Public Sector Issuers Roundtable Report

1. Canadian Economy Expected to Rebound in 2021 but the Outlook is Uncertain

There is a great deal of uncertainty in the outlook with many unknowns. Caution is required for the economic outlook as temporary stabilization programs are scheduled to roll-off and could result in potential head winds for the recovery.

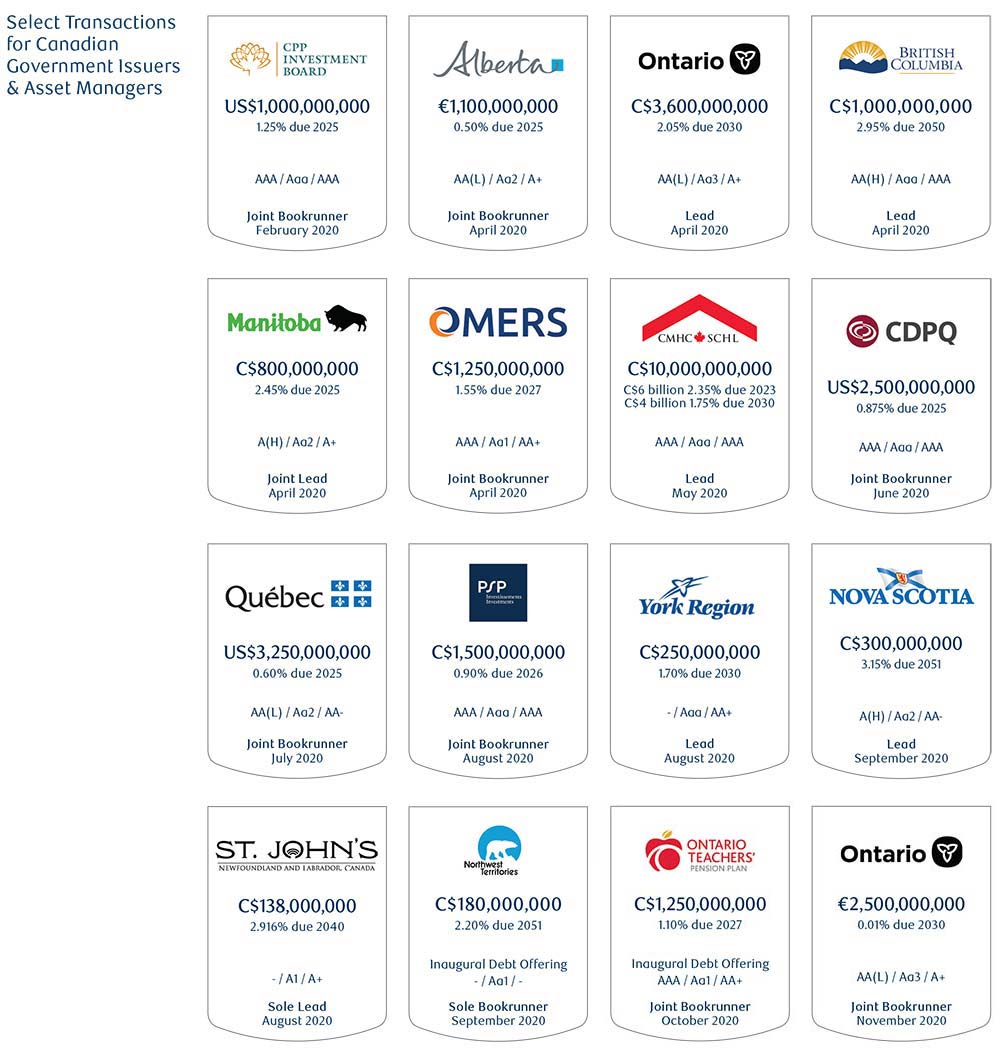

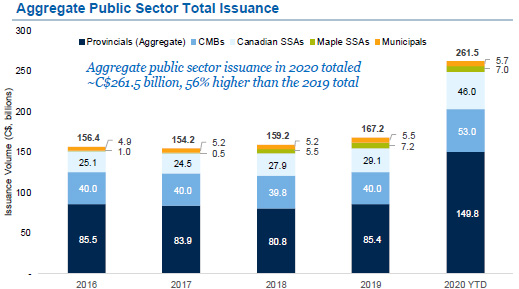

2. A Record Year for Bond Issuance by the Canadian Public Sector

In terms of highest aggregate issuance amount, highest number of new issues, largest annual funding programs for many of the provinces, highest number of carve-out orders by investors, largest single provincial issue size in CAD and EUR.

3. The Central Bank Effect

The initiation of asset purchase programs had a soothing effect on the Canadian capital markets, causing credit spreads to retrace the sharp widening experienced at the height of the market crisis in the spring and tighten through the remainder of the year.

4. The Canada Brand Remains Strong Amongst International Investors

Canadian government issuers represent a stable, high quality and attractive yield proposition for international investors who have shown an increased participation in Canadian denominated debt of the Canadian public sector issuers.

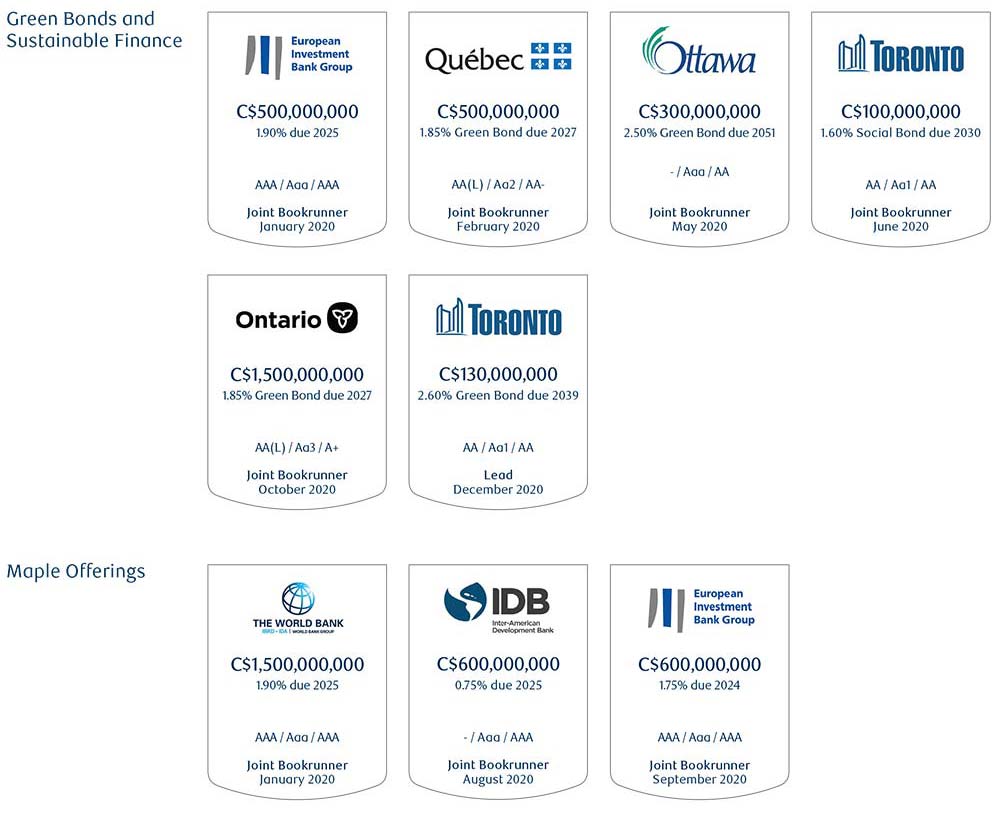

5. Sustainable Investing Poised to Evolve and Accelerate for Canadian Public Sector Issuers in 2021

Canadian government issuers recognize the benefits of incorporating ESG principals into their financing programs. The investors stress the importance of ESG disclosure and reporting for their customers and note that they are seeing a noticeable increase in demand for socially responsible investment products.

Source: RBC Capital Markets

SSA Maple Roundtable Report

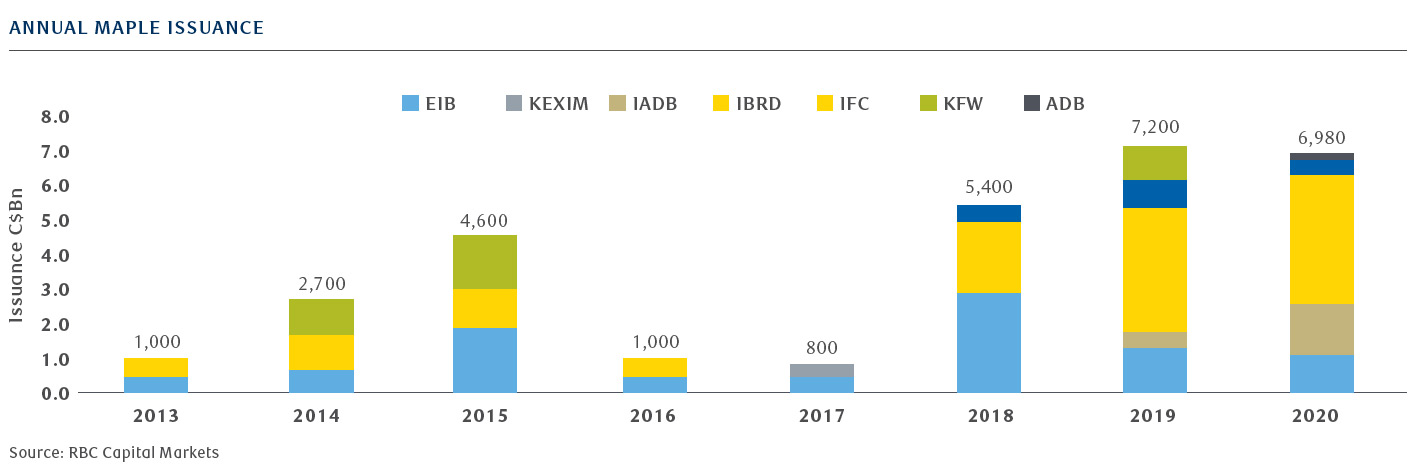

1. Funding programs for SSA issuers have increased significantly due to the pandemic

The Canadian dollar market, albeit smaller in comparison to the rest of the issuance currencies such as USD and EUR, are getting increased attention for the obvious diversification opportunity.

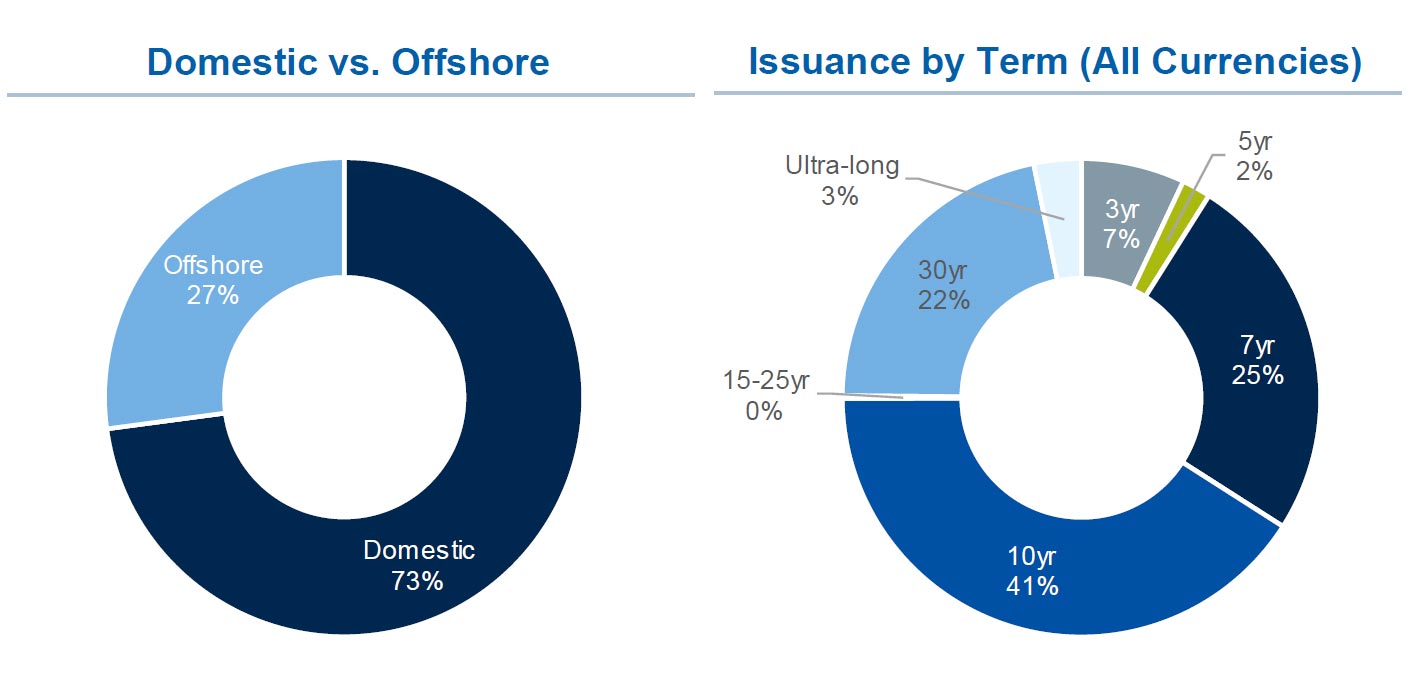

2. Increased domestic demand for Maple SSA issuance complements robust international demand

Maple bond issuers are seeing continued growth in domestic investor participation in their issuance while offshore interest in CAD investments is also growing.

3. SSA Issuers would welcome opportunities to offer more duration in CAD

SSA issuers value duration and the Canadian market offer very long term maturities. Subject to swap costs and pricing, SSA issuers are open to longer dated issuance.

4. ESG, in particular Sustainability, continues to be a major focus

Maple bond issuers are heavily focusing on the Sustainable development bond market in addition to the Green Bond market.

Municipal Treasurers Roundtable Report

1. Prudent Fiscal Management

The majority of Canadian municipalities were very quick to recognize the fiscal risks of the covid-19 pandemic.

2. Revenues

Larger municipalities with transit systems were exposed to more significant revenue short-falls as fare box receipts dropped materially.

3. Transit

Jurisdictions that feature large transit systems reported a significant drop in ridership levels during the first wave of the pandemic.

4. Expected Borrowing Requirements for 2021

By the conservative nature of the Canadian municipality capital expenditure and related borrowing requirements design, the capital planning system does not typically result in any surprising swings in the year-to-year borrowing requirements for municipalities.

5. Support from Senior Levels of Government

The majority of the municipal funding relief in 2020 has come through the federal “Safe Restart Agreement” which provides provinces and municipalities with formula-based payments according to each municipality’s needs for assistance with social services, transit, and general municipal shortfalls.

6. Environmental, Social & Governance (ESG) Related Issuance

There is a growing movement in Canada, driven primarily by the municipalities, to broaden ESG bond issuance to include social and sustainable bonds in addition to the more traditional green bond issuances.

In addition, we encourage you to view the RBC Government Finance Public Sector Debt Market update that is published monthly. The December edition includes a year-end recap of issuance trends by the Canadian governments in 2020.

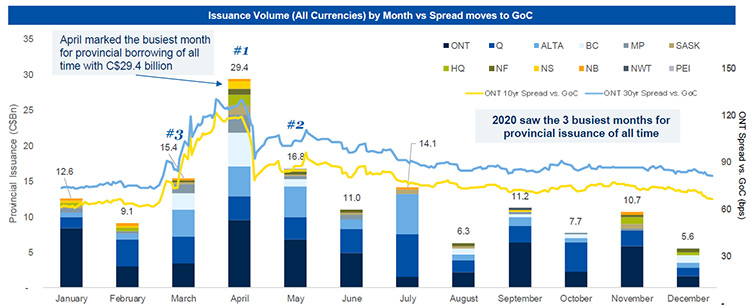

- Total new issue supply for 2020 reached C$180.4 billion, an increase of 57% over the C$114.6 billion seen in 2019 and marking the most active year for domestic issuance on record

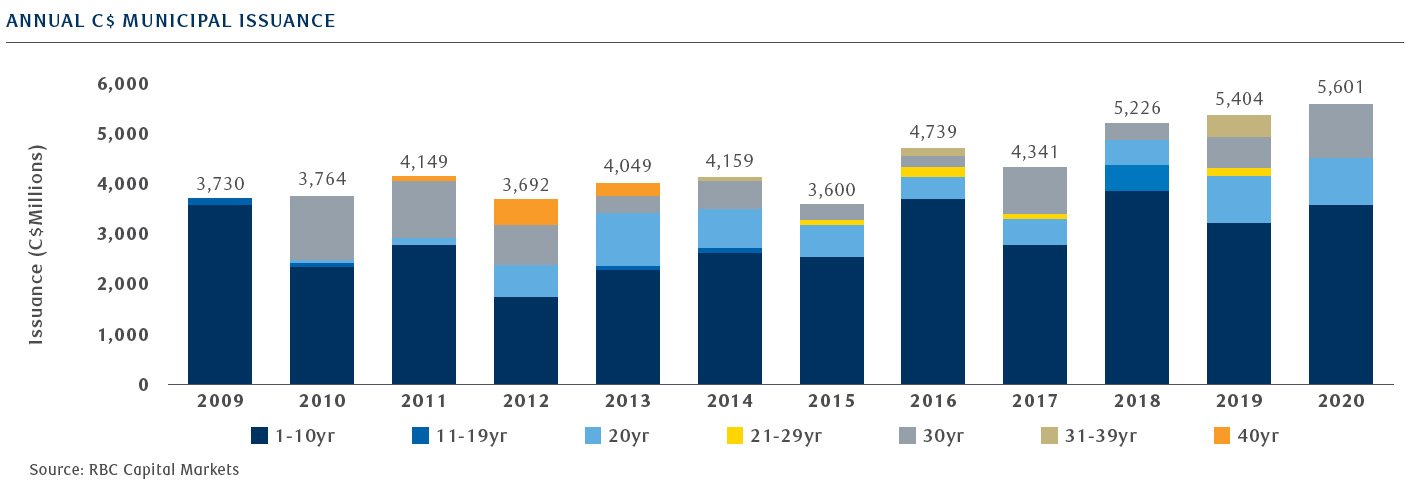

- 2020 marked a record year for domestic provincial issuance, offshore provincial issuance, CHT issuance, municipal issuance, and Canadian SSA issuance

Source: RBC Capital Markets

Public Sector Debt Market Update Report

Contact info:

RBCCM Government Finance

RBCCMGovernmentFinance@rbccm.com

416-842-7756