Listen on Apple Podcasts, Google Podcasts, Spotify or Simplecast

While there are challenges ahead, there is a renewed optimism that we may be entering a recovery stage – where a period of fiscal discipline and strategic focus can set companies up nicely for long-term success.

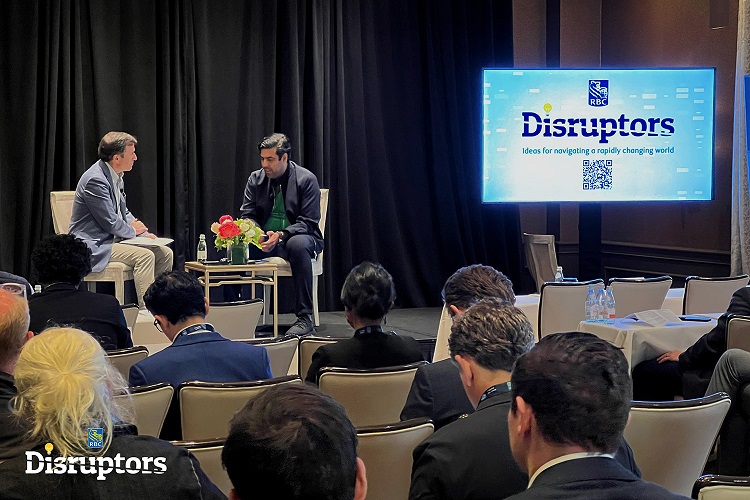

That was the spirit from the RBC Capital Markets Technology Private Company Conference in LA, an annual gathering of tech founders and investors exploring ideas, risks and opportunities in tech land.

On this episode of Disruptors, John Stackhouse is live from LA and is joined by Sachin Dev Dugal, Chief Wizard at Builder AI — named one of the world’s top three Most innovative Companies in AI, alongside Open AI and DeepMind. Builder uses low code and customizable software to provide flexible, bespoke apps at the speed and cost of an off-shelf product — aiming to make building software as easy as ordering a pizza.

Silicon Valley and other tech centres are hopeful and as markets look toward rate cuts going into 2025, a new confidence can be felt. But until then, many executives and investors could remain focused on managing cash and costs, proving out business models, especially in AI, and maintaining secure relationships with patient investors.

And for those who remain strategically focused, operationally lean and results oriented, the outlook is pretty sunny.

To read ‘The Roaring ‘20s are back, thanks to seven stocks, two letters and one central bank’ by John Stackhouse, click here.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.