Frédérique Carrier is Managing Director, Head of Investment Strategy at RBC Wealth Management. This article was originally published by RBC Wealth Management.

Economic growth that seems to have hit a wall and an unwelcome embrace of populism have turned the investment case for European equities more opaque.

We upgraded European equities in May 2017 when economic data surprised on the upside, political risk waned after the election of centrist Emmanuel Macron as French president, and valuations were attractive. But now, the loss of economic growth momentum in early 2018 and the reappearance of political risk lead us to downgrade European equities to Market Weight from Overweight.

Plateau point

While the European recovery is continuing, leading indicators suggest to us that growth is no longer accelerating and may have plateaued earlier than we expected, while economic surprises are tending to be negative rather than positive. Disappointing data in Q1, such as the composite Purchasing Managers’ Index (PMI), a gauge of economic activity, was explained away by most observers by one-off factors including weather, strikes, and the timing of holidays. However, the trend seems to have some legs as euro area industrial production for April came in at -0.9 percent m/m, slightly weaker than the consensus expectation.

But this is not to say that the economy is weak.

The recovery continues to be supported by the return of capital expenditure, itself underpinned by rising utilisation rates and the availability of credit. Such investment is occurring at a time when unemployment is falling and wages are growing modestly, both of which are helping consumers loosen their purse strings. Governments have also adopted a less austere attitude to their finances. RBC Capital Markets expects Q2 growth of 1.2 percent y/y, a respectable level for the region.

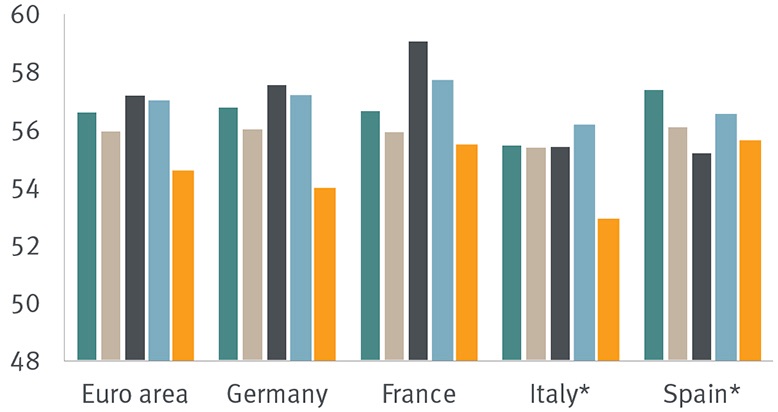

Economic momentum wanes but remains healthy

Euro area composite PMI quarterly average

PMIs remain much above the expansionary level of 50.

* Italy and Spain April-May only

Source - Haver Analytics, IHS/Markit, RBC Capital Markets

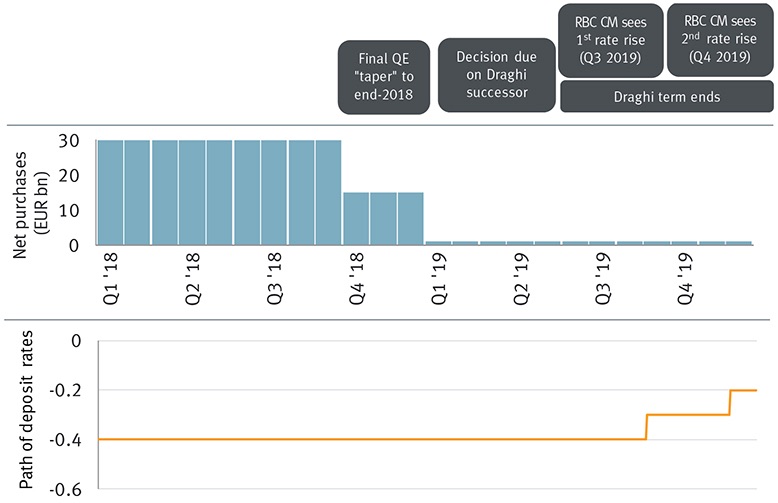

The path of growth and inflation is sound enough for the European Central Bank (ECB) to pursue its plan of withdrawing monetary stimulus. The ECB has indicated that, if conditions permit, it will reduce the monthly pace of asset purchases to €15B from September until the end of December when the quantitative easing (QE) programme will come to an end. It expects to maintain interest rates at current levels until “at least through the summer of 2019,” after which it has pencilled in a modest increase in rates.

The Italian job

Political risk is no stranger to the region and headline noise reappeared in June in regards to Germany and Sweden. Yet, in our minds, the key political risk which should preoccupy investors resides in Italy, the eurozone’s third-largest economy, given its high indebtedness; still vulnerable banking system; and latent, underlying Euroscepticism.

We believe the recent Italian upheaval also changes the equation for the European investment case despite financial markets’ seeming complacency about the political risk.

Indeed, markets cheered when non-Eurosceptic Giovanni Tria was recently appointed as minister of economy and finance, overlooking the fact that the populist government aims to raise spending, cut taxes, reduce the retirement age, and roll back some of the pro-growth reforms instituted by the previous government. We think those policies would not only worsen the fiscal deficit, but may also weaken the Italian economy.

According to EU calculations, Italy’s structural deficit would swell to 2.0 percent of GDP in 2019 under those proposals instead of narrowing to 0.8 percent of GDP, a level the EU estimates would enable Italy to reduce its heavy debt burden and put it on a sustainable path. A 2 percent deficit is not worrying per se, but it needs to be put in the context of the country’s weight within the EU, its high indebtedness, and its still somewhat fragile banking system.

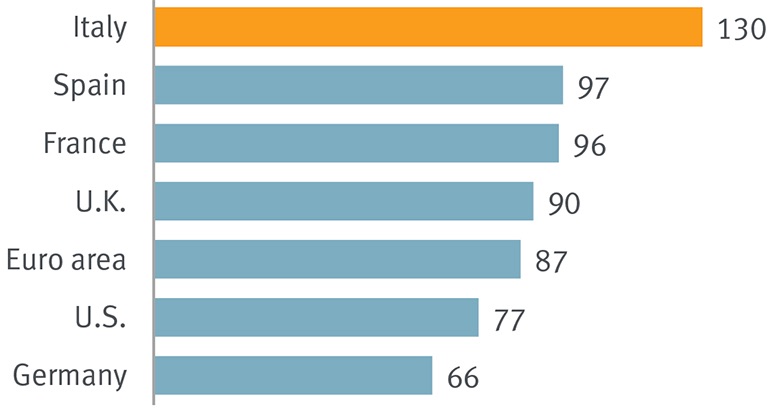

Italy has a heavy debt load

2017 government net debt % GDP

Italy’s high indebtedness could swell further by fiscal deficits.

Source - Bloomberg, RBC Wealth Management

Furthermore, while support for the euro in Italy has improved, it is the lowest in the EU at only 59 percent, compared to 71 percent in France and 80 percent in Germany, according to the European Community Barometer survey. Confrontation with Brussels could project the euro membership issue back to the fore. Hence, a wider deficit in this context would raise the vulnerability of the region, in our opinion.

With just under 70 percent of its sovereign bonds held domestically, including a 20 percent share bought by the Bank of Italy under the ECB’s asset purchase programme, a financial crisis could be sparked by a dispute with the EU about Italy’s fiscal situation and/or downgrades from rating agencies should the downgrades persuade investors to offload their Italian financial assets.

It is conceivable, though not our base-case scenario, that a major dispute could raise the spectre of a euro exit. Italy would then have to choose between returning to fiscal prudence and into the fold of the EU, or leave the EU and print its own low-credibility, much-devalued currency.

We assign a low probability to a crisis like this occurring, but we think investors are now more likely to stay on the sidelines given this noisier political backdrop, curbing further inflows into European financial assets.

Taking a step back

If the investment case is becoming more opaque with growth having peaked and the return of political risk, why not choose to go to Underweight instead of Market Weight for the region?

We feel a neutral weighting is more appropriate for two reasons. First, economic growth is plateauing, but it is still above average, and the ECB’s dovish stance remains supportive. The ECB has recently suggested that its quantitative easing programme will end by year end 2018, but that interest rates will remain at their present level “at least through the summer of 2019” or for as long as necessary to ensure inflation expectations continue to recover. Loose monetary policy is weighing on the euro which has weakened by more than seven percent since the beginning of the year, a welcome respite for the economy and exporters in particular. The consensus earnings estimates are for growth of some 11 percent and nine percent for this year and next, respectively, both of which we believe are not only respectable levels, but seem achievable.

RBC Capital Markets’ expectations for monetary policy

Source - RBC Capital Markets, RBC Wealth Management; monthly data

Second, valuations are not overly demanding. The European equities market is currently trading on a price-to-earnings ratio of 14.6x and price to book value of 1.7x, both of which are roughly in line with their long-term averages while the wide discount to the U.S. has yet to close.

With the European economy seemingly plateauing, a murkier political outlook, and valuations appearing closer to fair value on some measures, we think it is prudent to downgrade European equities to Market Weight. We have removed our positive bias toward banks, and would be selective on cyclicals, focusing on Industrials and Technology. We continue to prefer core markets to the periphery.

Required disclosures

Research resources

Non-U.S. Analyst Disclosure: Frédérique Carrier, an employee of RBC Wealth Management USA’s foreign affiliate Royal Bank of Canada Investment Management (UK) Limited; contributed to the preparation of this publication. This individual is not registered with or qualified as a research analyst with the U.S. Financial Industry Regulatory Authority (“FINRA”) and, since she is not an associated person of RBC Wealth Management, she may not be subject to FINRA Rule 2241 governing communications with subject companies, the making of public appearances, and the trading of securities in accounts held by research analysts.

This publication has been issued by Royal Bank of Canada on behalf of certain RBC ® companies that form part of the international network of RBC Wealth Management. You should carefully read any risk warnings or regulatory disclosures in this publication or in any other literature accompanying this publication or transmitted to you by Royal Bank of Canada, its affiliates or subsidiaries.

The information contained in this report has been compiled by Royal Bank of Canada and/or its affiliates from sources believed to be reliable, but no representation or warranty, express or implied is made to its accuracy, completeness or correctness. All opinions and estimates contained in this report are judgements as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. This report is not an offer to sell or a solicitation of an offer to buy any securities. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Every province in Canada, state in the U.S. and most countries throughout the world have their own laws regulating the types of securities and other investment products which may be offered to their residents, as well as the process for doing so. As a result, any securities discussed in this report may not be eligible for sale in some jurisdictions. This report is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. Nothing in this report constitutes legal, accounting or tax advice or individually tailored investment advice.

This material is prepared for general circulation to clients, including clients who are affiliates of Royal Bank of Canada, and does not have regard to the particular circumstances or needs of any specific person who may read it. The investments or services contained in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about the suitability of such investments or services. To the full extent permitted by law neither Royal Bank of Canada nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any means without the prior consent of Royal Bank of Canada.

Clients of United Kingdom companies may be entitled to compensation from the UK Financial Services Compensation Scheme if any of these entities cannot meet its obligations. This depends on the type of business and the circumstances of the claim. Most types of investment business are covered for up to a total of £50,000. The Channel Island subsidiaries are not covered by the UK Financial Services Compensation Scheme; the offices of Royal Bank of Canada (Channel Islands) Limited in Guernsey and Jersey are covered by the respective compensation schemes in these jurisdictions for deposit taking business only.