Published May 26, 2021 | 4 min watch

Key Points

- We know how the next recession is going to unfold because it has unfolded. As a result, there's an additional level of confidence in the M&A market.

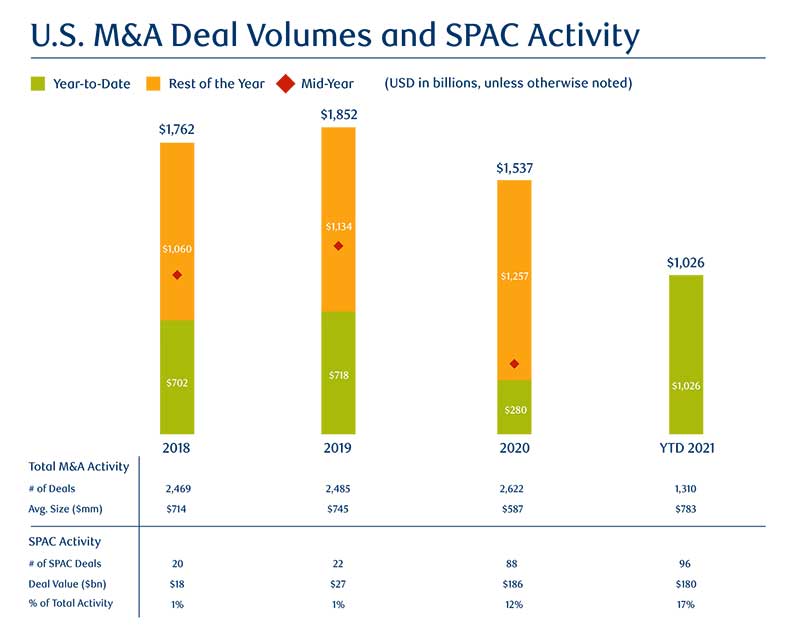

- In the first four months of 2021, SPACs accounted for roughly a little over 20% of all M&A transaction volume in the United States.

- SPACs represent $700 billion to $1 trillion of buying power and we expect SPACs to remain significant in the market.

- ESG is now a critical consideration in all M&A deals.

Can you provide an overview of recent M&A activity and what’s been driving the market?

Vito Sperduto: We have seen an unprecedented level of activity since mid-year 2020 once the M&A markets reopened.

Larry Grafstein: Before this pandemic hit, there was some concern that we wouldn't really know when the next recession would come about. Now we’re in a position where we know how the next recession is going to unfold because it has unfolded. As a result, there's an additional level of confidence that, perhaps, we're past a recession.

“We know how the next recession is going to unfold because it has unfolded. As a result, there's an additional level of confidence.”

Larry Grafstein, Deputy Chairman, Global Investment Banking

Vito Sperduto: There has been an acceleration of key trends. For some businesses, conditions during the pandemic were beneficial and enabled them to outperform. In other cases, parties that have not benefitted from recent conditions are looking to M&A as a means to augment their businesses.

When we think about the amount of private capital on the sidelines right now, and how that might be deployed, they’re considering some of the traditional sectors that have not performed well during the pandemic. They’re trying to determine where there are bargains to invest in, so that they’re well positioned as things reopen.

Larry Grafstein: People are now looking ahead to numbers for 2022 and 2023, these numbers are more normalized. They’re easier to predict with a higher degree of confidence. The unusual patterns of 2020 and 2021 are soon to be behind us.

Looking at the recent performance of the SPACs market, what is influencing its ongoing development?

Vito Sperduto: In the first four months of 2021, SPACs accounted for roughly a little over 20% of all M&A transaction volume in the United States. To put that in perspective, prior to 2020, SPAC transactions represented roughly 1%. Traditional M&A deals have been about $600 million to $650 million in size. Looking solely at the SPAC market, deals have averaged around $2 billion in size.

“SPAC market deals have averaged around $2 billion in size.”

Vito Sperduto, Co-Head, Global M&A

Source: Dealogic as of 05/03/21. Note: Year-to-date through 04/30/21. Includes all deals with transaction value of US$20 million and greater. Excludes government deals and RBC Capital Markets cancelled deals. Includes deals where transaction value was disclosed.

Larry Grafstein: There is a certain amount of ownership dilution that is attributable to the formation of a SPAC. As a consequence, SPACs create an incentive to do transactions that are six to seven times the amount of capital raised in the SPAC itself.

Vito Sperduto: Everyone took notice last fall when Churchill Capital acquired MultiPlan. At roughly $10 billion, that deal set a new bar. We saw that bar reset again when Altimeter acquired Grab in a $35 billion transaction. I think the market is going to be less and less about emerging technologies. You’re going to see more traditional businesses really take advantage of SPACs as a tool to go public on a faster timeline.

What impact might regulation have on the SPACs market?

Larry Grafstein: There’s been no shortage of regulatory intervention on things like mergers and IPOs. We wouldn’t expect SPACs to avoid scrutiny. Perhaps, SPACs should have an extra level of scrutiny just because of the speed with which they’ve proliferated. I think many of us feel comfortable that regulation will be a long-term positive for SPACs.

Vito Sperduto: There’s $165 billion plus of dry powder in SPACs that have raised capital and are looking for transactions. That’s $700 billion to $1 trillion of buying power out there. SPACs will be a significant player going forward, regardless of where regulators take the market.

“There’s $700 billion to $1 trillion of buying power out there. SPACs will be a significant player going forward, regardless of where regulators take the market.”

“There’s $700 billion to $1 trillion of buying power out there. SPACs will be a significant player going forward, regardless of where regulators take the market.”

Vito Sperduto, Co-Head, Global M&A

How are ESG considerations becoming evident in the M&A market?

Vito Sperduto: ESG has become a must have in our dialogue and it is definitely a consideration as we’re thinking about bringing together potential partners in a transaction, or as companies are being evaluated.

Larry Grafstein: We talk all the time about how this is a macro trend, ESG is going to be critical to the success of companies. And of course, derivatively, M&A depends on the success of companies as well.

What’s the outlook for the M&A market, do you see any signs that a bubble may be emerging?

Vito Sperduto: Conditions are very strong in the marketplace. There’s certainly a plethora of transaction opportunities. In terms of a potential bubble, I think that we’re far from that. I think we’re still seeing good transactions being executed across the board.

Larry Grafstein: There are always individual transactions that, in a very robust equity market environment, are at risk of not working out, but there is not the type of frenzied, excess speculation that we might have seen at other market highs. Strong performance in the M&A market, of course, will depend on ongoing confidence and favorable conditions.

Vito Sperduto: We’re starting to see some incredible growth among all of our clients. Certainly as things continue to reopen, with increased levels of vaccination, and with progress that’s being made from an infrastructure perspective here in the US, we expect their businesses are going to continue to perform. As a result, they will be well-positioned to consider potential transactions.