Despite a strong growth case for SAF – including few viable alternatives – prohibitive prices, low supply and limited feedstock availability put a question mark on the timing of its commercial momentum and widescale adoption by the aviation industry. In parallel, amid an increasing number of SAF-related projects on the ground, RBC assesses the industry's potential, differentiating between stated capacity and credible supply, studying SAF’s practicality from a feedstock perspective.

Assessing demand levels: regulatory incentives, requirements

SAF is produced from sustainable, renewable feedstocks (cooking oils, solid waste from homes and businesses such as packaging, textiles, and food scraps etc.) and is very similar in its chemistry to fossil jet fuel. Using SAF results in a reduction of CO2 emissions of up to 80% (IATA) compared to jet fuel produced from fossil sources.

Furthermore, as a “drop-in” solution that can be pumped straight into aircraft engines, SAF is the preferred option among green alternatives for power jets, with electric or hydrogen engine for large aircraft a long way away, notes RBC. The aerospace industry (including players such as Airbus and Boeing) has committed to 100% SAF capability by 2030 for all commercial and military aircrafts, vs 50% today.

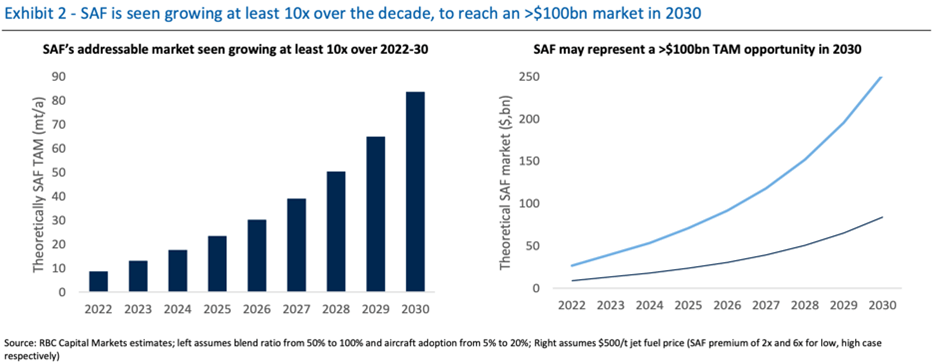

As a result, RBC argues that the SAF market could reach a value of over $100bn at the end of the decade, with demand of 24 mt/a, of which 12 mt/a implied by US and EU regulations. The EU’s ReFuelEU Aviation’s 2% blending mandates on suppliers in 2025 will increase to 5% in 2030, while in the US, the DOE's Sustainable Aviation Fuel Grand Challenge aims at boosting SAF use to at least 3bn US gal/a (or ~9 mt/a) in 2030.

SAF capacity potentially flying way above policy targets

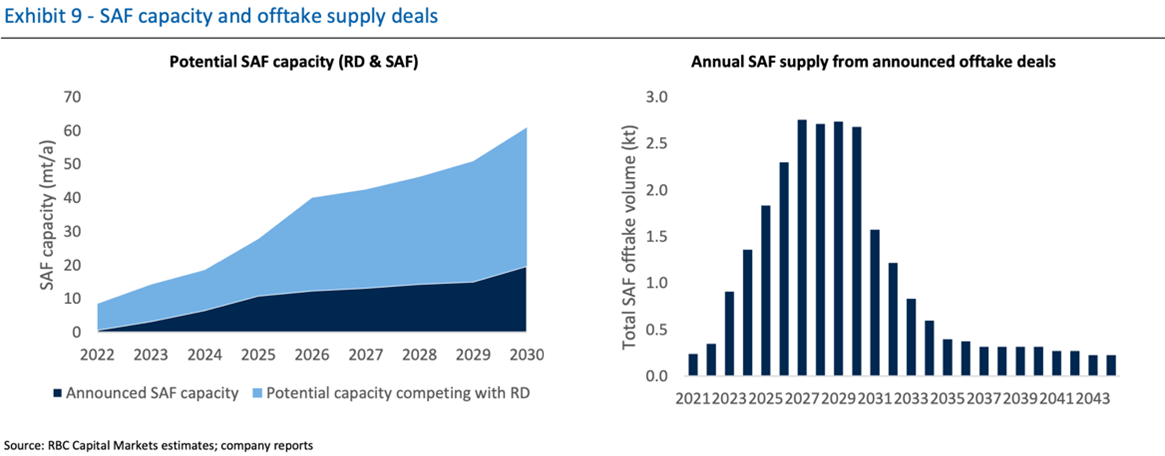

Over the past three years, many oil majors, refiners and pure players have unveiled or increased production plans in SAF though few producers have set out production roadmaps for SAF specifically - most tend to refer to total biofuel production, grouping renewable diesel (RD) and SAF together. Looking at capacity roadmaps of over 20 producers, RBC estimates total end-decade SAF capacity could range from 20 mt/a to as high as 60 mt/a, which could indicate significant overcapacity relative to what policies suggest.

Assessing supply levels

RBC expects a total of ~23 mt of SAF to be supplied from 2022 to 2044, with offtake significantly skewed to the second half of this decade, with 12 mt (52% of total offtake) to be delivered over 2026-30 and total yearly offtake ranging between 2 and 3 mt/a over that period. This suggests airlines remain far below demand implied by policies in the EU and the US. As a result, RBC argues that more agreements will materialise in the near term.

RBC stresses that biggest offtake suppliers are smaller pure-players in the biofuel space - 2/3 of total offtake deal supply comes from five producers only, which include Renewable Diesel market leader Neste, Integrated Energy major Shell and three pure players in the agriculture biofuel space, while Colorado-based Gevo and DC-based Alder fuels concentrate more than 40% of the offtake market today.

Assessing the supply / demand balance, RBC concludes that an analysis of SAF offtake deals suggests volumes summing to 2 -3 mt yearly between 2026 and 2030, meaning there could be a significant deficit through most of the decade.