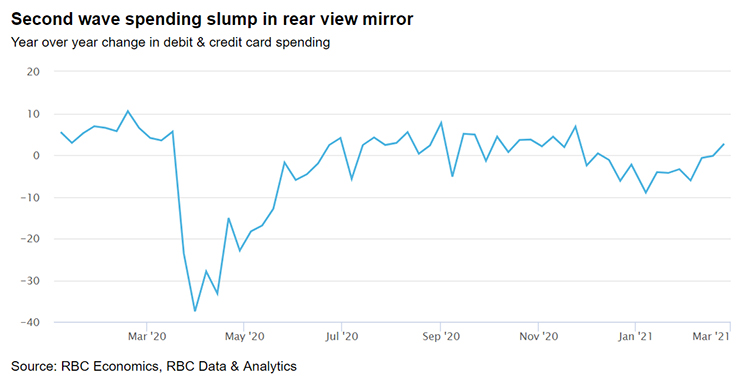

- Canadian household spending bounced back in February as virus-containment measures eased in much of the country. After dipping in December and January, overall card transactions were 2.7% above year-ago levels.

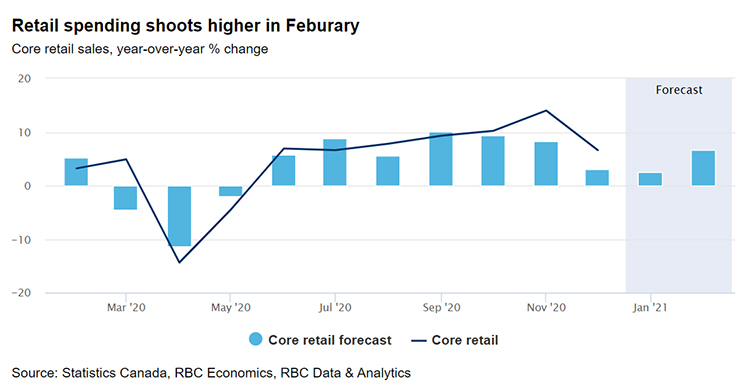

- Data suggest ‘core’ retail sales (excluding motor vehicle and gasoline sales) rebounded, rising as much as 7% above year-ago levels in February – reversing much of the slowing over December and January and confirming the relative resilience of sales compared to the spring 2020 lockdowns. The recovery happened despite restrictions on in-store shopping in much of Ontario, suggesting sales could strengthen further in March.

- Household purchasing power continues to be propped up by significantly larger-than-usual government income supports. With incomes holding up well, households are positioned to spend after virus-containment measures are lifted.

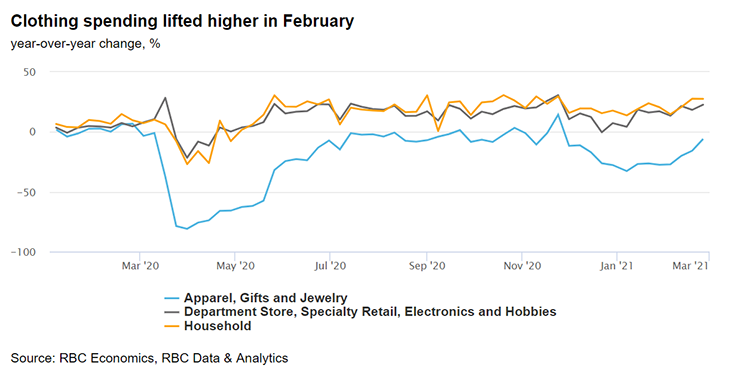

- Spending on clothing appears to have bounced higher after slowing sharply over the holidays.

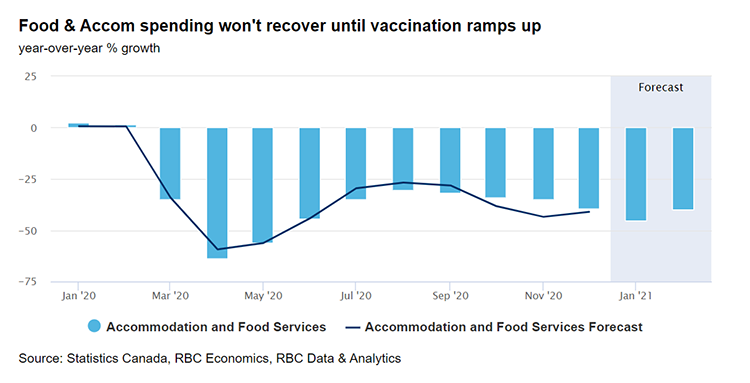

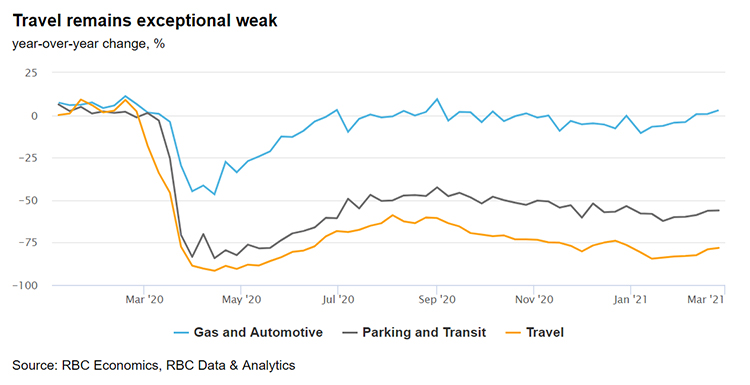

- High-contact services remain very weak. Spending on food & accommodation was still running 40% below year-ago levels in February.

- Accelerating vaccine distribution represents the light at the end of the tunnel for service-sector industries. Households have ample purchasing power to ramp up spending quickly. And that light is getting closer with Canada set to receive enough doses of the Pfizer and Moderna vaccines to provide at least a first dose to most of the population over the age of 60 (who accounted for 70% of hospitalizations and over 95% of deaths from COVID to-date) by mid-April.

Spending shifts and highlights

To view past reports, please visit the COVID Consumer Spending Tracker.

RBC’s consumer spending tracking report uses RBC Data & Analytics’ proprietary database of anonymized card transactions by Canadian clients. The data are an accounting of merchant transactions that are divided into various spending categories covering tens of millions of weekly card transactions worth billions of dollars each week. Transactions, both in person and online, are classified into 11 broad spending groups: Dining, Education, Finances, Groceries, Health, Household, Shopping, Transport, Travel, Utilities, and Other. Within each group, the data are further classified: for example, shopping covers merchants classified as clothing stores, hobby shops, electronics stores, and jewellers, among others. We exclude purely financial transactions such as cash advances and insurance from spending.

We examined changes in the value of all transactions in these areas for 7-day periods starting January 1st, comparing spending to the same period one year ago. To examine the impact of important events, we looked at how spending changed on specific days, both on a daily basis and on an annualized basis relative to that same weekday a year ago.

Online spending volumes are estimated based on the presence of an RBC card at the time of the authorization. Pre-COVID averages are calculated as the average of the first 11 weeks of 2020, and post-COVID averages are averages of subsequent weeks.

Protecting your privacy and safeguarding your personal information is a cornerstone of our organizational ethics and values and will always be one of our highest priorities. The underlying data for this analysis was aggregated based on transaction date, region and merchant category, and cannot be used to identify any individual client or merchant. For additional information please visit www.rbc.com/privacy.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.