-traditional players are continuing to push into the space, consolidation is accelerating as incumbents rush to broaden their capabilities and build scale (e.g. Doctor On Demand merging with Grand Rounds), and more payers and providers are working to "in-source" more of these functions.

Walmart's recent acquisition of a telehealth vendor is another good example of the size and types of bets these newer, well-capitalized entrants are willing to make to gain footholds in healthcare. While these moves help validate the immensity of the longer-term opportunity, they also make it increasingly difficult for investors to easily spot the vendors and strategies that will win out. This weighs on valuations, but it’s also an opportunity for investors to start to build positions in the most innovative, most disruptive and highest-quality names in the sector.

Sean Dodge authored “2022 RBC Digital Health Outlook: Both Innovation and Adoption Should Continue to Accelerate” published on January 5, 2022. For more information about the full report, please contact your RBC representative.