Longer term, it stands to reason that consumers may move to cut out the middleman. Ultimately, financial transactions are about trust. And if consumers are able to trust new players, new business models will inevitably emerge.

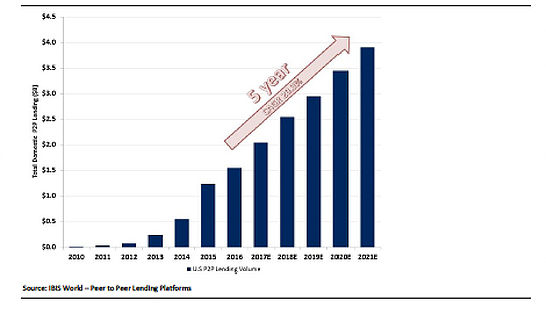

Case in point, demand for non-traditional lending products such as peer-to-peer loans has been growing exponentially. These products satisfy demands traditional lenders aren’t meeting, such as unsecured lending for those who don’t tick the usual boxes. But increased availability of attractive rates and flexible repayment terms means they’re also becoming popular as a way to finance purchases.

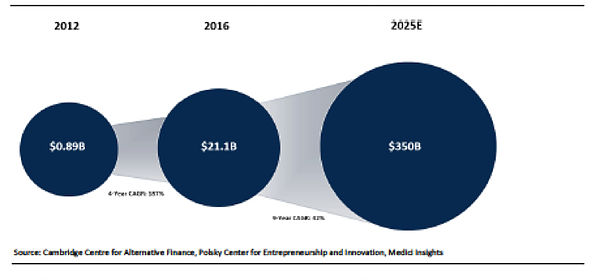

Exhibit 92: Total estimated P2P consumer and business market growth

With the consumer lending market worth $13.1 trillion, P2P and alternative lenders have ample scope to make gains. They may even expand into student lending, mortgages and other categories.

Similarly, as online and mobile retail continue to dramatically outpace brick-and-mortar stores, consumers will seek greater control on how they pay, how they’re served by issuers and how they’re rewarded for spending. This is likely to make private label cards more useful and, so, more appealing, which will fuel growth.

It’s not all roses for alternative lenders. The top challenges they face are:

Sustaining growth: It’s hard for alternative lenders to get substantial funding unless they establish themselves as regulated banks or Bank Holding Companies. Typically, they tend to avoid this due to the high capital requirements and other regulatory burdens.

Potential credit losses: How will the next macroeconomic downturn affect model funding?

The regulatory landscape: With regulatory rules being relaxed, traditional lenders may decide to move into the space. Will alternative lenders be ready and able to compete?

>

Collective Action: Up close

The future will be determined by those who are willing to reinvest, adapt and turn future threats into opportunities.