Published August 31, 2022 | 2 min read

Key Points

- Emerging technologies make it easier to gather and analyze new forms of data – opening up novel insights on companies, consumers, and end-markets for investors.

- We believe the market for alternative data has eclipsed the $1 billion mark and is expected to grow at a~53% CAGR from 2022-2030 according to Grand View Research.

- Nimble information services providers may benefit from the continuously evolving data frontier and are well positioned to capitalize on expanded data use cases.

- On the consumer side, the use of alternative data offers greater financial and credit inclusion for those who were previously “unscorable” with traditional credit models.

- It’s important to monitor evolving privacy regulations, which could serve as a curb on the rapid growth and proliferation of alternative data into the investment process.

Data, the crystal ball to predict the future

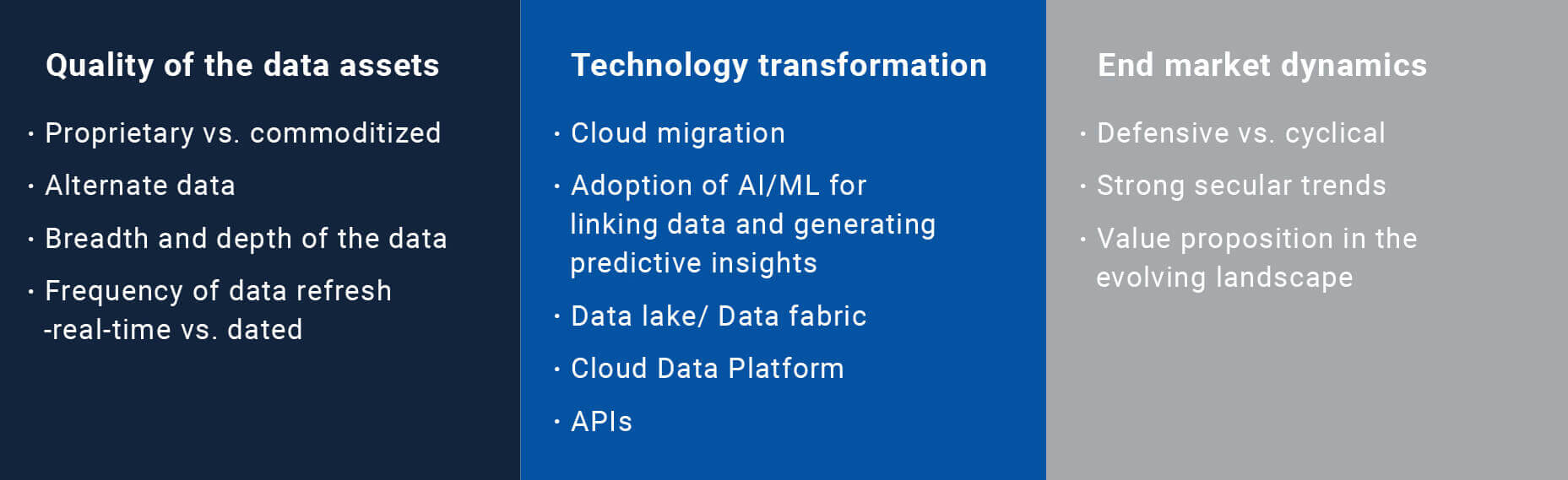

Data is the new oil – and there’s an ongoing arms race around finding, cleaning, linking and analyzing quality data properly. Moreover, new technological advancements are currently multiplying the value of data, largely focused on efficiently gathering, deploying and utilizing the vast sums of information available today, which is increasing at a rapid pace.

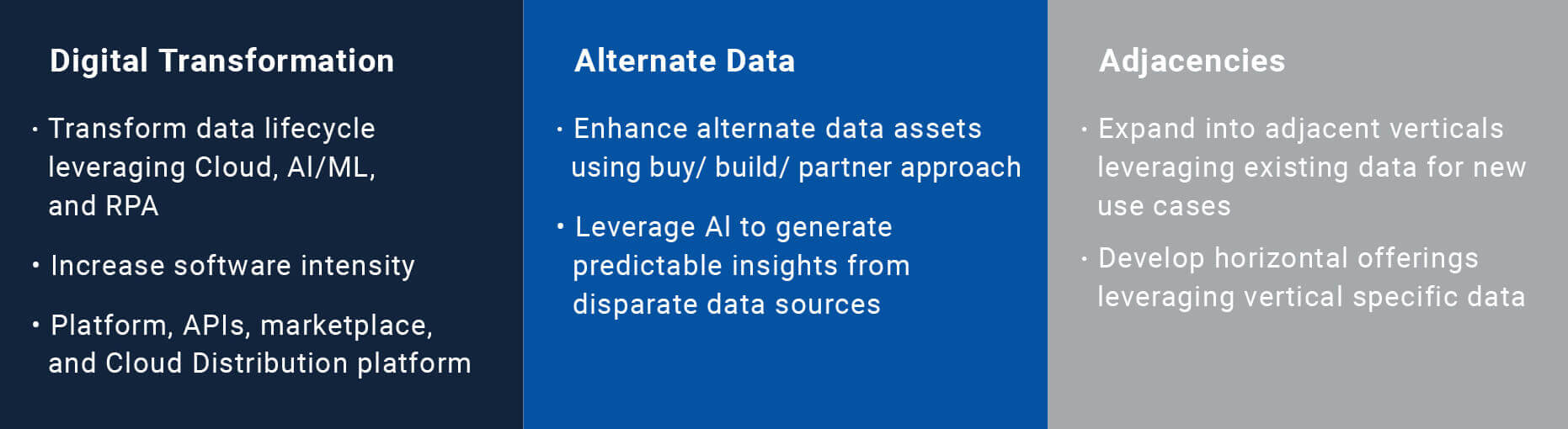

Through cloud technology, artificial intelligence (AI), machine learning (ML) and robotic process automation (RPA), the transformation of the data lifecycle is already underway. The quality, depth and breadth of data are being rapidly enhanced. The result is higher accuracy along with near real-time updates and the ability to combine/link data to generate new perspectives as well as predictive insights, all while lowering frictions in distributing data.

A key part of the mix is using alternative data to supplement traditional data sources, such as financial statements, news releases or management statements. In the business world, this information is supplemented by technology and alternative data to determine sentiment, such as management tone, and glean insights into future business trends and stock returns.

AI and ML is also transformative and making it possible to generate insights and predictions, while RPA and AI is streamlining data ingestion by automating manual data entry. Additionally, Natural Language Processing (NLP)/ Entity Linking enables organizations to combine and link disparate datasets programmatically. Cloud Distribution Platforms (CDP) and APIs have also made it easier to distribute data and deepen the integration within customers’ workflows.

Importantly, the use of specific alternative data assets around app use, credit or debit card transaction data, geo-location tracking, satellite data, website traffic data or data obtained from text processing of social media offers the ability to provide deeper insights not previously available to investors. For investors, this type of data can offer fresh perspectives and provides faster, more accurate insights into company and sector performance.

The market for alternative data: $1 billion and growing

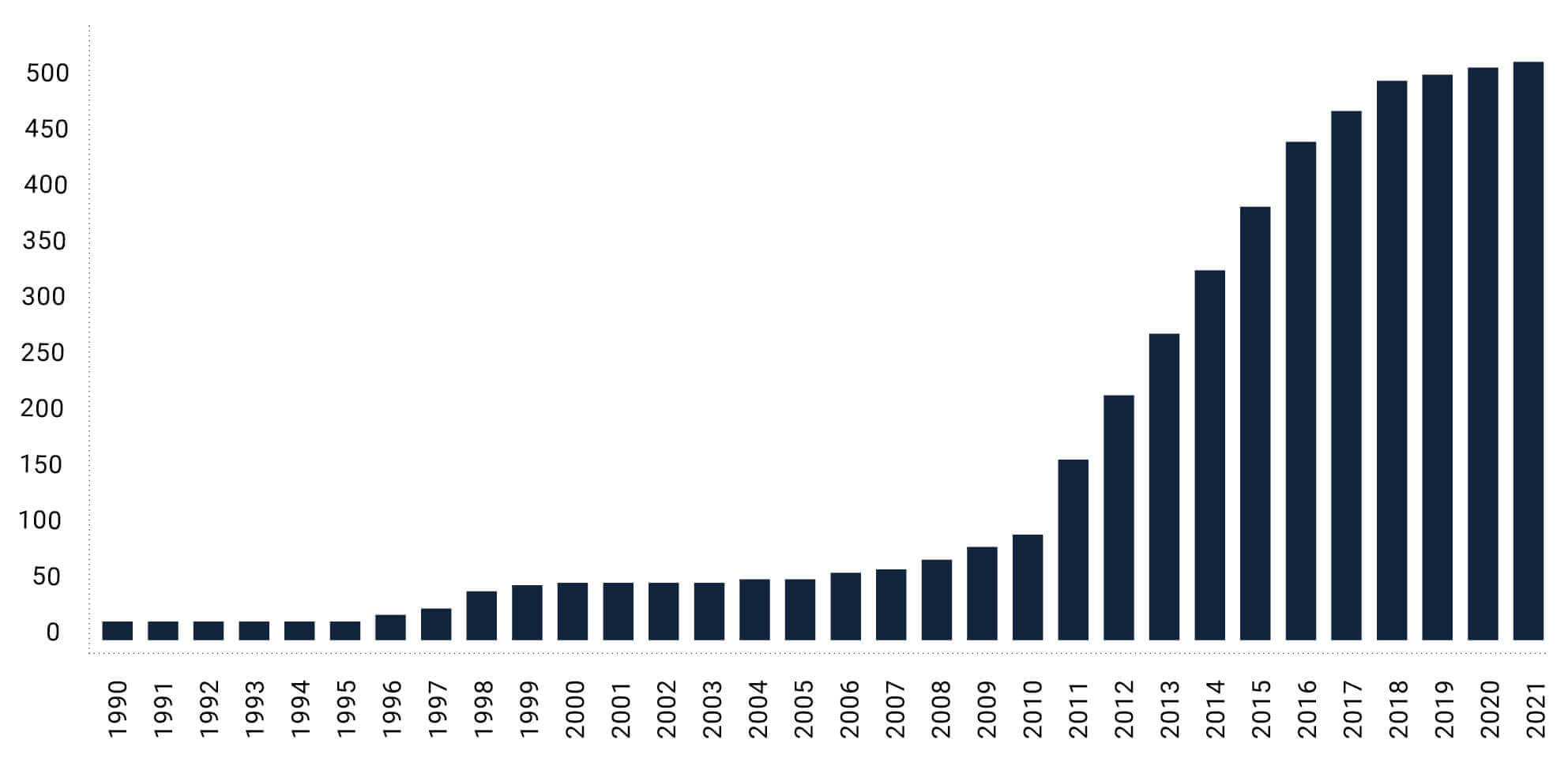

The demand for alternative data has been outpacing supply as active asset managers continue to look for an edge to outperform markets, as well as compete with low-cost index funds where investor spending on alternative data has grown exponentially in the last several years. At the same time, investment firms are expanding their data expertise and have more than quadrupled their alternative data analysts between 2013 and 2018.

Alternative data spending has eclipsed $1 billion, where upstarts are scrambling to meet this soaring demand and there is now over 450 active providers of alternative data.

Number of Alternative Data Providers

The US alternative data market is predicted to grow at ~53% CAGR between now and 2030, according to Grand View Research. That projected growth is driven chiefly by increased demand from hedge funds, mutual funds, private equity, pension funds, unit trust and life insurance companies, while corporates and financial institutions will make use of alternative data in their risk management processes.

Expanding access to credit and bolstering financial inclusion

Within the consumer lending sphere, too, alternative data is of growing importance. For consumers who have insufficient credit data for credit scoring, alternative credit data – such as rental payments, asset ownership and utility payments – may be the only means to get a loan.

Collecting alternative credit data in itself is not enough, however: it needs to be processed and analyzed. This is where AI and ML solutions can be useful in greatly reducing processing time, as well as incorporating alternative data such as cell phone and banking data.

Lenders can offer their services to more clients by using an automated loan processing system with alternative data to score customers with thin credit files – who potentially number around 80 million in the US –which expands access to the financial system.

The privacy interface

A key risk factor in alternative data gathering is the potential for collision with privacy regulations, which vary greatly between countries, where a unified approach could block data acquisition but anonymization of data could potentially mitigate the impact.

The EU, for example, now has the world’s toughest data privacy regime in the form of the General Data Protection Regulation (GDPR), which governs how individuals’ data can be processed and transferred.

The picture is evolving not just due to governments’ actions but as a result of major companies such as Apple and, more recently, Google, which have limited the amount of users’ data shared via their systems. Lastly, the class action lawsuit around Oracle’s “surveillance machine” has made headlines and the future of third-party tracking is unclear.

Separately, there are concerns around the security and potential overreach of technologies such as FaceID and other biometrics, where it will be important to continue monitoring the ongoing privacy landscape.

Expanding the data universe

One thing is for certain, technology and alternative data are reshaping the global investment industry and potentially disrupting traditional processes. That said, the proliferation of data is contributing to an improved value proposition that should deliver premium pricing for information services providers. It also offers the potential for outsized investment returns for those at the bleeding edge of nascent technologies where we see upside for information services providers that can capitalize on these trends.

Ashish Sabadra authored “RBC Imagine: Disrupt or Get Disrupted – Cloud and AI/ML Disrupting the Data Lifecycle,” published on June 9, 2022. For more information about the full report, please contact your RBC representative.