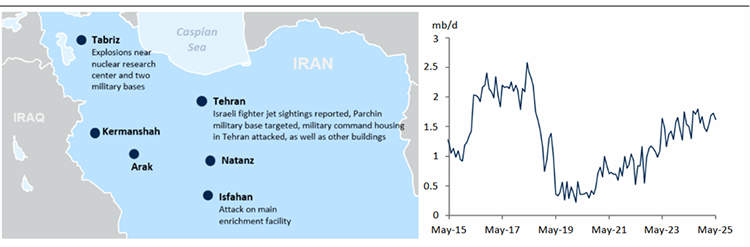

In a dramatic escalation, Israel last night launched a series of airstrikes targeting Iranian nuclear and ballistic missile facilities, scientists and senior military personnel, raising the specter of a wider Middle East war. The Natanz uranium enrichment facility was reportedly struck, but there is no word on the status of the Fordow enrichment plant, which is widely seen as more impenetrable to a unilateral Israeli strike given its more fortified location. Natanz is home to the older, lower-speed centrifuges, while Fordow houses the more advanced, high- speed models that produce the near-weapons-grade levels of uranium. Iranian state media confirmed the killing of the Commander of Iran’s Islamic Revolutionary Guard Corps (IRGC) Hossein Salami, and there are unconfirmed reports of other senior IRGC commanders having also reportedly perished in the Israeli strikes.

“Certainly, the timing is noteworthy with nuclear talks between the US and Iran scheduled to resume Sunday as well as President Trump’s public pronouncement that he wanted to see if diplomacy could yield a new agreement that would eradicate the risk of Iran obtaining nuclear weapons.”

Helima Croft, Head of Global Commodity Strategy and MENA Research, RBC Capital Markets

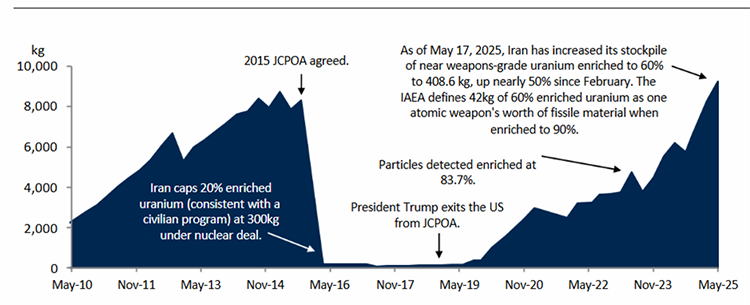

Israel has already closed its airspace in advance of an anticipated Iranian response. A key question is whether the Iranian retaliation will be limited to Israel or if the leadership will seek to internationalize the cost of last night’s action by targeting bases and critical economic infrastructure across the wider region. Certainly, the timing is noteworthy with nuclear talks between the US and Iran scheduled to resume Sunday as well as President Trump’s public pronouncement that he wanted to see if diplomacy could yield a new agreement that would eradicate the risk of Iran obtaining nuclear weapons. Iran has made rapid advances in its uranium enrichment activities in recent months and today the IAEA found Iran in breach of non-proliferation obligations, a move that potentially paves the way for the snapback of UN sanctions against the country. In televised remarks, Prime Minister Benjamin Netanyahu stated that Iran has enough enriched uranium for nine atomic bombs and insisted last night’s preventive action was necessary to avert a full-scale nuclear crisis.

The White House for its part has released a statement insisting that Israel acted alone and warned Iran against targeting US personnel and assets in the region. While President Trump has expressed opposition to extended Middle East military engagements, he has previously enforced his declared red line on the death of US citizens, most notably when he ordered the drone strike on the Quds Force leader Qassem Soleimani in January 2020 after a US military contractor was killed in Iraq. As we noted yesterday, the Iranian defense minister warned America “that all its bases are within our reach” and that they “will, without any consideration, target them in the host countries.” In addition, Iran-backed militias in Iraq have been responsible for countless attacks on US military personnel in the region, including in Jordan in 2024, and they are likely amongst the most formidable remaining members of the Axis of Resistance alongside the Yemen-based Houthis.

Figure 1 - Iran Enriched Uranium Stockpiles

Sources: Congressional Research Service, IAEA, AP, RBC Capital Markets

Figure 2 - Initial Reported Attacks on Iran by Israel, Iranian Crude Exports

Sources: New York Times, Pertro-Logistics, RBC Capital Markets

“If oil is caught in the cross-fire, we anticipate that President Trump will seek OPEC spare barrels to try to keep a lid on prices and shield US consumers from the economic impact of the Middle East conflict.”

Helima Croft, Head of Global Commodity Strategy and MENA Research, RBC Capital Markets

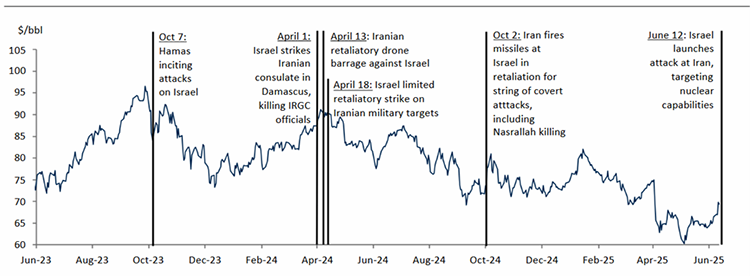

Oil has already spiked following last night’s move, and its ultimate landing point will likely hinge on whether Iran revives the 2019 playbook and targets tankers, pipelines, and key energy facilities across the region. There will obviously be heightened concern about the security of the Strait of Hormuz given that 20.9 mb/d are transported through the waterway on a daily basis. It is our understanding that it would be extremely difficult for Iran to close the strait for an extended period given the presence of the US Fifth Fleet in Bahrain. Nevertheless, Iran could still launch attacks on tankers and mine the strait to disrupt maritime traffic. During the Iran-Iraq war (1980-1988), hundreds of international vessels and oil installations were targeted by the warring sides in an effort to deprive their rivals of trade revenue, and ultimately the US Navy was forced to intervene to protect Kuwaiti ships in what was at the time the largest US naval convoy operation since WWII. Israel for its part has seemingly spared Iran’s critical Kharg Island terminals, which account for 90% of the country’s oil exports. However, if this proves to be an extended military operation, it is conceivable that the Netanyahu government could seek to eliminate the primary source of funds for Iran’s proxy network and nuclear program. If oil is caught in the cross-fire, we anticipate that President Trump will seek OPEC spare barrels to try to keep a lid on prices and shield US consumers from the economic impact of the Middle East conflict.

Figure 3 - Iran and Israel Key Attacks since October 7

Sources: Bloomberg, RBC Capital Markets

Helima Croft authored “Israel/Iran QuickTake: Endgame,” published on June 13, 2025. For more information on the full report, please contact your RBC representative.