When we explored Large Cap ESG performance last month, we observed that weaker YTD performance and inflows into Value funds dampened sustainable fund flows. We’ve observed a similar pattern with Small and Mid-Caps (SMID). Similar to the broader sustainable fund universe, flows hit new highs in January and then recently eased back from highs.

But, our research shows that investors still appear to be enthusiastic about investing in ESG companies—particularly clean or renewable energy funds. Our latest “ESG Stat Pack” looks at the latest ESG trends and factor performance in the SMID Cap space.

Here are the key takeaways from our report:

Popular clean energy names become SMID Cap leaders

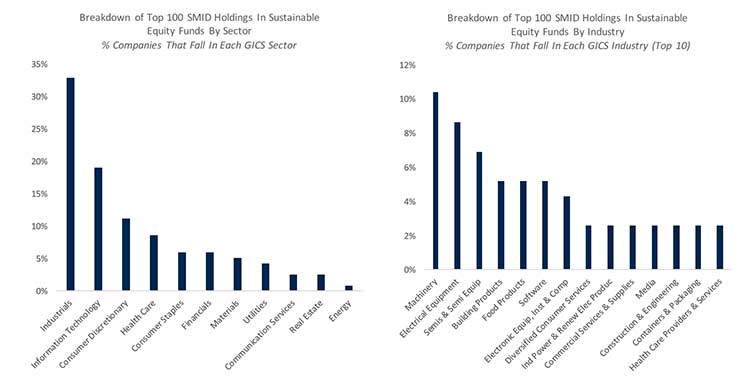

The Industrials and Tech sectors experienced the largest increase in sustainable fund ownership during 4Q20, followed by Consumer Discretionary and Health Care. The 20 most popular Russell 2500 names, many tied to clean energy themes, have become the established SMID Cap leaders.

As a basket, clean energy themes outperformed very strongly in 2020, but have been weak so far this year. We are on the lookout for more attractive valuation opportunities; These names are still trading well above their recent average on a relative forward P/E basis, and are trading slightly above their recent average on a forward PEG basis.

Source: RBC US Equity Strategy, Morningstar, S&P Capital IQ/ClariFi

SMID Caps with stronger ESG scores outperformed

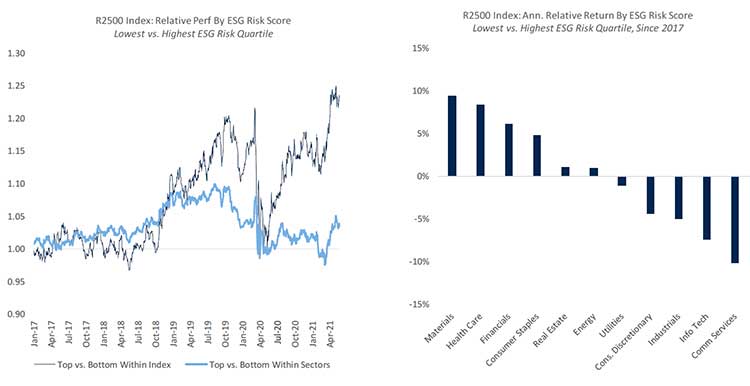

Within the Russell 2500, companies with stronger ESG assessments have slightly outperformed those with weaker scores on a sector-neutral basis since 2017, according to leveraged data from Sustainalytics. The highest scoring categories include Materials, Health Care, Financials, Staples, REITs, and Energy.

Although we expect this gap to narrow over time, it’s important to note that SMID Caps generally lag behind Large Caps when it comes to issuing material ESG disclosures and therefore, may receive lower scores.

The ESG momentum factor (yr/yr improvement in ESG risk scores) has been an in-line performer within the Russell 2500 since 2018, on a sector-neutral basis. Among categories, Healthcare, Communication Services, Materials, and Consumer Discretionary showed the greatest improvement in scores.

Source: RBC US Equity Strategy, Morningstar, S&P Capital IQ/ClariFi, Sustainalystics, constituents are equal weighted

Focusing on better valuation opportunities ahead

As we reported last month, we don’t believe the pullback in flows indicates a turning point for sustainable funds. Our research shows that investors still appear to be enthusiastic about investing in ESG companies - particularly clean or renewable energy funds - and policymakers continue to focus on decarbonization. In the meantime, we’re focused on finding more attractive valuation opportunities among popular clean energy names with solid momentum.

“Within the Russell 2500, companies with stronger ESG assessments have slightly outperformed those with weaker scores on a sector-neutral basis since 2017.”- Sara Mahaffy, U.S. Equity Strategist, RBC Capital Markets, LLC

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.