While going through an expected period of consolidation, gold prices have gained significantly this year, primarily on the back of a redoubling of trade concerns, Fed rate cut expectations, compounded negative economic trends and worries across markets. The elevation of risk is becoming increasingly interconnected across rates, equities, currency markets, and volatility at large. While a significant portion of this elevated risk is easily traced back to geopolitics, trade, and binary political and policy choices, we think that there is a clear momentum in gold’s favor at this point for 2020. And in our view, President Trump’s use of Twitter has become a part of gold’s price discovery process.

Laying out the facts

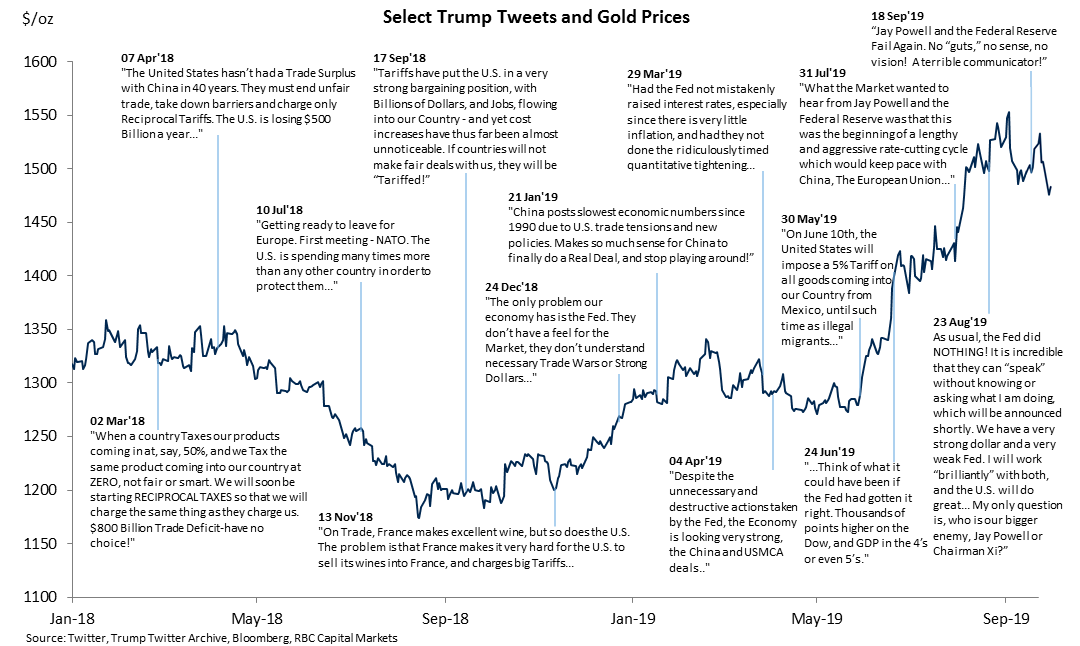

This is important: we believe that the US President’s utilization of Twitter has become a source of information and thus price discovery for the gold market. Whether through the impact on risk appetite and gold itself or via other assets (rates, the dollar, equities, etc.), interpretations of Tweets as policy and the extrapolating of such forces has introduced numerous unknowns; thus injecting uncertainty. Whilst our analysis – done in conjunction with our RBC Elements data science team – finds that negative sentiment does not represent a statistical driver of gold, the Trump-driven conversation and sentiment creates uncertainty which, in itself, presents event risk. We identify the longer-term implications of uncertainty as the number of unknowns this activity introduces, as well as the proliferation of unknown paths for both policy and a number of financial assets. Example: a Tweet on the beginning or ending of an avenue towards a trade deal with China has, and likely will, continue to have market impact. Recent peaks in negative sentiment around China and trade conversation have coincided with the recent rally from the $1300/oz to $1500/oz, for instance.

Making an Impression

Beyond isolated market-related topics on Twitter, much can be said about the noise created by deploying Twitter so frequently as a tool to communicate intentions, opinions, policies, and anything in between. It is worth noting that spikes in negative conversation volume have tended to precede the majority of upward moves in gold prices since late 2018. In recent months in particular, periods of increased negative conversation volume have tended to be followed by or coincided with higher gold volatility as well. Furthermore, as rates have fallen, economic worries have proliferated, and risk appetite has shifted, benefiting gold prices. This has opened the door for gold to rally on the back of risk, and the event risks presented by the injection of uncertainty into the market via Trump’s Twitter account, given that the gold-positive macro backdrop (recession fears, market stumbles, easy monetary policy, geopolitics, and general uncertainty) had already opened the door for this increase in prices.

Positioning: Quite Extended

That is not all. As of late, a lot of the new and growing allocations seem to also be hewn from more of a “buy and hold” type of cloth. Taking a step back, over the course of this year, monthly flows into gold-backed ETPs were not very consistent, yet on a quarterly basis, net inflows reigned. In Q1, January’s strength offset a weak February and flattish March and was a predominantly US story. This is perhaps unsurprising given US politics, trade tensions, and doubts about the US economy at the start of the year. However, Q2 (which started weak), gained momentum each month, with June unsurprisingly seeing massive inflows. On a net basis, European listed funds (including the UK) drove the bulk of the increase as global uncertainty, coupled with Brexit worries, and trade issues drove outsized interest. This has given rise to the more “buy and hold” type of strategic allocations globally, in our view. While hedges against uncertainty will likely drive investor interest in most regions, the outcome of Brexit and the implications it has on the EU as a whole will likely prove important for sustainable interest — as much as trade wars and other risks perhaps.

What conclusions can we draw?

Gold’s role as a perceived store of value and perceived safe haven drives many to view it as shelter during a market storm. Secondly, it benefits from having a long history in the global monetary system, yet is not controlled by any single entity, leaving it as a globally accepted but non-debasable asset. When investors are looking for somewhere to run, many view gold as an attractive option, particularly when the world’s central banks also seem to believe the same. In our view, any vulnerabilities to the current rally stem from a retrenchment of risk, a resolution to the trade war, a dialing back in Fed and global monetary policy expectations, a calming of economic fears, and/or stem from less risk and instability. We are reiterating both our base case and the high/low scenarios that the ongoing level of uncertainty in the market will continue to raise the floor for gold and presents the risk for both materially higher and lower prices versus our base case as risks unfold, easy monetary policy continues, and economic worries proliferate. In our view, it is all related. That is not to say that there are not inherent vulnerabilities to the rally, particularly given that the duration of the move is largely dependent on the ongoing political decision to keep the trade war going. At the moment, we seem to be embarking on a gold-positive run. The question is what is the duration of this current rally? Is it the beginning of a long-term bull run or is it simply a product of uncertainty (politically manufactured and otherwise) that is vulnerable to a reversal? In our view, the answer may be that it is a little bit of both.