Required Conflicts Disclosures

There is a projected $2 trillion investment gap over the next fifteen years for the metals and minerals needed to limit climate change below 2°C. From electric vehicles (EVs) to solar and wind power, the materials needed to develop clean energy technologies are often the same. Battery metals like lithium, cobalt, nickel, and graphite, wiring metals like copper and aluminum, solar cell metals like tellurium and indium, and the rare earth elements needed for wind turbines and EV motors – demand for all these “transition minerals” will surge.

An unprepared world

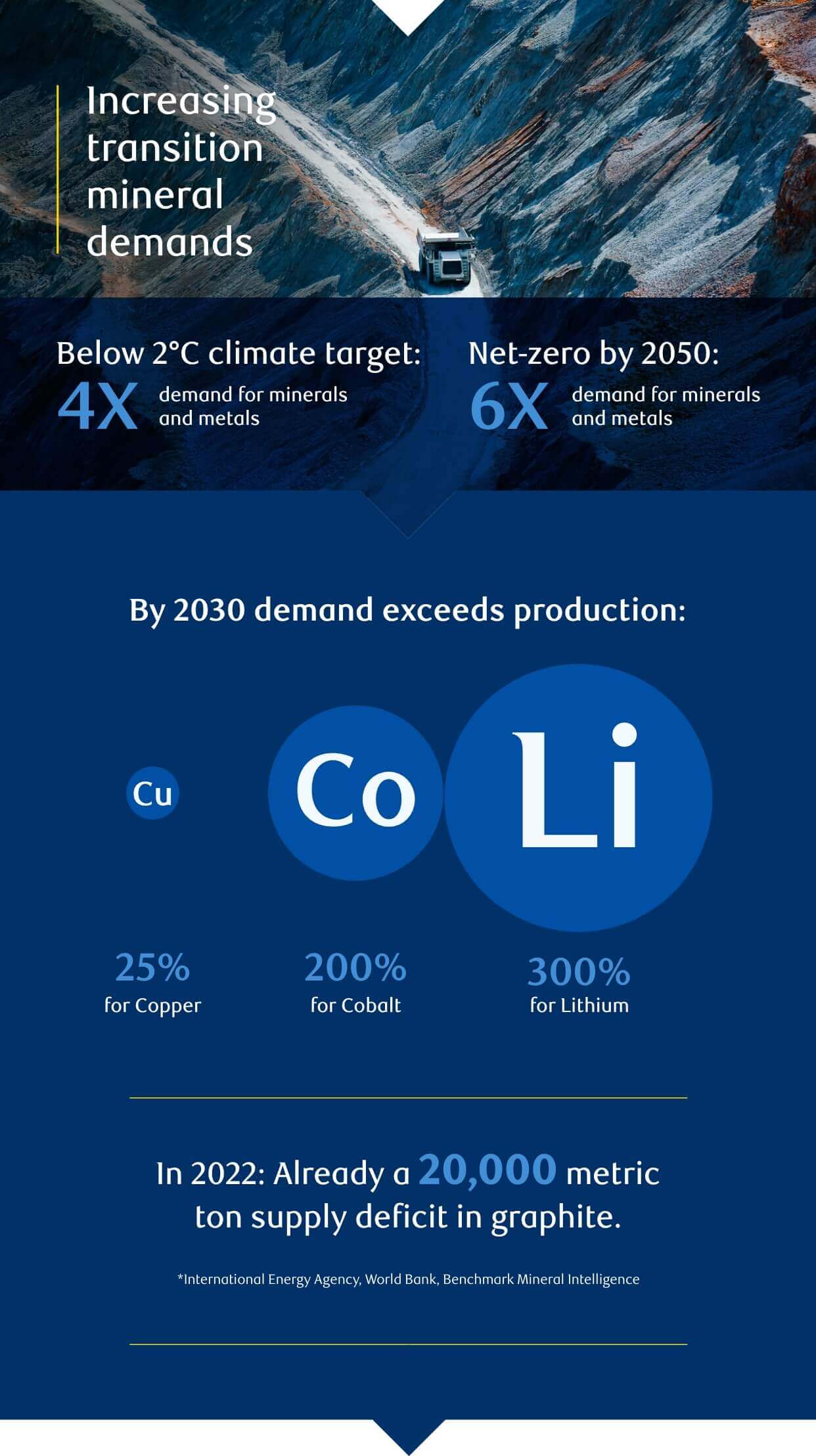

An International Energy Agency study suggests that staying “well below 2°C” will see demand increase fourfold by 2040. A more ambitious global net-zero by 2050 agenda would see demand rise even further, sixfold by 2040.

But the world is underprepared for this surging demand. Supply chains are underdeveloped, presenting a potent risk to clean energy deployment in terms of the total amount of supplies available. Significant concentration across existing mineral supply chains also threatens to disrupt the ability of countries to manufacture and deploy these technologies, and therefore their ability to pivot to a low-carbon energy future.

An opportunity for collaboration

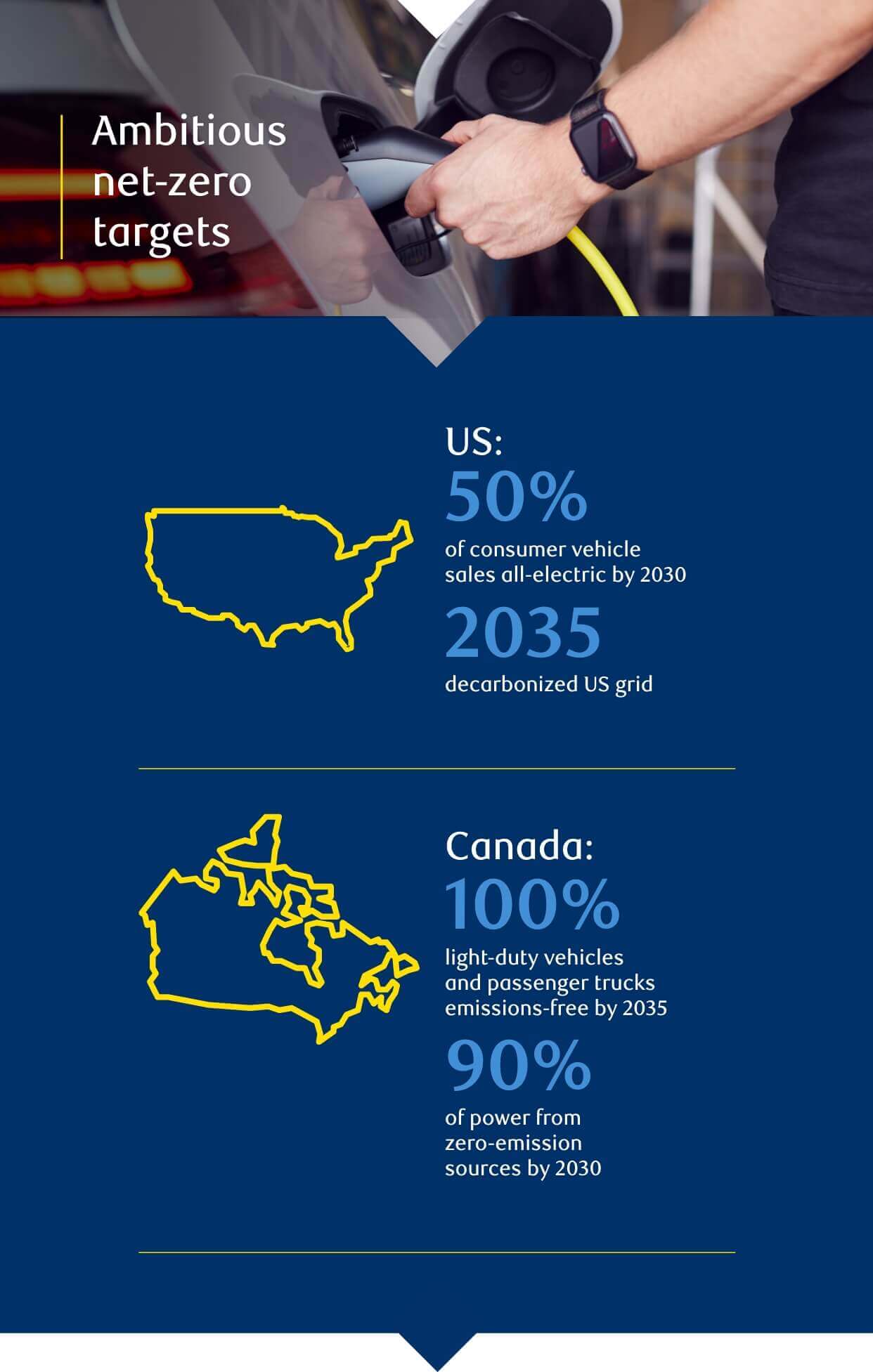

The risks for Canada and the US are particularly acute. While both nations have strong ambitions to reach net-zero by 2050, the vast majority of transition mineral supply chains are concentrated outside these countries.

For the United States and Canada to deliver on their ambitious decarbonization agenda while securing their low-carbon energy system against supply shocks, they should mobilize their own long-standing history of friendship and collaboration to meet the mineral challenge.

Both countries share common interests in securing a supply chain that can meet growing mineral needs and is governed transparently, sustainably, and free of disruption. Such a partnership can diversify the global supply chain through localization, use the demand side power of the integrated US-Canadian consumer market to set global resource-governance standards, and create a starting point for collaboration with likeminded countries to strengthen mineral value chains around the world.

The opportunity for the United States and Canada to lead is vast, and the potential tools at the two partners’ disposal are powerful. For Washington and Ottawa to bring these forces to bear, however, they must proceed with a set of principles in mind.

Ahead of the Global Energy Forum 2022, RBC Capital Markets has collaborated with the Atlantic Council to produce a flagship report on the impact of mineral mining on the energy transition, The United States, Canada, and the Minerals Challenge. In it, they outline the challenges of the transition mineral status quo, the opportunity for collaboration and the path ahead.