Published February 26, 2021 | 3 min read

Key Points

- Investors are starting to recognize the “tech-like” attributes of many digital health and HCIT companies - this is both changing how they think about valuation and broadens the field of interested parties.

- More companies are also going public, whether through IPOs or SPAC transactions. There were nine HCIT IPO/SPAC transactions in 2020, but only five in 2019 and zero in 2018 and 2017.

- The start of the Biden administration offers hope that the transition to value-based care will accelerate.

- Many healthcare companies are exiting the year on pretty firm footing, with clear evidence of how much investment is needed in areas like health data liquidity/interoperability, care delivery and operational efficiency, with likely postitive impact on CAPEX.

Prior to the pandemic, technology was quietly infiltrating the healthcare space, but in such a highly-regulated space, progress was slow. Once the COVID-19 pandemic took hold, however, stay-at-home orders to combat the virus turned telemedicine into a must-have. Virtual appointments were made possible by regulatory relaxations, and the frequency and normalization of telemedicine has also made patients more comfortable with using technology for their health.

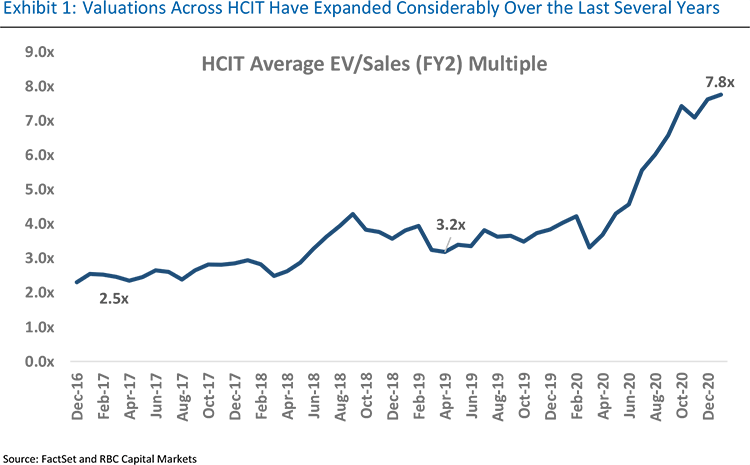

Investors, naturally, are taking notice, and both private and public funding reached record levels in 2020, which is continuing to drive momentum and contribute to higher valuations. But our analysts believe that there is much more room to run. The faster-growing digital health/HCIT stocks currently trade at an average 10x NTM revenue, which is well above Jan 2020 levels of 4x, but still a significant discount to the 20x average of their similarly-growing and scalable "tech" peers (some of which trade as high as 40x).

Room to grow

While the pandemic kicked things off, particularly in clearing regulatory hurdles and increasing awareness of technological solutions, what’s driving valuations now is different. Investors are starting to recognize the “tech-like” attributes of many digital health and HCIT companies, which opens the field of interest.

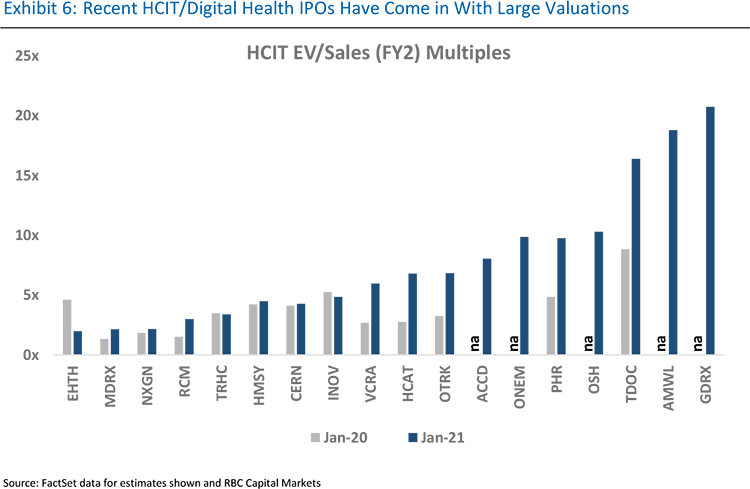

Like traditional tech stocks, many HCIT names have very large addressable markets, steep revenue growth trajectories and similar software-like scalability. At the same time, recent IPOs have come into the space with large valuations, helping to lift the group average. But HCIT stocks continue to trade at a significant discount to similarly-growing and profitable “tech” peers.

All of these factors are driving investment, which in turn is likely to accelerate innovation as new funding is spent on R&D and M&A for the development of new solutions. Digital health venture funding will total around $12 billion for 2020, according to data compiled by Rock Health and the average deal size is also at record levels, exceeding $30M so far in 2020 vs $20-22M in 2018 and 2019.

Like traditional tech stocks, many HCIT names have very large addressable markets, steep revenue growth trajectories and similar software-like scalability.

IPO and SPAC activity will accelerate

More companies are also going public, whether through IPOs or SPAC transactions. There were nine HCIT IPO/SPAC transactions in 2020, but only five in 2019 and zero in 2018 and 2017. And those 2020 IPOs have performed well – the seven IPOs of last year are currently trading around 85% above where they initially priced. This activity will only spur investor interest, expand valuations and set the stage for more firms to go public this year.

This is an industry that in the US and globally is ripe for disruption, with large cost, access and efficiency problems. The addressable market is massive, with healthcare spending in the US alone approaching $4 trillion in 2019. Meanwhile, as the cost burden is shifting to individuals and consumers who are comfortable with more tech-enabled care options, the traditional delivery system must modernize to keep pace.

This is an industry that in the US and globally is ripe for disruption, with large cost, access and efficiency problems. The addressable market is massive, with healthcare spending in the US alone approaching $4 trillion in 2019.

The new administration

The start of the Biden administration offers hope that the transition to value-based care will accelerate. Many public equity investors had anticipated that the US would have moved further from fee-for-service models by now, but the pandemic has again provided impetus here.

At RBC’s Healthcare Private Company Conference in December 2020, we hosted a fireside chat with the founder and CEO of Aledade, Dr. Farzad Mostashari, the former National Coordinator for Health Technology early in the Obama administration. He pointed out that more recent data has shown that these programs are working and while they could benefit from some regulatory fine-tuning, for the most part, they’re fit for purpose.

Even if the new administration doesn’t do much pushing towards value-based care, it should at least lead to less regulatory uncertainty. More predictability in policy will allow providers and vendors to have confidence in making investments and changes towards new models.

Even if the new administration doesn’t do much pushing towards value-based care, it should at least lead to less regulatory uncertainty. More predictability in policy will allow providers and vendors to have confidence in making investments and changes towards new models.

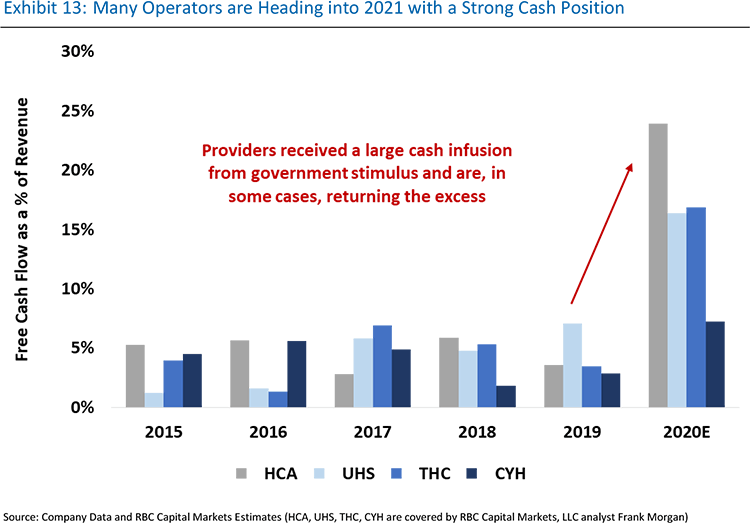

Funding for CAPEX

Although the healthcare sector in general survived the worst of the fallout from pandemic-related disruptions, many still delayed planned HCIT projects and investments. As a result, many are exiting the year on pretty firm footing, with clear evidence of how much investment is needed in areas like health data liquidity/interoperability, care delivery and operational efficiency.

Individuals have many more options for care today than the traditional doctors’ offices and hospitals and if these legacy sites don’t modernize their facilities, they may find themselves losing patients. Providing the pandemic continues to come under control, CAPEX budgets may find themselves freed up, and the likelihood is that many companies will be looking to invest in technology.

There are a multitude of tailwinds then to spur HCIT this year. Our analysts expect momentum to continue across company lifecycles in terms of valuations, firms going public, and investment opportunities, for both disruptive new firms and existing healthcare institutions expanding their technology capabilities.

Required Disclosures and Disclaimers