Key Points:

- We believe consumer packaged goods companies (CPGs) should focus on long-term investing during market downturns.

- A potential recession may be shallower and longer than previous recessions, creating a

“growth malaise” for the U.S. - Economic indicators may worsen later this year, particularly as we begin to see the full impact of inflationary pressures on consumers.

- Higher inflation is now beginning to shift consumer preference for at-home cooking and generating trade down toward value and private-label brands.

Against the weakening macro backdrop, we thought it might be a good time to compare consumer behavior against past recessions to help consumer packaged goods companies (CPGs) better understand how to engage with consumers during economic hardship.

Our latest research compares key macro indicators and trends against the 2008-09 recession and offers recommendations on how to tweak corporate strategies to better navigate the current economic environment.

Focus on long-term strategies, not short-term R&D cuts

Instead of protecting earnings by cutting marketing, advertising, and R&D budgets, we recommend that CPGs focus on investing in the long-term health of the business during market downturns. Consistent and balanced growth builds trust and terminal value, which is worth noting as the latter represents 70%-80% of a company’s value.

Our research suggests that CPGs that made long-term investments during prior recessions experienced the best value creation, and ultimately emerged stronger from periods of crisis. For example, Coca-Cola's “2020 Vision” was implemented during the 2008-09 downturn and set the foundation for the company's success in the next decade.

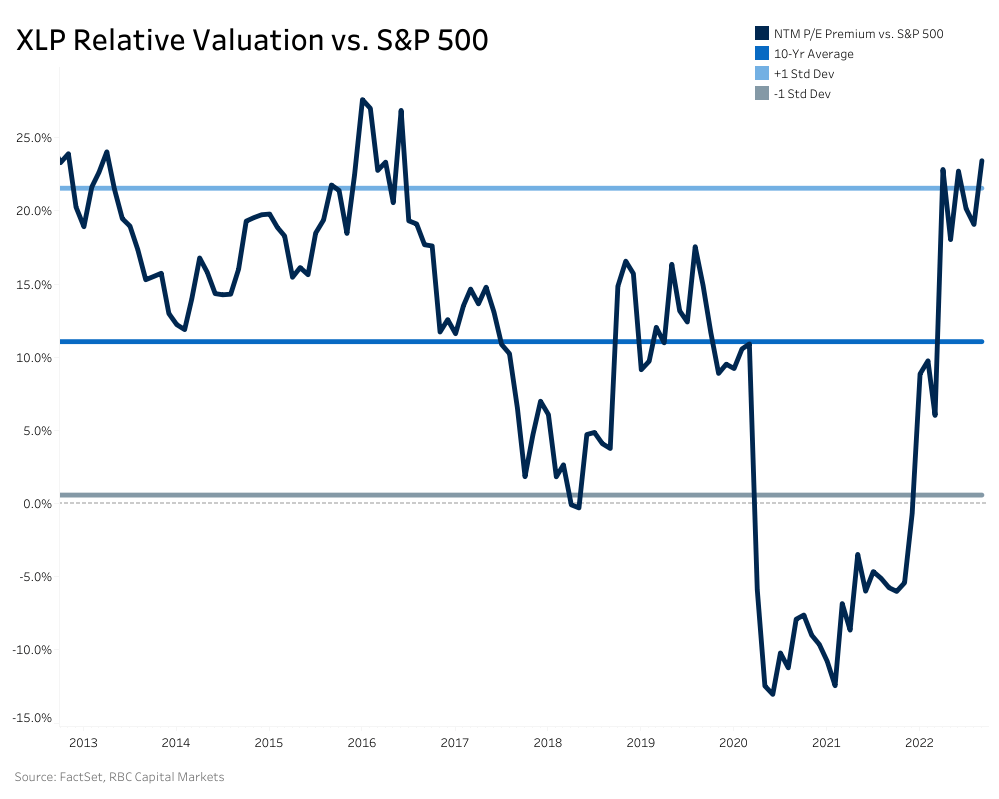

Also, keep in mind that consumer staples tends to outperform in the early market recession “fear” phase, but underperforms as we near the actual recession. Currently, the sector’s valuations are near historical highs, with the current premium to the S&P 500 at ~22%, nearly 2x the historical average over the past 10 years.

"Our research suggests that CPGs that made long-term investments during prior recessions experienced the best value creation, and ultimately emerged stronger from periods of crisis."

- Nik Modi, Consumer Staples Analyst, RBC Capital Markets

A potential recession may last longer than prior downturns

Our research reveals that the current downturn may not be as deep as prior recessions, but may last longer, creating a “growth malaise.”

Although recessions occurring in the early 2000s and 2008-09 were led by the dotcom bubble and the housing crisis, respectively, we expect that a potential 2022-23 recession will be broad-based with high inflation impacting most economic sectors (e.g., consumer products, industrials, housing). We also believe tighter monetary policy from the Federal Reserve will have an extensive impact on financial markets.

Here are other ways our current macro environment differs from the beginning of prior recessions:

- The consumer price index is currently around ~8% vs. low-single-digits inflation in 2008 (4.0%, March) and 2001 (2.9%, March).

- U.S. gas prices have declined from their year-to-date peak and are now at ~$3.7, slightly lower than the inflation-adjusted price of ~$4.4 in 2008 but higher than the ~$2.4 in 2001.

- The unemployment rate currently hovers around 3.7%, lower than ~5% at the beginning of the prior two downturns, providing some economists with optimism about the economic outlook.

Economic indicators may worsen toward the end of 2022

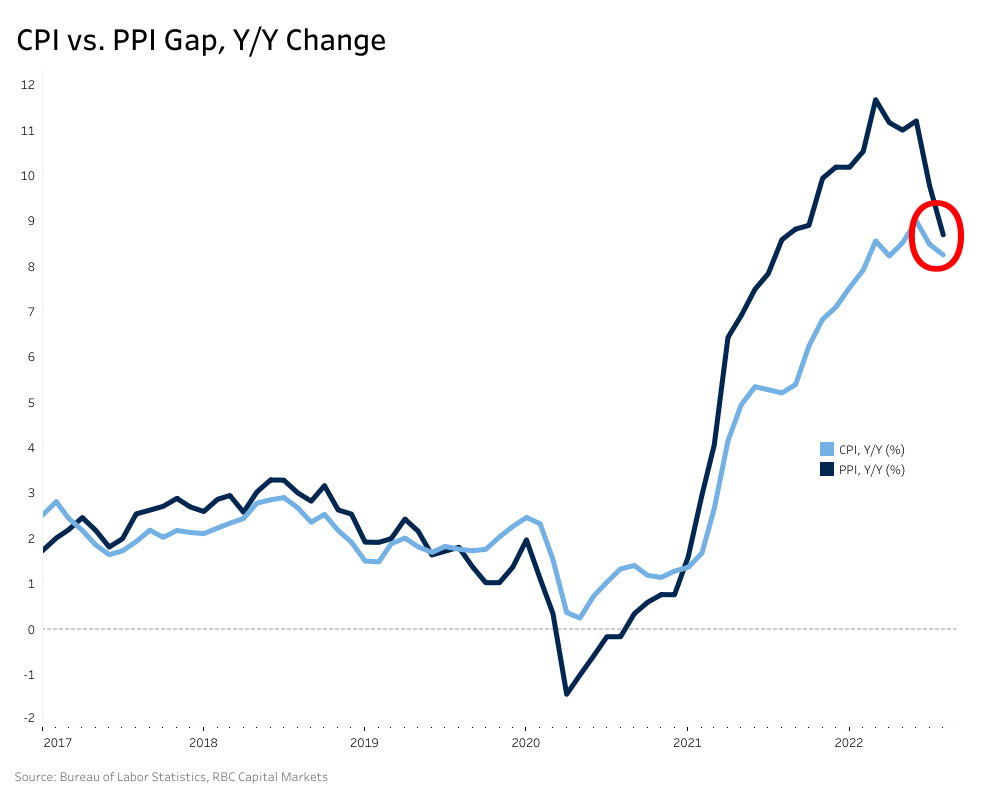

Although we’re more bearish about the economic outlook than consensus expectations, we believe economic indicators may worsen towards the end of this year. Even with the pullback in consumer confidence and spending, we don’t believe we’ve yet realized the full impact of inflationary pressure on consumers, as seen in the dramatic spike in travel following the loosening of COVID-19 restrictions. Moreover, the gap between the consumer price index and producer price index, while narrowing, has yet to close, indicating not all producer inflation has been passed to the consumer yet.

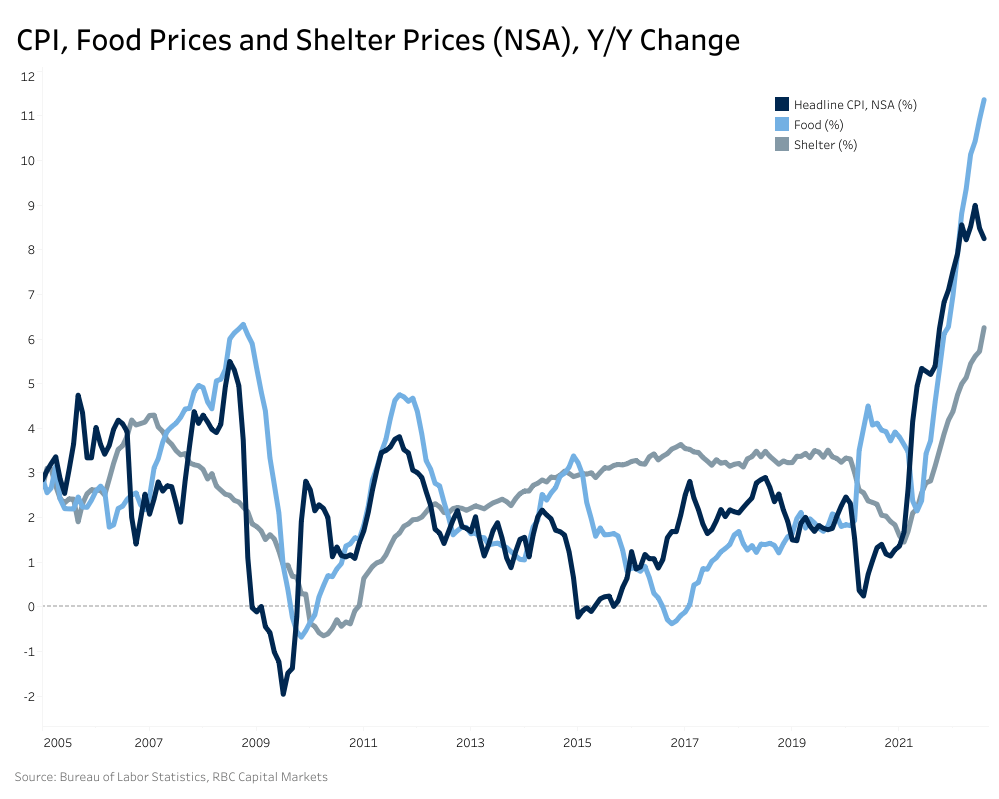

As inflation lingers around a 40-year high, many consumers are unfamiliar with this level of price pressure, particularly across the two most basic necessities: food and shelter. We think consumers will soon start to feel the brunt of inflation and adjust their consumption behaviors. Once that happens, our concern is that the labor market, which has been remarkably strong, will start to flatten for the middle class due to price pressures, the loss of government support, and lower excess savings.

Higher inflation shifts preference for at-home cooking and value brands

CPG categories and companies were less impacted by economic weakness than macro-sensitive sectors during the 2008-09 recession. But we did notice a shift from away-from-home to at-home, particularly in food & beverages, and a preference for value and private-label brands.

Although away-from-home food and beverage spend was high this summer, inflation has led many consumers to shift to at-home cooking and increase purchases of packaged meat, pasta, and instant potatoes once again. Although demand for at-home luxury items was high during the pandemic, consumers are now trading down to more value and private-label brands.

As manufacturers focus on realizing net price increases to offset cost inflation, promotional intensity is lower than now than in 2008-09, with total volume sold on promotions in the ~21% range compared to ~26% in 2019. But we expect activity to pick up as unemployment rises, and product supply normalizes.

Ultimately, we believe retailer margin pressures and potential foot traffic concerns could manifest in higher promotional spending, which may impact 2023 earnings power for the consumer staples sector.

Nik Modi authored “Consumer Staples Recession Playbook: How to Drive Growth Through a Macro Downturn” published on September 15, 2022. For more information about the full report, please contact your RBC representative.