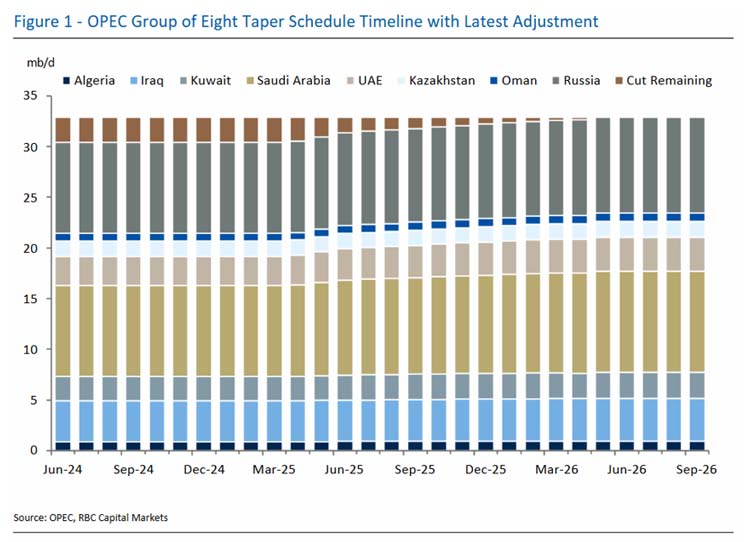

Once again, OPEC’s group of eight producers making voluntary cuts opted for a super-sized three-month output increase of 411 kb/d in June.

While the official communication cited strong fundamental conditions, we think continuing compliance challenges within the group played an important role in the decision. Iraq, Kazakhstan, and to a lesser extent Russia, have all continued to miss their marks, though the latter has apparently provided a plan for rectifying its overhang. We sense that Kazakhstan’s clear lack of effort may have tipped the scales in favor of another multi-month hike that portends another move lower in prices come Monday. With today’s decision, the group of eight voluntary producers will have unwound almost half of their 2.2 mb/d nameplate production cut in a three-month period.

Though the Kazakh energy minister walked back his national interest comments, statements by IOC officials on earnings calls and business news networks indicating that the government had not made any request for production cuts likely helped seal the supply decision. Yesterday’s interview with the Chevron CEO seems to have been especially harmful to the Kazakh case in light of the fact that these IOCs did comply with a government request to curtail output in 2020.

As we have stated from the start of his tenure, HRH Prince Abdulaziz bin Salman strongly believes in active market management, but also the principle that every country must pull its weight. He is seemingly not afraid to use his spare capacity to discipline members that breach the OPEC rules-based order based on the March 2020 experience. That said, in our travels and conversations this week, it was apparent that frustration with Kazakhstan’s lack of effort was broad-based in the producer group, and this was not just a bilateral dispute. Moreover, during our participation in the IMF’s Regional Economic Outlook event, it was evident that the GCC producers have the financial bandwidth to endure a period of lower prices due to their economic reforms and diversification efforts.

Iraq, on the other hand, is facing an especially perilous outlook in a $60/bbl and below Brent price environment.

Due to deep political divisions, sectarian strife, and the presence of numerous armed actors, multiple governments in Baghdad have relied on a costly patronage machine, a bloated public sector workforce, and outsized subsidy spending to maintain social order. In addition, due to ongoing port capacity and midstream issues, Iraq lacks the ability to massively ramp up exports to offset further price declines. Baghdad will also likely have to divert a greater share of oil production to domestic power burn than in previous years, as it is now losing its waivers to import Iranian gas and power due to Washington’s push for maximum pressure sanctions.

Though Iraq also has IOCs operating in the country, it has made production curtailment requests before and has also applied reductions to NOC-operated fields when it has sought to bolster its compliance.

In our view, Iraq should be especially incentivized to figure out how to make progress on its targets as it could be facing a summer of discontent and resumption of destabilizing protests if power cuts and brown-outs return in 100+ degree summer heat. Kazakhstan may well have a different calculus as its financial position is not as fragile as Iraq, though not as strong as the GCC with their large sovereign wealth funds and foreign reserves. Certainly, market attention will now shift to the full ministerial meeting at the end of the month.

“Barring a major offramp in the trade war or another geopolitical crisis that provides price relief, there will likely be few spring flowers for the oil producers with the weakest balance sheets in the month of May.”

Helima Croft, Head of Global Commodity Strategy & MENA Research, RBC Capital Markets

Helima Croft authored “OPEC wrap-up: Rules-based order,” published on May 3, 2025. For more information on the full report, please contact your RBC representative.