Our Investment Focus

RBC Capital Partners actively seeks structured cash flow term loan, subordinated debt, and mezzanine financing opportunities to provide flexibility in cash flow management and a cost effective alternative to raising additional equity to finance transformational events, including:

- Growth capital

- Acquisitions

- Financial sponsor buyouts

- Shareholder buyouts

- Management buyouts

- Refinancing of existing facilities

- Senior debt relief

- Equity withdrawals (or dividend recapitalizations)

RBC Capital Partners can work together with our RBC senior debt partners to provide mid-market companies and financial sponsors with a comprehensive financing solution to facilitate transactions.

Junior capital investments range from $3 million to $20 million in any single transaction, plus the ability to partner on larger transactions and provide minority equity investments to further support growth.

Our Investment Criteria

RBC Capital Partners is seeking investment opportunities in businesses in a variety of industries* that have some or all of the following characteristics:

- Proven and sustainable free cash flows, with EBITDA typically exceeding $3 million, and an Enterprise Value greater than $10 million

- Strong management teams with a significant financial commitment (“at-risk” capital)

- Established track record of business plan execution

- Operate in market niches and possess a sustainable competitive advantage

- Based in Canada and/or the U.S.

*excluding real estate and natural resource extraction

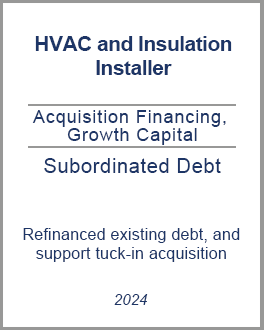

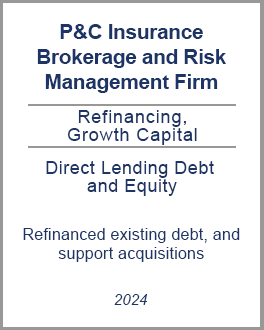

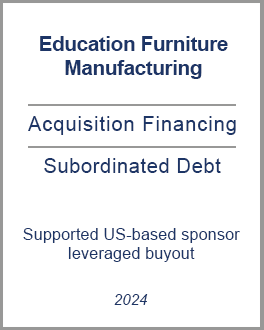

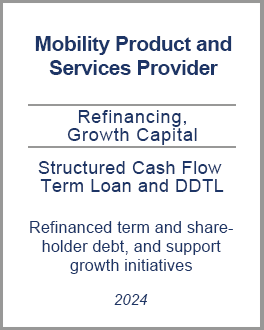

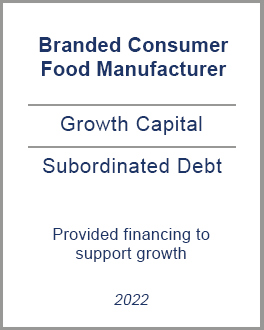

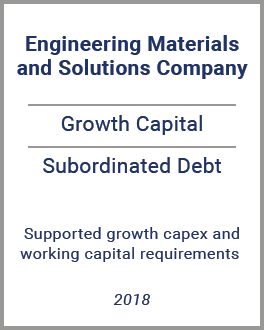

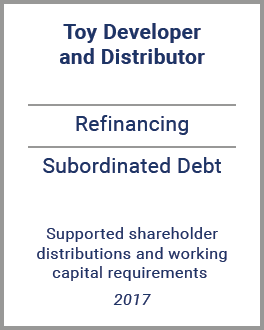

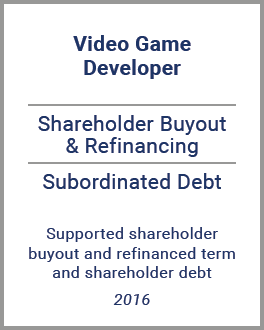

Notable Transactions

Managing Director

+1 416-842-4056

patrick.trainor@rbccm.com

Patrick has over 20 years of mezzanine investment and merchant banking experience. He joined RBC in 2007 from CCFL Mezzanine Partners and was previously with McKenna Gale Capital, two leading independent mezzanine funds. Patrick also spent time in business development and as a university lecturer. Patrick is a Chartered Financial Analyst, and has an MBA from Saint Mary’s University.

Director

+1 416-842-1154

jordan.mcmullen@rbccm.com

Jordan is responsible for sourcing and executing junior capital investments. Prior to joining RBC, Jordan worked as an Investment Manager at Crown Capital Partners. There he gained exposure to middle-market public and private companies across numerous industries and geographic regions. His core responsibilities included investment underwriting and portfolio management, including full cycle management of complex transactions and development of creative financing structures. Jordan has been directly involved in the investment underwriting and portfolio management of greater than 25 completed mid-market transactions representing greater than $500 million in capital deployed. Jordan holds the Chartered Financial Analyst designation and a Bachelor of Arts in Political Science and Economics from the University of Toronto.

Director

+1 437-238-5489

matthew.hall@rbccm.com

Matt has over 15 years of middle market transaction and private equity experience. Prior to joining RBC, Matt was Managing Partner at Market Square Equity Partners targeting middle market buyouts. Previously he worked at Covington Capital, a diversified private equity and venture capital fund. Matt has an MBA from the University of Western Ontario (Richard Ivey School of Business) and is a Chartered Business Valuator (CBV). Matt is responsible for sourcing and executing junior capital investments at RBC.

Director

+1 416-842-2146

steve.lewis@rbccm.com

Steve is responsible for sourcing and executing junior capital investments. Prior to joining RBC, Steve was a Partner and Senior Vice President at Ernst & Young Orenda Corporate Finance. Steve spent over 25 years at EY during which he co-founded the Canadian capital markets advisory business. He has led hundreds of transactions in a variety of industries involving many forms of financing and capital structures. Steve holds an MBA from McMaster University as well as the Chartered Professional Accountant designation.

Vice President

+1 416-974-7162

david.goldband@rbccm.com

David is responsible for sourcing and executing junior capital investments. Prior to joining RBC, David worked at Grant Thornton Limited in their corporate restructuring and turnaround group, assisting mid-market companies develop turnaround plans across multiple industries. In this role, David also acted as an advisor to financial institutions in reviewing and reporting on debtors’ viability and operational performance. David holds the Chartered Professional Accountant designation, the Chartered Insolvency and Restructuring Professional designation and an Honours of Business Administration degree from the Richard Ivey Business School at Western University.

Vice President

+1 416-974-0782

laura.m.ryan@rbccm.com

Laura is responsible for sourcing and executing junior capital investments. Prior to joining the Capital Partners team, Laura worked in both the Capital Markets Asset Based Lending and Corporate Client Group Finance teams within RBC. In her role on the ABL team, Laura’s focus was on structuring Capital Markets private-equity backed LBO transactions primarily supporting the Building Products & Industrials coverage team in New York. Laura underwrote 23 transactions representing over $1Bn of ABL capital deployed both in lead and participating roles. In her role on the Corporate Client Group Finance team, Laura worked on a variety of senior debt transactions supporting a diverse client base of mid-market companies. Prior to joining RBC, Laura was a Senior Associate at PricewaterhouseCoopers in the Audit & Assurance practice. Laura holds a Honours Bachelor of Commerce degree from the Smith School of Business at Queen’s University and is a CPA, CA.

Vice President

+1 416-842-2896

janice.lai@rbccm.com

Janice joined the RBC Capital Partners team in 2018 and has since provided junior capital and equity co-investments to a variety of industries with a particular focus on consumer and healthcare sectors. During her time at RBC, she also spent a few months with the Mid-Market Mergers & Acquisitions team. Prior to RBC, Janice worked in the audit practice at Grant Thornton LLP providing assurance services to mid-market companies in manufacturing, distribution and services. Janice holds the Chartered Professional Accountant designation and has an Honors Business Administration degree from Ivey Business School.