A growing number of corporate bellwethers have recognized the broad societal and environmental issues we are collectively facing and taken steps to make proactive, positive changes to their operating models. Investors are increasingly interested in backing these types of environmentally and socially conscious companies and the expectation for businesses to adopt sustainable practices has risen. These trends have led to a growing market for environmental, social, and governance (ESG) investing, which is graining traction globally.

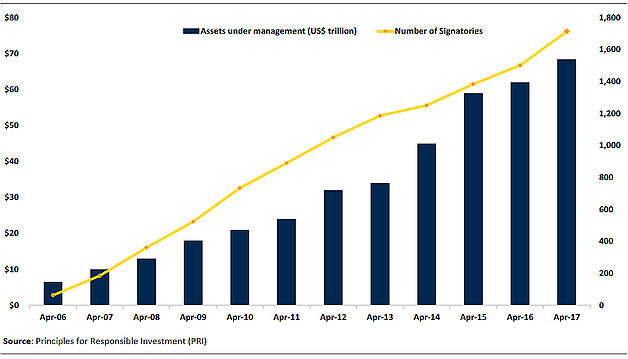

A United Nations supported-initiative, Principles of Responsible Investing (PRI), introduced a voluntary framework in 2006, outlining six principles to promote awareness of ESG-related issues among global investors. PRI now counts almost US$70 trillion in assets under management (AUM) amongst its signatories, including asset owners, investment managers, and service providers, with a 24% CAGR in signatory AUM since the framework was introduced over ten years ago.

- “Society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.” BlackRock founder and CEO, Larry Fink

Corporate bellweathers such as Home Depot, Best Buy and Walmart have already started initiatives to tackle issues like energy usage, waste and carbon emissions. Overall, we believe this mindset is becoming increasingly important for companies not only in the assessment of investment value, but to remain competitive with rapidly changing societal preferences.

Escalating Uncertainties: Up close

The future will be determined by those who are willing to reinvest, adapt and turn future threats into opportunities.