Following years of strong gains, ESG investors are driving support for environmental and social (E&S) policies to new heights. In 2021, support for E&S shareholder proposals hit record levels.

This year, the number of proposals on the ballot is on pace to hit records, with political lobbying, climate governance and workforce Diversity, Equity, and Inclusion (DEI) once again dominating the proposals.

Our latest report breaks down E&S proposals at both the category and sector level and explores other key proxy voting themes.

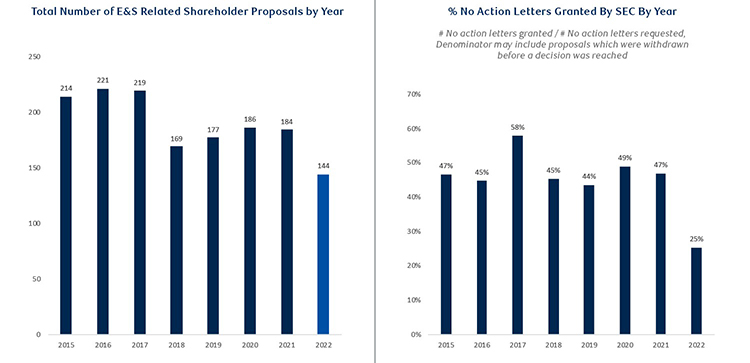

E&S proposals on pace to hit record levels in 2022

The number of E&S shareholder proposals on the ballot is set to hit records in 2022. So far there are already 181 E&S related shareholder proposals on the ballet (based on our review of proxy statements for meetings taking place through late May), note that at this point last year there were just 131 E&S shareholder proposals on the ballot.

The increase we are seeing this year is at least partially attributed to new SEC guidance on how it plans to handle no-action requests from corporates. So far, there have been fewer no-action requests granted.

Source: RBC US Equity Strategy, Factset; includes E&S proposals across all regions on the ballot; 2022 captures E&S proposals through late May 2022

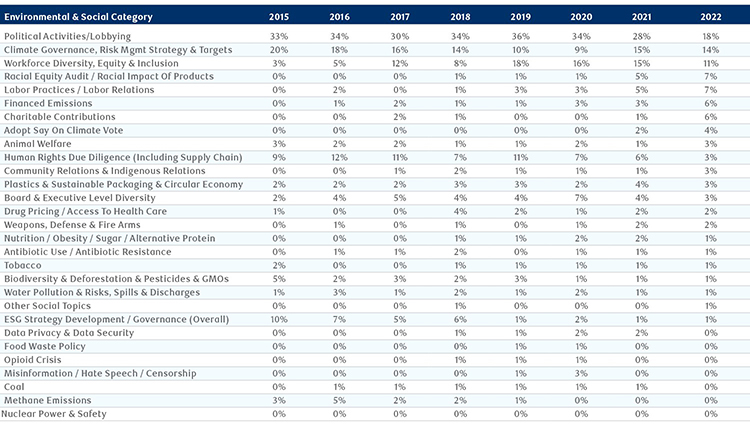

Racial equity audits gain traction as a key ballot issue

Like last year, political activities, climate governance and strategies, and workforce DEI topics comprise most shareholder proposals on this year’s ballot.

Proposals for racial equity audits (where a third-party assesses how a company’s policies, products, and services contribute to racial equality), emerged as a focus area in Financials last year. This year, we not only noticed a further increase in proposals related to this topic, but we also found that they were dispersed among different sectors.

Our research also revealed an increase in proposals addressing both financed emissions and labor practices.

Source: RBC US Equity Strategy, Factset; includes E&S shareholder proposals on proxy ballots from all regions through late May 2022; table includes E&S categories with at least one shareholder proposal in 2022

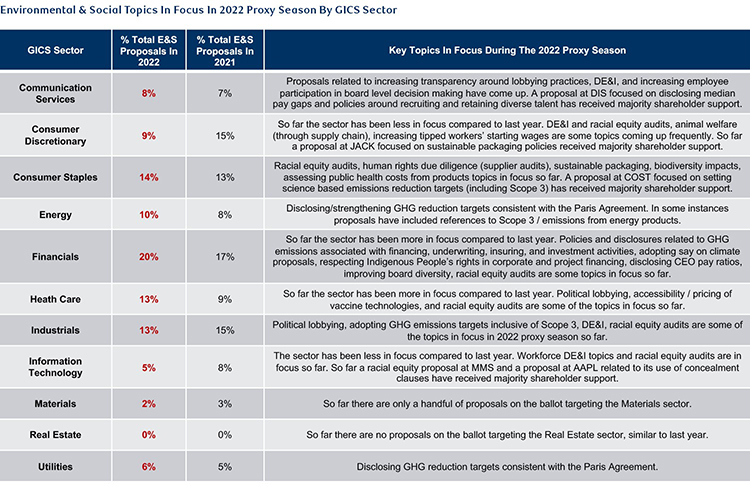

Finance and healthcare more in focus in 2022

The grid below breaks down key E&S themes on the ballot for each major GICS sector during this year’s proxy season.

Overall, Financials and Health Care are seeing a higher percentage of proposals compared to last year, while the Consumer Discretionary and Tech sectors now represent a smaller percentage of proposals. Like last year, there are no proposals on the ballot targeting the real estate sector so far.

Source: RBC US Equity Strategy, Factset; includes E&S related shareholder proposals from all regions on the ballot through late May 2022

Sara Mahaffy, ESG Equity Strategist, RBC Capital Markets, LLC, authored the research report “The ESG Scoop: E&S Topics in Focus for 2022 Proxy Season,” published on April 11, 2022. For more information, please contact your RBC representative.

Our Commitment to ESG

ESG StratifyTM encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.