Why we wrote this

Canada needs to lead the world in net zero agriculture, and our organizations want to play a constructive role in that journey.

To do that, we’ve embarked on a long-term research project, rooted in our foundational report, The Next Green Revolution. We are following that up with a series of smaller reports, to explore the opportunities in policy, human capital, financial capital and technology. None of these are a panacea, but in aggregate, the themes and research can help get us closer to our shared goal of a more sustainable food system.

This report, focussed on ag-tech, shows the opportunities that a range of technologies present to Canada―and also the need for our country to be strategic in our approach. Our team analyzed investment data, sector pathways, and the impact of public policy, both in Canada and other countries. We also worked with the Creative Destruction Lab’s ag-tech program, based in Calgary, to gain insights into the experience of entrepreneurs.

Canada has a history of producing groundbreaking research and development, a lively ecosystem of startups, and a deep talent pool that includes tech-savvy farmers, world-class scientists and creative agri-entrepreneurs. We also understand the imperative to advance a just transition through technology rather than pursuing technologies for their own sake.

Innovation will be key to the low carbon, sustainable food systems of the future. This is Canada’s moment to unlock it.

John Stackhouse, Senior Vice President, RBC Economics and Thought Leadership

Keith Halliday, Senior Director, BCG Centre for Canada’s Future

Evan Fraser, Senior Director, Arrell Food Institute at the University of Guelph

Key findings:

Canada can lead in a new world of agricultural technology

Imagine a bumper crop of wheat grown entirely without chemical fertilizers and using practices that regenerate the soil. Or a swarm of drones that use artificial intelligence to identify every plant in a field, sniping only the weeds with a precision spray. Or a fresh slice of salmon sashimi that was grown in a bioreactor, not caught from the sea.

These are among the game-changing technologies enabling the Next Green Revolution in agriculture. Like innovations that came before them, they’re accelerating productivity to help feed a growing global population. But they’re also playing a critical new role: reducing agricultural emissions and enabling soil to absorb greenhouse gas emissions.

While agriculture produces 10% of our national GHGs annually, its core raw materials—soil, plants, and animals—also hold almost unequalled power to pull emissions out of the atmosphere, where they contribute to climate change.

Unlocking that power, and cutting existing emissions, will depend on many things: including supportive policy, a well-trained workforce, and financing. Critically, this transformation will also hinge on technology—and our success in both developing it through responsible innovation and putting it to work to help the economy, the environment and individual farm operators. In previous research, we found that technological solutions could play a major role in cutting up to 40% of potential 2050 emissions from Canada’s agricultural sector.1

As a top exporter of key crops, with broad market access and a deep history of agricultural innovation, Canada is extremely well-positioned to not just lead the world in the adoption of these ag-techs but in the development of them. By engaging diverse actors in the Canadian food system, we can develop technologies that are responsible, creative, and efficient. Indeed, given our advantages, this opportunity is ours to lose.

We’ve identified seven key innovations or “ag-techs” we believe can both meaningfully reduce emissions and present opportunities for Canada to lead. Some, like anaerobic digesters, carbon capture utilization and storage (CCUS) and precision technology are ready and starting to scale now. Others, like vertical farms and plant science will be key solutions in the medium term. Still others, like cellular agriculture and precision fermentation, could transform the food systems of the future.

In every case, maximizing the potential of these innovations means building the right platforms for collaboration among not just farmers and entrepreneurs, but communities, investors, corporations, social enterprises, and governments. It’ll mean proving to farmers of all types that sizeable upfront investments in more proven ag-techs are worth it while de-risking their leaps of faith into emerging technologies. We need to also be careful that these tools, many of which are capital intensive, do not hurt smaller and medium-sized enterprises and producers and that they are truly deployed to help Canada achieve both our emission targets and drive a green economic transition.

Doing this will mean accelerating investment in research and development—particularly among private actors—and directing more of it toward the technologies that can do the most to cut emissions now. As it stands, most ag-tech investments in Canada are focused on productivity enhancing digitization and automation, which help increase yields and improve farm operations. We need more investment in innovation to advance sustainable and regenerative farming.

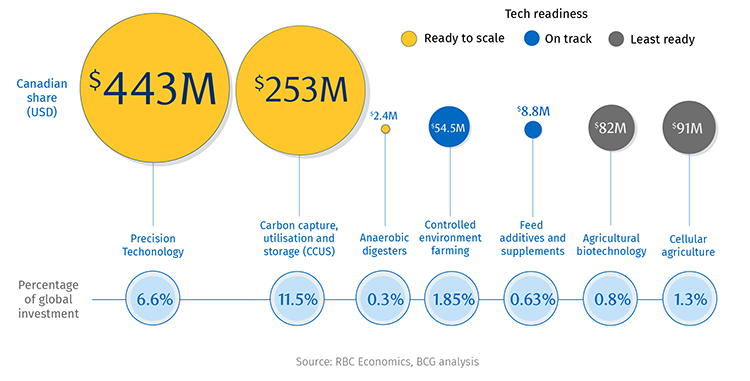

Canada’s share of global funding for most key technologies is low

Global venture capital and private equity investment in ag-tech since 2017

Ready to scale: These technologies are already playing a role in our effort to reduce emissions in agriculture. They are developed and commercially available, but require the right incentives, financing, and policy support to be adopted and scaled.

On track: These technologies are still considered nascent, though they are commercially available. They have strong potential to help Canada adapt to the effects of climate change and/or reduce emissions, but still require further development and growth.

Least ready: These technologies are mostly in the R&D stage and generally not yet commercially available (at least in Canada). They have immense potential to transform the sector and build on existing Canadian strengths and resources.

Mobilizing private investment is key to competing on the global stage

Canadian agricultural innovations can be found on fields around the world, from canola seeds invented by Prairie scientists to grain augers first imagined in Manitoba. Yet as we move into a new era of low emissions agriculture, much of our potential to build on this strength—using newfound advantages unlocked by artificial intelligence and data science—remains untapped.

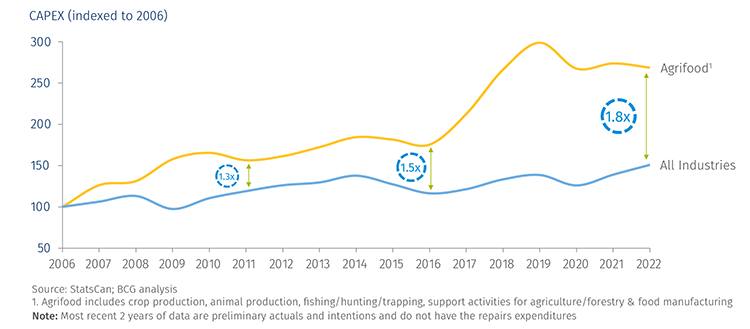

Agriculture has outpaced other Canadian sectors in investment over the last number of years—a positive sign suggesting both productivity and rising domestic demand for machinery and equipment with more technology embedded in it. But leading the world in this space demands more investment, particularly from the private sector. For generations, Canadian agricultural research and development has been overwhelmingly fuelled by public dollars. Over the last decade, the public sector accounted for as much as 90% of agricultural R&D, compared to about 30% in the United States.2

Meantime, Canadian agricultural startups and private companies have lagged international peers in drawing private investment. Of roughly US$36 billion in global venture capital and private equity investments in ag-tech since 2017, Canada received just 3%, or US$1 billion. The U.S. captured US$20 billion or 55%.

Canadian agriculture businesses have grown their R&D budgets significantly—at least doubling them from 2015 levels in recent years. But they still fall far short of Canadian public R&D funding, which steadily declined as a percent of GDP since the 1980s. As governments in peer countries like the U.S. and Europe accelerate public spending on sustainable agriculture (for example via the Inflation Reduction Act, and the European Green Deal), Canada risks falling even further behind. It is imperative for Canada to keep pace on incentives to avoid placing our producers and companies at a disadvantage or causing a brain drain to other nations. To compete, we’ll need governments to shift more support to on-farm implementation and uptake of ag-tech regenerative agriculture practices.

And we’ll need businesses to drive more investment—particularly in the technologies that hold the most promise to move the needle on climate change.

Agrifood investment has outpaced other industries in Canada

The global race to create the next generation of ag-tech is heating up

Israel

Israel, a small country with little arable land, is already the global leader in digital fertigation. This technique employs sensors and cloud-based analytics to determine the targeted release of water and fertilizer directly onto a plant’s roots. More recently, the country has expanded its agricultural focus to develop capabilities in vertical farming and alternative proteins. Israeli companies are leading the world in investment in plant-based proteins, drawing US$160 million as of the first half of 2022—22% of all funds globally. Investment in novel protein more broadly is the second largest globally, including for cultured meats (US$320 million as of the first half of 2022).3 The industry grew 160% in the first half of 2022 with more than 100 Israeli companies specializing in novel proteins (and more than 11 of these created between 2021 and 2022 alone). Israel devotes 17% of agricultural spending to research and development.

Singapore

Less than 1% of Singapore’s land is arable, but that hasn’t stopped it from setting ambitious agriculture targets. The country’s “30 by 30” goal aims to reduce its dependence on food imports by increasing domestic food production to 30% of demand by 2030. As part of this, the government is providing funding to help farmers upgrade equipment and test new technology on their farms, while also supporting innovation and ag-tech development. Singapore has clear strengths in urban and controlled environment farming (e.g., vertical farms, contained fish farms, and indoor farm factories that use AI and big data to maximize efficiency), and has more recently emerged as a hub for the development and regulation of alternative proteins.4 In 2019, Singapore announced a regulatory framework for the pre-market assessment of novel foods and is working with public and private sector organizations to support growth of cellular agriculture startups. It was the first country to approve cell-cultured meat for human consumption in December 2020 and is home to more than 20 cell-based meat producers.

Japan

Crisis drives innovation. After the 2011 tsunami and Fukushima nuclear disaster destroyed most nearby farmland, the Japanese government jumpstarted a vertical farm building boom to replace lost production. Today, Japan has more than 300 vertical farms—powered by robotic automation and smart technology—to help maintain its domestic supply of food, which is also increasingly challenged by the country’s aging population and migration to cities (causing abandonment of farmland).5 The government’s 2020 Environment Innovation Strategy aims to develop climate-smart technologies, including through new breeding varieties that reduce CH4 and N2O emissions from agriculture and livestock.

The Netherlands

Despite its smaller size, the Netherlands is the world’s second largest food exporter in dollar value behind the U.S. An agri-food powerhouse, the country excels at digitizing its greenhouses and fields with smart technologies. Dutch greenhouses, which account for 80% of cultivated land in the Netherlands, are among the most advanced in the world. More recently, the Netherlands has emerged as a frontrunner in plant-based food products, driven largely by innovations from Wageningen University and Research Centre. The university is the leading research hub for the Dutch food industry and often referred to as “Food Valley” or the “Silicon Valley of Food.” Home to a US$94 million plant-based food innovation centre, Wageningen University works with startups and researchers to develop new vegan products. Nearly 200 agri-food companies are present within a 10-km radius of the university, creating a dense network of collaboration between the public and private sectors. There are more than 60 companies and research institutions focused on plant-based protein in the country.6

The Transformative Seven

Building a low carbon agriculture sector will be a challenge unlike any we’ve faced. The good news is we have powerful technology to help us do it. We’ve identified seven innovations that, if applied in a way that is equitable and supported by producers and communities, hold the most promise to cut emissions and store or sequester them in soil.

Much remains open to debate. No matter how powerful the potential of a technology is, it is never a panacea, and needs to be adopted by producers, accepted by consumers, and supported by policy. Too often in the past promising technological innovations have also hurt communities. Considering these tensions, our goal here is to lay out the potential of these innovations to cut emissions in Canada and use this analysis as a lead up to successive phases of this collaborative project, where we will road test ideas with a range of groups and communities across Canada.

Boosting investment in the technologies we’ve identified will be key to realizing their potential. Together, RBC, BCG Centre for Growth and Innovation Analytics and Arrell Food Institute gathered the best available data on current investment levels. Still, much of this data remains insufficient or undisclosed. Establishing better transparency in this arena will be critical to tracking our progress going forward.

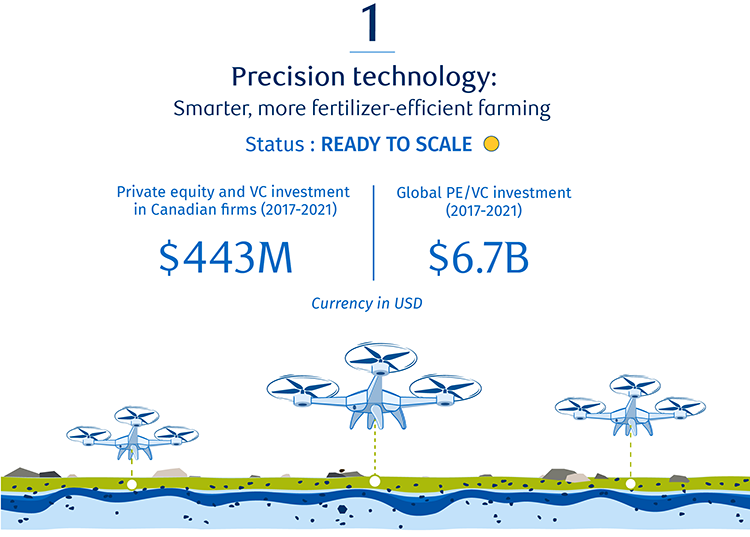

The Problem

When applied to fields, nitrogen fertilizer is a key cause of emissions. Additionally, tilling or ploughing the soil churns up carbon stored within it, releasing it into the atmosphere where it contributes to climate change.

The Solution

Precision technologies like smart tractors gather data on farm productivity and fertilizer use to empower better, more granular decisions about where to use inputs and in what quantities. Other tools like air seeders and soil sensors can enable farmers to seed and fertilize land with precision, and enable regenerative agriculture practices like reduced tillage that protect soil quality and biodiversity. Currently 13MT of carbon is stored in Canadian soil. Our research suggests that by embracing this technology as well as regenerative agriculture practices, an additional 21MT of carbon can be stored in soil by 2050.

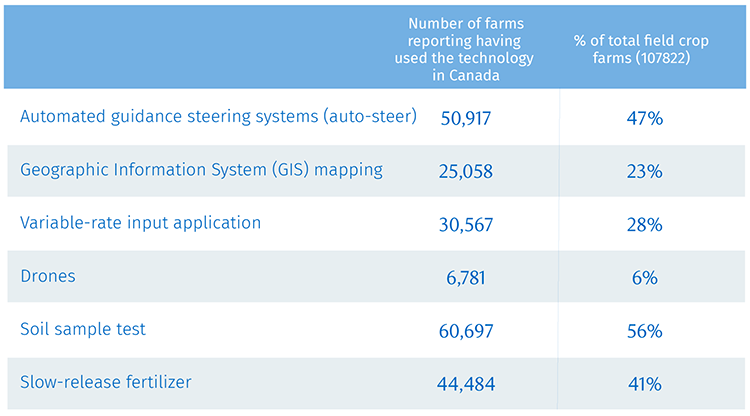

Canadian farmers have made strides in adopting some precision technologies. In Saskatchewan, for instance, adoption of precision tech has helped 80% of farmers use no-till or conservation tillage. And auto-steering for tractors has been a mainstay on farms for decades. But greater adoption of next generation tools that incorporate advanced technology like artificial intelligence and automated robotics—powered by data—could take precision farming to another level.

The Challenges

Canada lags the global average in investment in precision agricultural technology and there are a number of barriers to adoption among producers. To catch up, it must convince farmers that these next generation tools will work on their farms. Private and public sectors can help demonstrate the benefits by establishing sponsored field trials, by setting up carbon markets and by providing the data points and evidence necessary to prove the technology’s value to farmers. Protecting that farm data will also be key. Given the variance of soil quality and make-up across the country, farmers are more likely to trust demonstrations when they are close to their own operations.

+ Chart: Farmer Adoption of Precision Technologies in Canada, as of 2021

Canadian spotlight

Precision AI produces artificial intelligence-powered drones with onboard computer vision that allow granular decisions to be made on the farm. Its drones can identify every plant species it sees on the field, and can target weeds with precision spraying, thereby reducing the use of chemicals by up to 95%. Founded in Regina, Saskatchewan in 2017, the company has grown to over 40 full time employees globally and raised $20 million in seed funding in 2021.

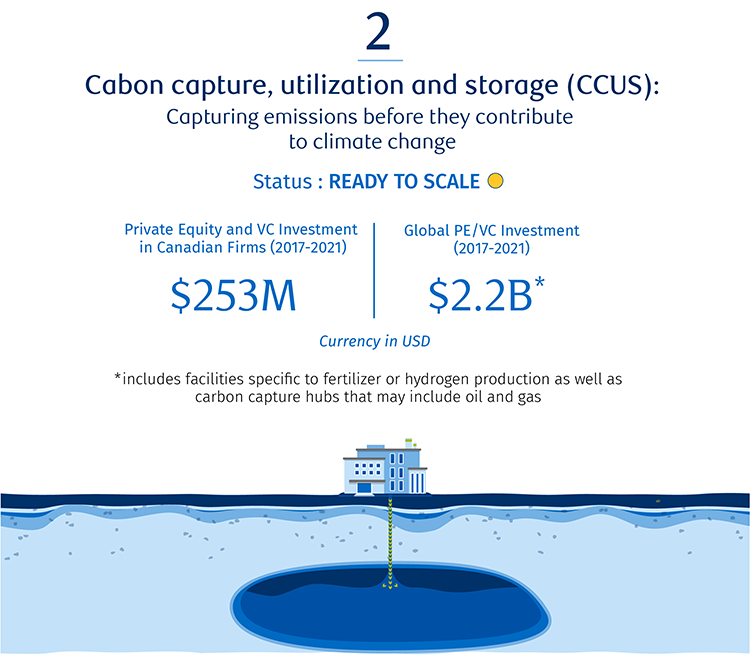

The Problem

The production of nitrogen fertilizer—key to the boom in yields in recent decades—involves the combustion of natural gas and its conversion into hydrogen. Both processes create large amounts of carbon dioxide that are emitted into the atmosphere where they contribute to climate change. Our estimates suggest fertilizer production emits 12 MT of emissions annually. Without change, emissions will rise to 35MT by 2050.

The Solution

Carbon capture, utilization, and storage systems (CCUS) trap carbon dioxide emissions before they enter the atmosphere, reuse them or compress them into liquid that is then shipped via pipeline to a storage facility. CCUS has the potential to capture and store 7MT of emissions by 2050.

Since 2019, Saskatoon-based Nutrien has been using CCUS to capture carbon dioxide from its Redwater plant. This liquid CO2 is then moved via the Alberta Carbon Trunk Line to oil recovery projects in central Alberta. Nutrien sent approximately 139,000 tonnes of CO2 via this route in 2021.7 But beyond this, CCUS is not widely applied in the Canadian fertilizer industry. And globally, just six fertilizer facilities use this technology.8

The Challenges

To enable widespread adoption of CCUS in fertilizer production, more infrastructure is key. This includes carbon sequestration hubs and extensions of existing trunk lines to reduce the financial barriers faced by production facilities. To provide this, we’ll need better coordination across a range of governments, regulators, and industry. Access to geological space for storing carbon, permitting for major projects, legal liability, and other complex technical aspects of these projects need a cohesive regulatory framework if we’re to increase deployment of capital in carbon capture.

Canadian spotlight

Headquartered in Vancouver, B.C., Svante’s technology allows CO2 to be purified and concentrated within 60 seconds. This approach focuses on separating CO2 from nitrogen. Dilute flue gas (generated in industries like steel and oil and gas) is diverted to a continuously rotating platform where the CO2 is trapped within proprietary filters made from nano materials with a high capacity for CO2 capture. It is then purified and ready for storage. The company’s first industrial pilot test plant in Saskatchewan, in partnership with Husky Energy (now Cenovus Energy), is able to capture 10,000+ tonnes of CO2 per year. With lower capital costs than other existing solutions, this technology makes large-scale commercial carbon capture possible.

The Problem

The food that goes into livestock must also come out, which creates methane emissions of about 8 MT per year in Canada, according to our research. Without change, these emissions from manure will rise to 10MT by 2050.

The Solution

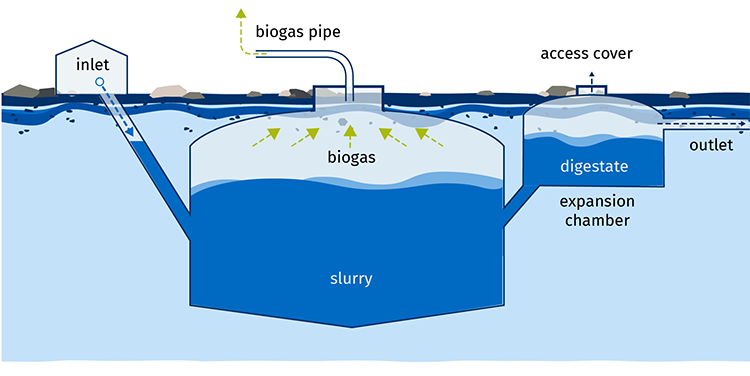

Anaerobic digesters turn methane captured from manure (from cows as well as pigs, chickens, and other ruminant animals) and off-farm organic waste like crop residue, food waste and silage into renewable natural gas, biogas and electricity. Digestate, a byproduct, can also be used as an organic fertilizer on fields or as dairy bedding. Anaerobic digesters have the potential to cut emissions by 2MT by 2050.

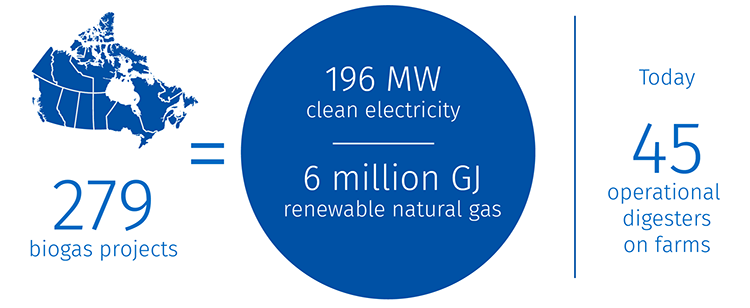

Canada has 279 biogas projects that are transforming methane into 196 MW of clean electricity and 6 million GJ of Renewable Natural Gas (RNG)— the equivalent of more than nine large hydro dams. And with just 45 operational digesters in the Canadian agriculture sector as of 2020, the most significant potential for the technology’s growth is on the farm.9 On-farm anaerobic digesters also add another revenue stream for farmers willing and able to undertake a project on their land.

In Canada, biogas development (including anaerobic digesters) has been driven by provincial energy and waste management policies. There is huge opportunity for growth, especially in agriculture, where crop residues and animal manure make up two-thirds of Canada’s easily available biogas resources. In addition to on-farm plants, community digesters have been touted as a pathway to growth, where their use and costs can be split among multiple farms and potentially even local municipalities.

The Challenges

But investment and development thus far is anemic, with just 29 projects underway. (Data on investments in anaerobic digester development is also quite sparse). The high costs for building these facilities (in the tens of millions per facility, depending on the size) are a barrier. While there are significant tailwinds for the industry, including from government policies like the clean fuel regulations and offset markets, greater demand for biofuels and derisking structures like power purchase agreements will also need to be developed.

+ Chart: Anaerobic digester diagram

Canadian spotlight

DLS Biogas builds biogas plants complete with remote monitoring capabilities. Biogas plants take organic waste (including manure), capture the methane, and transform it into renewable natural gas, electricity, and digestate. As part of its service offering, DLS Biogas provides feasibility and financial analysis, planning and construction management, and full-service operational support for farmers. The Ontario-based company is part of the Dairy Lane Systems family of companies, which has provided milking equipment and other services to dairy farmers for more than 30 years.

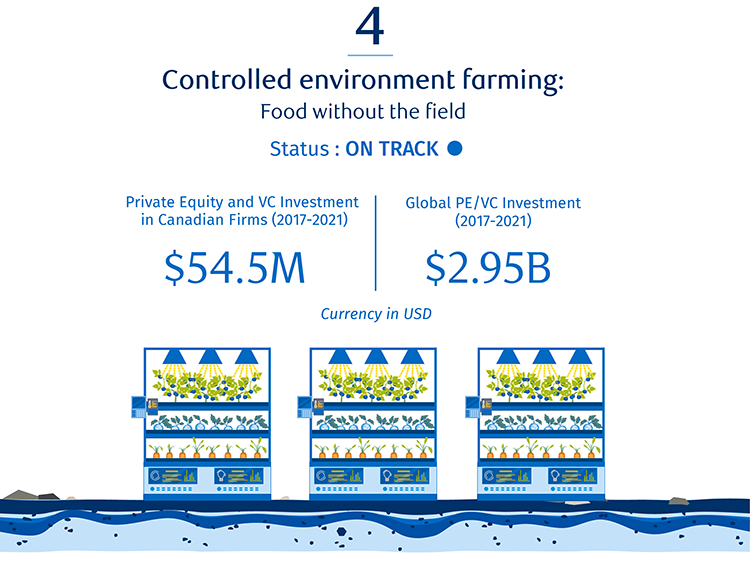

The Problem

Conventional field farming produces emissions through fertilizer application. Emissions are also created when land is converted to farming, and when food is transported from the field to the grocery store. Controlled environment farming has the potential to help change the pattern of land use change, which if left unaltered, will rise from 4MT to 24MT by 2050.

The Solution

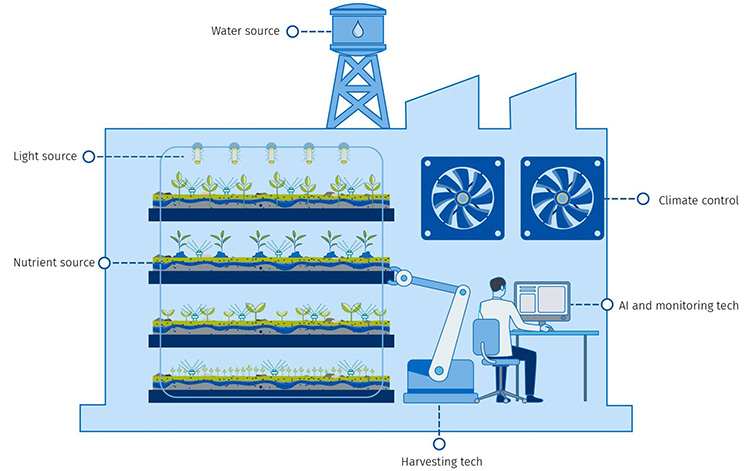

Greenhouses and vertical farms are the best known examples of controlled environment farming, which describes the production of food in an indoor environment. Vertical farms grow food indoors in stacked layers.

Vertical farming uses only 10% of the land and requires up to 90% less water than conventional farming.10 It can also create a stable, local supply of fruits and vegetables, cutting the need for emissions-intensive transportation, and improving domestic food security. When powered and heated with fossil fuels like propane—as many are now—greenhouses can actually add to our emissions footprint. But in the longer run, if these operations use low carbon or renewable energy, they could be a source of low emissions food. Controlled environment agriculture also allows more food to be produced on less land. When matched with the right policies to create incentives to protect land, this creates new opportunities to create wildlife habitat and capture carbon in soil. But while this tech is viable for microgreens and other vegetables and fruits, it is not currently a feasible option for other major crops such as berries.

Our estimates suggest we can avoid 20MT of emissions by preventing land use change between now and 2050.

According to the latest Census of Agriculture, Canada has roughly 5,000 greenhouses and nurseries. Big investments are also being made to develop vertical farming, including a few government programs and a $65M investment by McCain Foods.

The Challenges

Costs remain a hurdle. In addition to capital costs such as land and the buildings themselves, electricity expenses for LED lighting, which take the place of natural sunshine in the growing cycle, tend to be the biggest budget item for vertical farms. Vertical farms can’t quite compete with conventional field farming yet and operators have struggled with zoning laws that don’t recognize indoor farming as agriculture.

+ Chart: Vertical farming diagram

Canadian spotlight

Founded in 2011, GoodLeaf Farms was inspired by indoor hydroponic farming in Japan. Its pilot farm was constructed near Truro, Nova Scotia in 2015 and the company launched its first full-scale commercial farm in Guelph, Ontario in 2019. GoodLeaf grows microgreens and baby greens year-round using a hydroponic system, including LED lights and controlled heat and humidity. Its products, including micro arugula, lettuce, baby spinach, and more, are sold in Ontario.

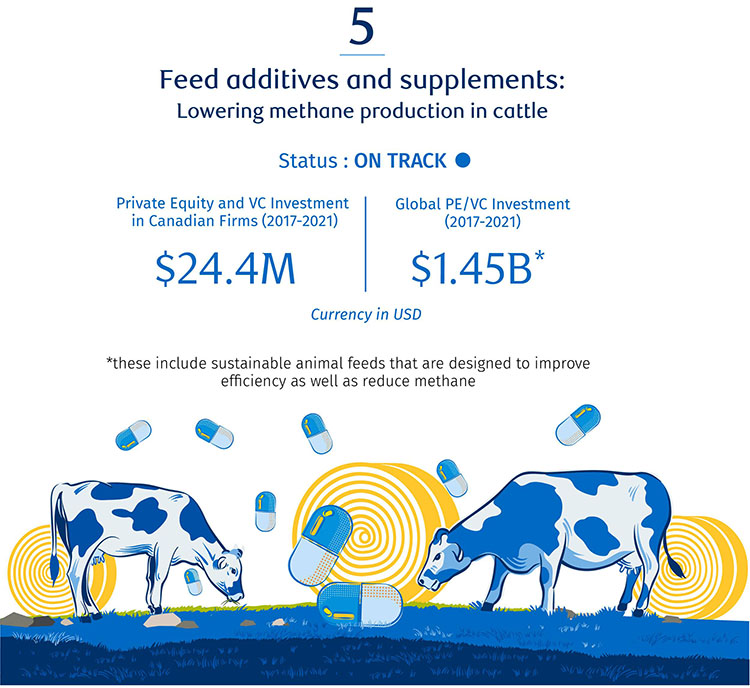

The Problem

Each year, a single cow will belch about 220 pounds of methane.11 The methane from cattle is shorter lived than carbon dioxide but 28 times more potent in terms of warming the planet. In Canada, enteric fermentation (the digestive process in livestock) contributes approximately 24 MT of GHGs.

The Solution

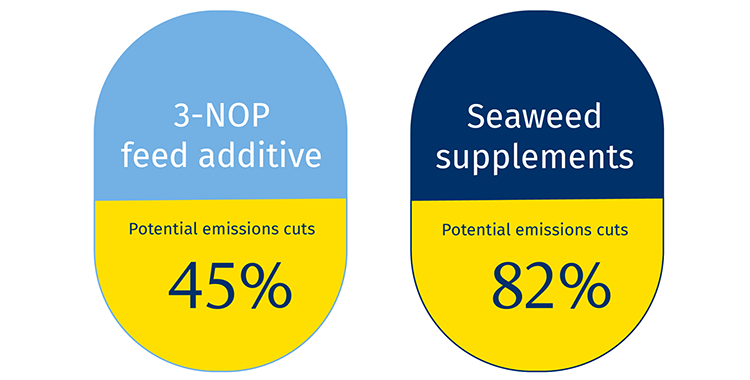

Scientists have discoveredhow to reduce cattle emissions through the gut microbiome. Feed additives like 3-NOP (3-nitrooxypropanol), algae and seaweed supplements suppress the enzyme that triggers the production of methane. They can also help cows digest food more efficiently. Additives and supplements have the potential to cut emissions by 16MT by 2050.

3-NOP has been shown to cut emissions by as much as 45% while adding seaweed to the diet of dairy cows could cut emissions by as much as 82%. Scientists are also working to ensure that this can be done without yield losses—potentially even improving the efficiency of cattle (that is, helping them grow more using less feed). 12

The Challenges

The biggest challenge to scaling feed additives is regulatory approval. 3-NOP has been approved in Brazil and in the European Union, where it was categorized under feed additives that offer an environmental benefit (streamlining the path to commercialization). But in Canada, where it’s classified as a veterinary drug, it’s unlikely to be approved for several years.

Cost is also a key barrier. Without a price on greenhouse gases (such as a carbon tax), farmers lack the incentive to adopt methane-reducing additives because there is not yet a clear economic benefit—only an environmental one. While a carbon credit scheme could help, there is still a heavy burden placed on the farmer to gather data to gain the credit.

Canadian spotlight

Established in 2007 in PEI, North Atlantic Organics (NAO) produces mineral supplements for animals and plants using organic sea plants (seaweeds). Inspiration for the business came to co-founder Joe Dorgan when he tried to convert his dairy herd to organic but was unable to find a natural source for mineral supplements. A breakthrough arrived in 2014, when Rob Kinley, an agricultural scientist working with the company, found that its seaweed cattle mix was able reduce methane emissions from cow’s digestion by 20%.13 The company is currently in the process of developing mineral supplements for plants and hopes to scale up production.

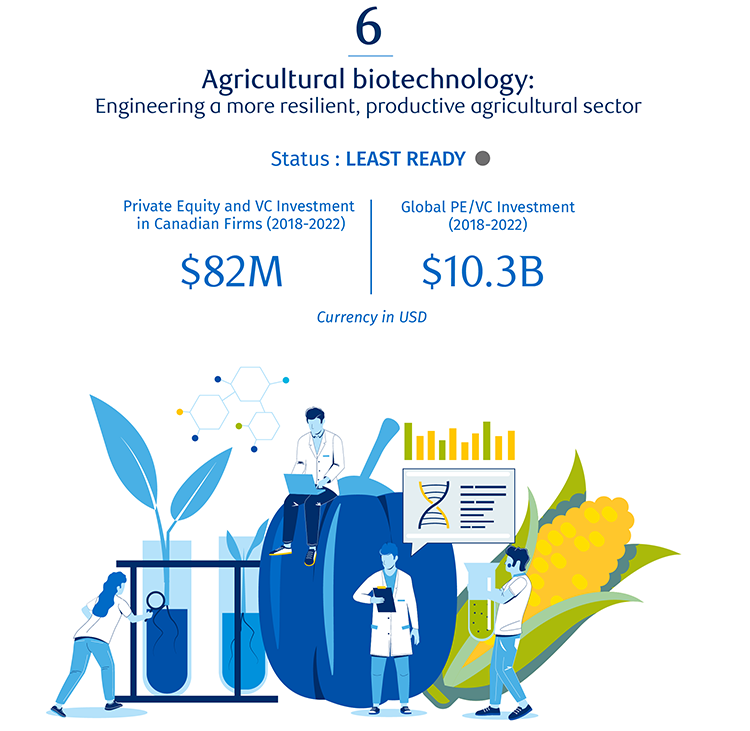

The Problem

Climate change is resulting in extreme weather events that can decimate crops. The overuse of fertilizer, as detailed above, generates nitrous oxide emissions.

The Solution

Agricultural biotechnology uses selective breeding, genetic engineering, gene editing, and tissue culture to accelerate and complement traditional approaches to produce crops and livestock with desirable traits, such as enhanced disease or drought tolerance (among other things). Its origins are in plant and animal breeding, which have been used for thousands of years to help produce new varieties of crops and increase yields. Canola, invented in Saskatchewan in the 1960s, is one example. In addition to breeding, genomic approaches that seek to enhance microbiomes, such as in the soil or the guts of animals, can enable carbon sequestration or prevent disease. The use of ag biotech approaches for carbon emissions reduction is relatively new and in the R&D phase.

Ag biotech can create crops that improve uptake of nitrogen and other nutrients in soil (thereby reducing the use of fertilizer). It can also create plants with greater resiliency to disease and extreme weather events (like flooding and drought), and optimize soil microbes to improve soil fertility and boost plant growth.

Some of the most exciting agricultural research is now taking place below the soil, as scientists study the power of microbiomes and root structures to counter climate change. Some are examining the potential to control photosynthesis to accelerate carbon sequestration. Others are developing microbiomes inoculated from disease. Biofertilizers are also being developed to secure the atmospheric nitrogen needed for plants to thrive.

The Challenges

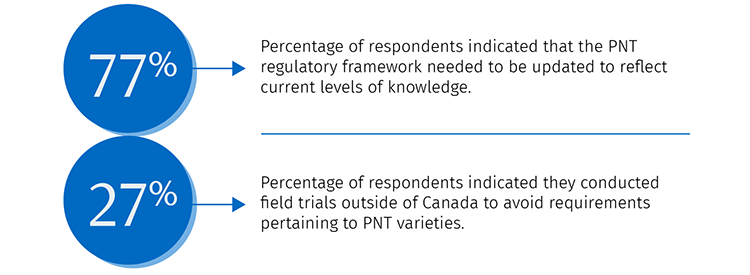

Among the biggest barriers to investment in Canada are regulations of plants with novel traits, which are more stringent than those of competitors. A survey of plant breeders conducted by CropLife Canada found that a quarter of plant breeding research was halted after projects were determined to be “novel” and thus, subject to PNT risk assessments and approvals that could cost up to millions of dollars before a product could be commercialized. Seventy-seven percent of respondents indicated that the PNT regulatory framework needed to be updated to reflect current levels of knowledge. Another 27% indicated they conducted field trials outside of Canada to avoid requirements pertaining to PNT varieties.

Canadian spotlight

Okanagan Specialty Fruits, based in Summerland, B.C., grows novel tree fruit varieties developed through bioengineering. Its flagship product is the Arctic apple, which doesn’t turn brown when bitten, sliced, or bruised (but does turn brown when it begins to rot). The company holds global intellectual property rights in compositions and methods for regulating expression of polyphenol oxidase (PPO) genes to control enzymatic browning in tree fruits.

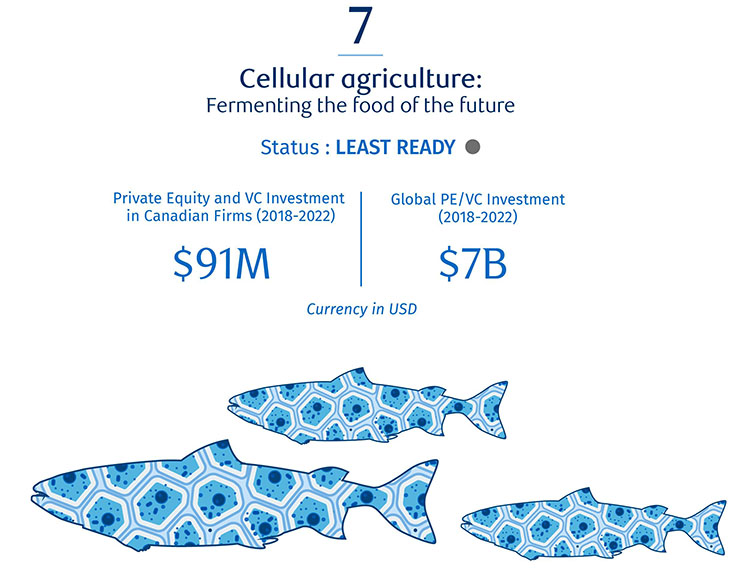

The Problem

Livestock produce emissions through enteric fermentation and manure, as detailed above. The pattern of land use change also generates emissions.

The Solution

Cellular agriculture is a discipline that can transform yeast, bacteria, cell samples and fungi into novel forms of proteins that can serve as alternatives for dairy or lab-grown meat and fish. It has the potential to produce alternatives to livestock and dairy products that require less land and inputs.

The lab-grown process is considered more sustainable since it uses less water and land to produce food and emits fewer greenhouse gases than a field of cows or barn full of chickens.

And Canada has a plentiful supply of feedstock, particularly carbohydrates, starches, and sugars, which could be used for cell-based agriculture products.14 (We currently dispose of leftover starches from peas after its proteins are used to make plant-based meats. This could instead be fed to specially bred micro-organisms such as yeast, which could then be used to make the proteins normally found in dairy products).

The Challenges

High upfront costs make starting a cellular agriculture company difficult. Investor education has also been a barrier. Aside from a few specialized investment firms, entrepreneurs say most investors don’t sufficiently understand the nuances of food science to gauge the potential of the vertical. Funding amounts tend to be low, with shorter terms. Entrepreneurs say more patient capital is needed to grow their companies.

Canadian spotlight

Cell Ag Tech is an Ontario-based cellular agriculture startup developing cell-cultured seafood, with a current focus on lean white fish. Cell Ag Tech was recently announced as a winner in Canada’s regional cellular agriculture competition, AcCELLerate-ON, for its work on scaling fish muscle stem cells in 2D and 3D. Earlier this year, Cell Ag Tech also entered into an agreement to collaborate with the Centre for Commercialization of Regenerative Medicine to develop a process for growing fish cells in bioreactors.

Recommendations: Canada’s time to lead

The Next Green Revolution depends on both putting ready technologies to work and responsibly developing the game-changing innovations that will define the future. Though other nations are rapidly mobilizing their own resources to accomplish these goals, few are as well-positioned as Canada to lead.

The following actions will be key to catalyzing the investment needed to scale the Transformative Seven, as well as remove key barriers to their adoption. In the next phases of our report series, we’ll gain a better understanding of how technology (buttressed by policy) can be applied to support producers (especially small- and medium-sized farms), foster acceptance by consumers and be inclusive of all stakeholders.

Contributors:

RBC

Trinh Theresa Do, Senior Manager, Thought Leadership Strategy

Naomi Powell, Managing Editor, Economics and Thought Leadership

John Stackhouse, Senior Vice President

Colin Guldimann, Economist

Benjamin Richardson, Research Associate

Farah Huq, Senior Director, Content Strategy

Darren Chow, Senior Manager, Digital Media

Zeba Khan, Manager, Digital Publishing

Aidan Smith-Edgell, Research Associate

Kitty Wu, Intern

Gwen Paddock, Director, Sustainability & Climate – Agriculture

Brenda Bouw, Freelance Writer

Boston Consulting Group

Keith Halliday, Director, Centre for Canada’s Future

Chris Fletcher, Managing Director and Partner

Sonya Hoo, Managing Director and Partner

Wendi Backler, Partner and Director, BCG Centre for Growth and Innovation Analytics

Youssef Aroub, Project Leader

Pilar Pedrinelli, Consultant

Rachit Sharma, Lead Knowledge Analyst, BCG Centre for Growth and Innovation Analytics

Arrell Food Institute, University of Guelph

Evan Fraser, Director

Deus Mugabe, Ph.D. Candidate, Plant Agriculture

Dr. Jesus Pulido-Castanon, Post-doctoral Research Associate

Emily Duncan, PhD Candidate

In addition to those cited in this report, we’d like to thank the following individuals for their insights:

- Alice Reimer, Strategic Advisor, CDL

- Alison Sunstrum, Founder, CEO CNSRVX-Inc

- Jim Baker, CEO, Cultura Technologies (Volaris Group)

- Simon Barber, Former Head, Asia Pacific Regulatory and Stewardship, Syngenta Seeds, Singapore

- Wilf Keller, Vice President of Outreach, Agri-Food Innovation Council

- Ray Price, CEO, Sunterra Group

- Gary Haley, Chair, Haley Family Investment Trust

- Jay Cross, President, Canadian Academy of Health Sciences; Professor, University of Calgary

- Lenore Newman, Canada Research Chair in Food Security and the Environment and Professor of Geography, Simon Fraser University

- Mark Thompson, Executive Vice President, Chief Corporate Development and Strategy Officer, Nutrien Ltd.

- Michelle Nutting, Director, Agricultural and Environmental Sustainability, Nutrien Ltd.

- Dan Heaney, Research Associate, Plant Nutrition Canada

- Tom Steve, General Manager, Alberta Wheat Commission

- Jason Lenz, Vice President, Alberta Wheat Commission

- Dan McCann, CEO, Precision AI

- Juanita Moore, Vice President of Corporate Development, GoodLeaf Farms

- Janay Meisser, Director of Innovation, United Farmers of Alberta

- Mauricio Alanís, Director, Sustainability Strategy and Partnerships, Maple Leaf Foods

- Ryan Phillippe, Director, Corporate Development, Genome Canada

- Josh Bourassa, Research Associate, The Simpson Centre for Food and Agricultural Policy

- Elena Vinco, Researcher and Policy Analyst, The Simpson Centre for Food and Agricultural Policy

- Guillaume Lhermie, Director, The Simpson Centre for Food and Agricultural Policy

- Lejjy Gafour, President, Cult Food Science Corp.

- Francis Rowe, CFO, Cult Food Science Corp.

- Jane Church, Corporate Engagement Manager, Nature United

- Tony Ward, Professor Emeritus, Department of Economics, Brock University

- Dave MacMillan, CEO, Deveron UAS

- Derek Eaton, Director of Public Policy Research and Outreach, Smart Prosperity Institute

- David Hughes, President and CEO, The Natural Step Canada

- Stuart Smyth, Associate Professor, College of Agriculture and Bioresources, University of Saskatchewan

- Kristjan Hebert, Managing Partner, Hebert Grain Ventures

- John Van Logtenstein, Vice-President, Dairy Lane Systems and DLS Biogas

- John Walker, Walker Farms

- Scott Walker, Walker Farms

- Clyde Graham, Executive Vice President, Fertilizer Canada

- Josh Pollack, Co-founder, CELL AG TECH

- Valentin Fulga, Co-founder, CELL AG TECH

- Without change to current practices or market share, we project Canada’s current agriculture emissions could rise to 137 megatonnes by 2050

- Agricultural Institute of Canada, “An Overview of the Canadian Agricultural Innovation System.” 2017. https://www.aic.ca/wp-content/uploads/2021/04/AIC-An-Overview-of-the-Canadian-Agricultural-Innovation-System-2017.pdf

- The Times of Israel, “Israeli companies lead world in plant-based food tech investments — report,” August 2022. https://www.timesofisrael.com/israeli-companies-lead-world-in-plant-based-food-tech-investments/

- Eco-Business, “Is Singapore poised to become Asia’s hub for alternative protein?,” August 2021. https://www.eco-business.com/opinion/is-singapore-poised-to-become-asias-hub-for-alternative-protein/

- BBC Storyworks, “How technology is transforming Japan’s agriculture” https://www.bbc.com/storyworks/future/the-technology-transforming-agriculture/how-technology-is-transforming-japans-agriculture

- Fast Company, “How the Netherlands became a plant-based protein powerhouse,” November 2020. https://www.fastcompany.com/90573547/how-the-netherlands-became-a-plant-based-protein-powerhouse

- Nutrien, “2022 Environmental, Social ESG And Governance (“ESG”) Report,” 2022. https://nutrien-prod-asset.s3.us-east-2.amazonaws.com/s3fs-public/uploads/2022-03/Nutrien_ESG%20Report%202022.pdf

- Global CCS Institute. “Facilities Database,” https://co2re.co/FacilityData

- Canadian Biogas Association, “Canadian 2020 Biogas Market Report.” April 2021. https://www.biogasassociation.ca/images/uploads/documents/membersOnly/2021/Canadian_2020_Biogas_Market_Full_Report.pdf

- Columbia Climate School: State of the Planet, “How Sustainable is Vertical Farming? Students Try to Answer the Question,” December 2015. https://news.climate.columbia.edu/2015/12/10/how-sustainable-is-vertical-farming-students-try-to-answer-the-question/

- UC Davis, “Cows and climate change: making cattle more sustainable,” June 2019. https://www.ucdavis.edu/food/news/making-cattle-more-sustainable

- Breanna M. Roque, Marielena Venegas, Robert D. Kinley, Rocky de Nys, Toni L. Duarte, Xiang Yang, Ermias Kebreab, “Red seaweed (Asparagopsis taxiformis) supplementation reduces enteric methane by over 80 percent in beef steers,” March 2021. https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0247820

- CBC News, “How feeding cows seaweed could help P.E.I. meet emission targets and boost this business Social Sharing,” November 2021. https://www.cbc.ca/news/canada/prince-edward-island/pei-seaweed-feed-methane-emissions-climate-change-1.6228982

- Ontario Genomics, “Cellular Agriculture Canada’s $12.5 Billion Opportunity In Food Innovation,” November 2021.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.