This week saw a flurry of new Ukrainian attacks on Russian oil refineries, as Kyiv continues to go after a primary source of Kremlin funding with Western aid increasingly hanging in the balance.

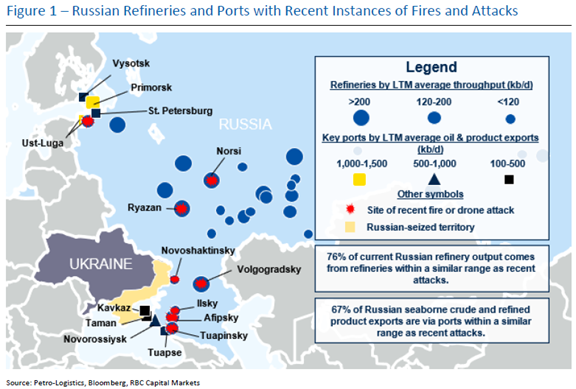

In total, Ukraine has now struck eight refineries, which account for 27% of runs in Russia. Of these refiners, 3 have seen a significant drop in refinery throughput since being targeted. The increasing tempo of attacks brings Russia’s refined product flows further into question, given Moscow’s recent announcements to taper refined export cuts broadly through June as well as a six-month ban on gasoline exports.

We expect these energy infrastructure attacks to continue as Kyiv aims to halt Moscow’s recent military momentum.

Russia has already started to recapture territory after persevering through Ukraine’s counteroffensive last year. As we have previously noted, we have heard frustration from Ukraine’s Baltic backers about Russia’s resilient energy revenue and the way Washington prioritized keeping Russian barrels on the market. The urgency to close the energy ATM has only increased with US assistance currently being held up in Congress and President Trump expected to cut off funding if he returns to the White House next January.

We will be closely watching to see if Ukraine starts targeting more energy export infrastructure.

As we have previously noted, Ukraine seemingly has the capability to target the majority of export facilities in western Russia, which would put ~60% of Russia’s crude exports at risk. Last summer, a senior adviser to President Zelensky stated then that “from a legal and moral perspective, it’s completely unjustified for these vessels to continue to deliver Russian oil,” and Ukrainian forces struck a tanker in the Black Sea. Ukraine halted such maritime attacks following US pressure to allow a “commodity safe transit corridor” in the Black Sea. However, we could envision Ukraine rethinking the energy deal made with Washington and moving to strike a more material blow against Russia’s revenue machine. Hence, we could see a shift to targeting export facilities, especially if Russia continues to make battlefield gains and Western aid is imperiled.